The investment landscape is witnessing a transformative shift as investors increasingly favor exchange-traded funds (ETFs) over traditional mutual funds. Recent announcements, particularly BlackRock’s decision to convert its substantial $1.7 billion High Yield Municipal Bond Fund into an active ETF, underscore this trend. This article delves into the implications of this transition, the driving forces behind the growth of ETFs, and what it signifies for the broader financial ecosystem.

BlackRock’s strategic move signals a pressing change in investor preferences. Financial advisors are now incorporating active ETFs into their portfolios, recognizing their benefits compared to mutual funds. As articulated by a BlackRock spokesperson, this shift reflects not just a change in product preference but rather an evolving landscape of investor needs. Though mutual funds continue to have roles to play, the growing appetite for ETFs points toward a future where these two investment vehicles may serve distinctly different segments of the market.

The significance of BlackRock’s transition lies in its willingness to forgo substantial fee income typically associated with mutual fund structures. This decision, endorsed by Pat Luby from CreditSights, indicates a clear recognition of the potential for ETF growth. The firm’s readiness to adapt to investor demands illustrates a proactive approach to changing market conditions, rather than a reluctance to abandon established revenue streams.

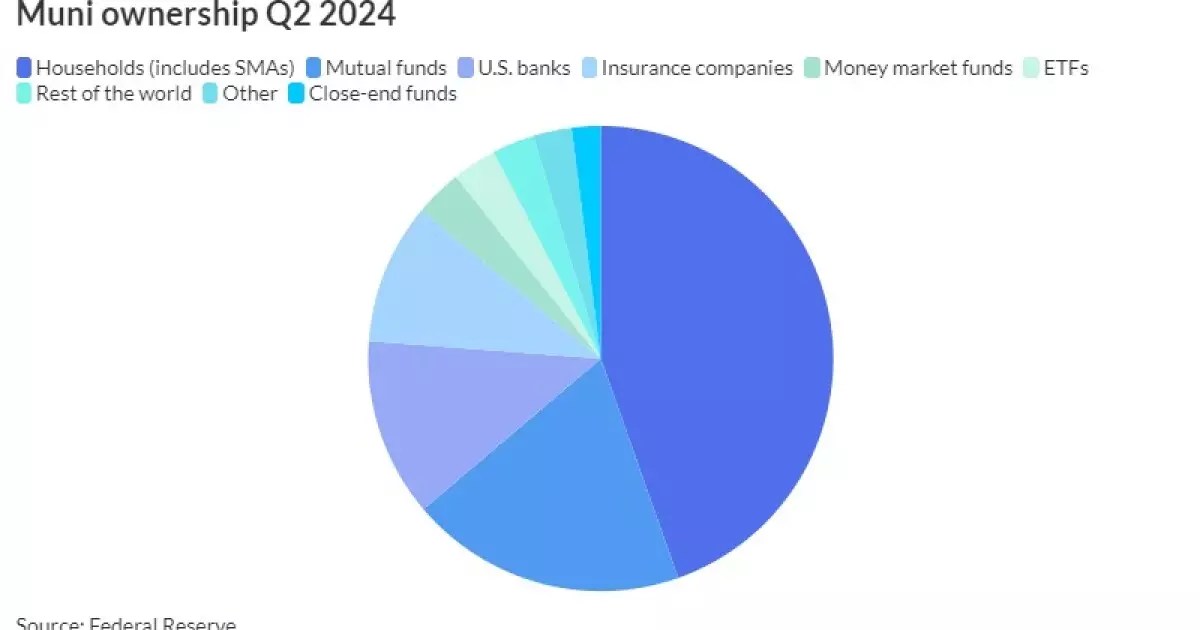

The comparative metrics of ETF growth compared to mutual funds paint a compelling picture. According to recent Federal Reserve data, ETF ownership reached $122.4 billion in Q2 2024, demonstrating a year-over-year increase of 15.7%. In contrast, mutual funds, while still sizable at $775.1 billion, showed only a modest rise, primarily attributed to market value gains rather than substantial inflows.

The discrepancy in growth rates between ETFs and mutual funds can largely be traced back to cost considerations. Mutual fund fees have long been a point of contention, with investors often facing higher expense ratios. Roberto Roffo, a seasoned expert in the municipal bond space, highlights that ETFs typically enjoy a fee structure that is, on average, 50% lower than that of mutual funds. This lower cost, combined with the attractive liquidity and trading flexibility offered by ETFs, has significantly influenced investor choices. The ability to trade ETFs throughout the day offers a level of convenience and immediacy that mutual funds simply cannot match.

The Rise of Mutual Fund-to-ETF Conversions

The trend of converting mutual funds to ETFs gained traction in 2021, sparked by a wave of enthusiasm for the ETF model. However, this enthusiasm has not translated into a robust number of conversions from major players within the mutual fund space. Despite the influx of new ETFs, only 118 mutual fund-to-ETF conversions have taken place since that year, with BlackRock’s conversion marking a notable addition to the list but still relatively rare among large firms.

Analysts like Dan Sotiroff from Morningstar reflect on the unique challenges of these conversions. While fixed-income products may lend themselves more easily to this transition, issues such as capacity constraints often deter firms from converting equity-based mutual funds into ETFs. In fixed income, the flexibility in managing assets allows for more robust growth without the same risks of diminishing returns that come with equity strategies.

Future Implications for the Investment Landscape

As BlackRock leads the charge toward an ETF-centric future, the implications for the wider investment arena cannot be understated. Firms are not only responding to current investor preferences but are also strategizing their positions for the coming years. With a discernible shift toward the ETF structure, many financial institutions are assessing how best to position themselves to meet the demands of a changing clientele that prioritizes cost-efficiency and flexibility.

Moreover, as indicated by Luby, asset managers who wish to remain competitive by 2026 and beyond must start adapting their strategies now. With investor behavior evolving rapidly, the capacity to innovate and fluidly transition between investment products will be vital to maintaining relevance in the evolving market.

In essence, BlackRock’s conversion of its municipal bond mutual fund into an ETF epitomizes a broader, undeniable trend within the investment sector. The movement reflects a fundamental rethinking of how investment vehicles can serve an increasingly discerning client base. As ETFs continue to gain traction, the financial services industry faces an imperative: remain adaptable and aligned with investor needs to thrive in a future where flexibility and efficiency take center stage.

Leave a Reply