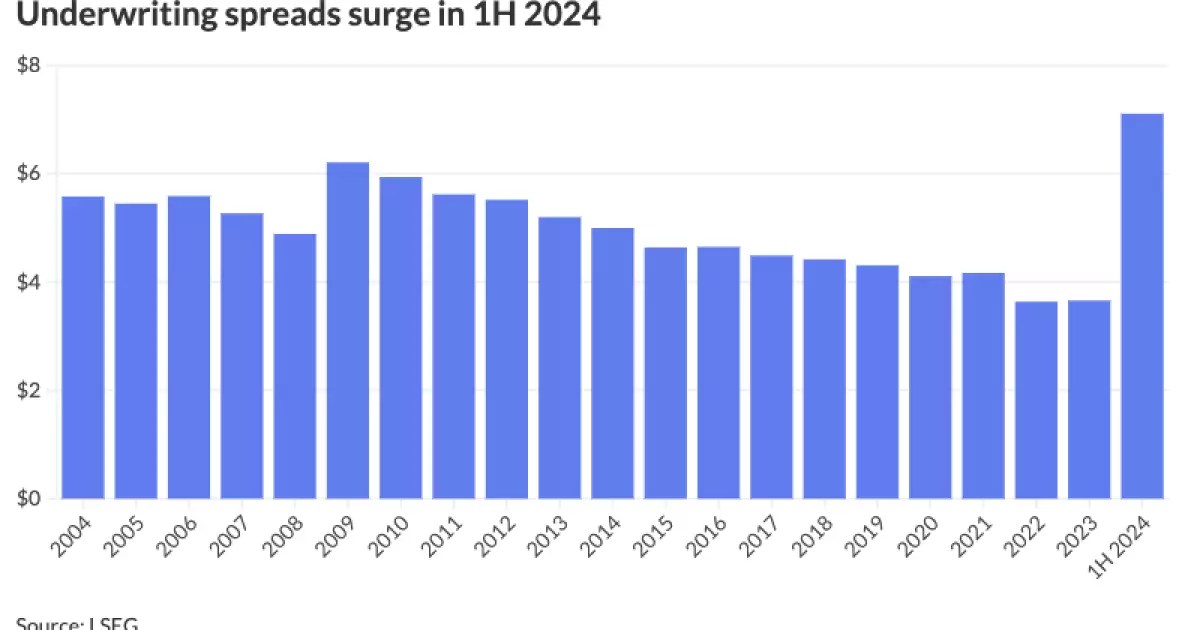

In the first half of 2024, underwriting spreads for all bonds experienced a significant surge, surpassing $7 for the first time in 25 years. The data from LSEG indicates that underwriting spreads escalated to $7.11 during this period from $3.70 in the first half of 2023. Negotiated bonds witnessed an increase in spreads to $6.55 in 1H 2024 from $3.78 in 1H 2023, while competitive deals saw a spike to $9.08 from $2.61 in 1H 2023. Both refunding and new-money spreads also exhibited growth, with the former rising to $6.77 in 1H 2024 from $3.36 in the previous year and the latter increasing to $7.26 from $3.88 over the same timeframe as per data from LSEG.

Wesly Pate, a senior portfolio manager at Income Research + Management, attributed the rise in spreads to the type of deals entering the market. Pate highlighted that underwriting costs are scalable and a surge in smaller deals can lead to a natural shift in underwriting costs towards higher values. He emphasized that the market has seen a rise in the number of deals, exceeding the market value of issuance, particularly voter referendum passed deals that tend to increase underwriting costs. The necessity for borrowers to purchase “bandwidth” in a market with an abundance of bonds compared to the financial crisis era has also contributed to the increase in underwriting spreads.

Matt Fabian, a partner at Municipal Market Analytics, stated that the primary market space is currently at a premium due to the excess bonds in circulation and slower distribution mechanisms via separately managed accounts (SMAs). The reduced underwriting capacity resulting from the exits of Citi and UBS has further influenced the rise in spreads. Michael Decker, senior vice president of policy and research at Bond Dealers of America, acknowledged the decrease in underwriting competition and highlighted the consequences of market volume and increased risk for dealers.

There is a consensus among market experts that the surge in underwriting spreads may continue, especially in the second half of the year. Anthony Tanner, a research analyst and market strategist, views this change as positive, considering the current economic environment and interest rates. While some anticipate a revision to move back to the long-term run rate, the prevailing uncertainty in the market could sustain wider underwriting spreads. The potential implications of political outcomes, such as Republicans winning the presidency and Congress, could further impact underwriting spreads as well.

The escalation in underwriting spreads in the first half of 2024 reflects the evolving dynamics of the bond market, influenced by various factors such as the type of deals, market volume, and changes in underwriting capacity. While some experts view this trend as temporary, others perceive it as a necessary adaptation to the prevailing market conditions. As the market continues to navigate through uncertainties, the future trajectory of underwriting spreads remains a topic of intrigue and discussion among industry professionals.

Leave a Reply