In recent weeks, the municipal bond market has exhibited notable resilience in the face of economic uncertainties and market volatility. On a day marked by slight declines in U.S. Treasury yields, municipal securities have managed to maintain their stability, as evidenced by commentary from industry experts like Jeff Timlin, a partner at Sage Advisory. Timlin points out that municipal bonds are not typically deployed for short-term tactical maneuvers, particularly in times of market upheaval such as the elections, which reinforces their standing as a more stable asset class compared to their U.S. Treasury counterparts.

Investors have been actively engaging in the municipal bond market, leading to a modest decline in muni yields. This active buying trend has been underscored by recent inflow statistics indicating sustained interest from mutual fund investors. The LSEG Lipper data highlights a significant 20-week streak of inflows into muni mutual funds, though recent weeks have shown signs of moderation in these inflows.

The decreasing pace of inflows, which recorded $305 million for the week ending on Wednesday compared to a more robust $1.264 billion in the previous week, suggests a potential reassessment among investors. Nonetheless, experts like Timlin anticipate that fund flows will stabilize within a relatively tight range, indicating an underlying confidence in municipal securities as investment vehicles.

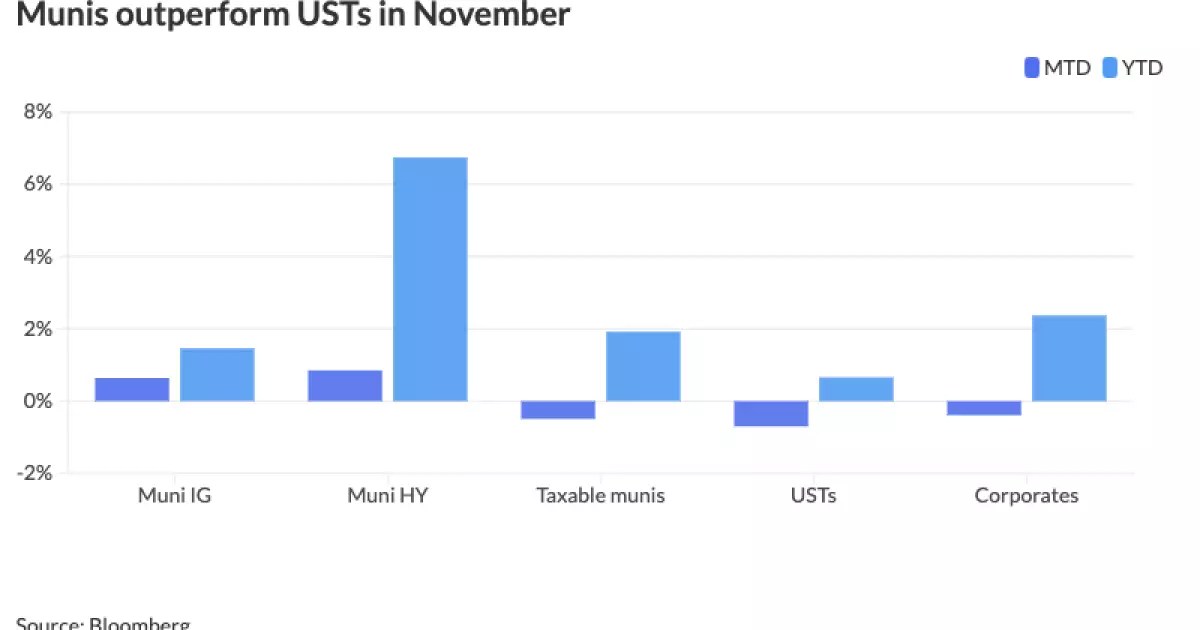

Tax-exempt municipal bonds continue to demonstrate superior performance relative to U.S. Treasuries and corporate bonds, leading to tightening muni-UST ratios. This scenario is indicative of a broader trend where municipal securities are gaining favor among investors, reinforcing their viability as a sound choice for capital preservation and income generation. For instance, the two-year municipal to UST ratio was noted at 62%, while longer maturities also reflected favorable comparisons, with a 30-year ratio at 82%.

The upcoming week in the municipal bond market is expected to be particularly active as issuers seek to complete their offerings before the Thanksgiving holiday. This push is likely to manifest in increased demand for new issuances. Notable among the upcoming issuances are $1 billion worth of airport system special facilities bonds intended for United Airlines, along with several significant transactions planned by various states and authorities across the nation.

Daryl Clements, a municipal portfolio manager at AllianceBernstein, has expressed optimism regarding the absorption of new supply, anticipating that market conditions will enable these issuances to be well received. For example, Connecticut is preparing to price $1.38 billion worth of transportation infrastructure bonds, while the Dormitory Authority of the State of New York is set to offer around $2.5 billion in new-money and refunding state sales tax revenue bonds.

As municipal bonds continue to perform strongly, particularly in contrast to U.S. Treasuries, the market appears to be well-positioned for sustained growth. Analysts have observed that the yield curve remains relatively stable, with little fluctuation across different maturity segments. The one- to 30-year segments are yielding between 2.65% and 3.79%, reflecting a consistent interest from investors.

The underlying fundamentals of the municipal market, characterized by a combination of fiscal responsibility from issuers and increasing demand for tax-exempt income, suggest that the sector may continue to attract investors seeking stability and yield amidst a volatile economic landscape. Investors are likely to find refuge in municipal bonds as they navigate the complexities of the current financial environment.

The municipal bond market stands resilient amid fluctuating economic conditions, showing robust demand and stability. With encouraging fund flows, the upcoming wave of issuances, and the perceived safety of municipal bonds, investors may find themselves drawn toward this asset class. As municipalities across the United States continue to manage their debts responsibly and capitalize on infrastructure projects, the outlook for municipal bonds remains positive as a critical component of a diversified investment portfolio. As market participants monitor these developments, it is clear that municipal bonds are poised to maintain their relevance in the investment landscape, offering potential nourishment for both conservative and yield-seeking investors alike.

Leave a Reply