Bond insurance has proven to be a robust financial instrument in the current investment landscape, particularly through the first three quarters of 2024. The market has witnessed a notable surge in activity, with a 26.8% increase in debt wrapped by bond insurance compared to the same period last year. This article explores key trends and factors driving the growth of bond insurance, focusing on market dynamics, issuer strategies, and the role of institutional investors.

In terms of raw numbers, the bond insurance market wrapped approximately $28.921 billion from January to September 2024, compared to $22.814 billion during the same timeframe in 2023, according to data from LSEG. An essential aspect of this growth is attributed to the increased number of transactions. The market saw 1,217 deals during the first nine months of 2024, a significant rise from 995 deals recorded in the previous year. Such figures indicate not only robust demand for bond insurance but also a vibrant market for municipal bonds, reflecting investor confidence amid fluctuating economic conditions.

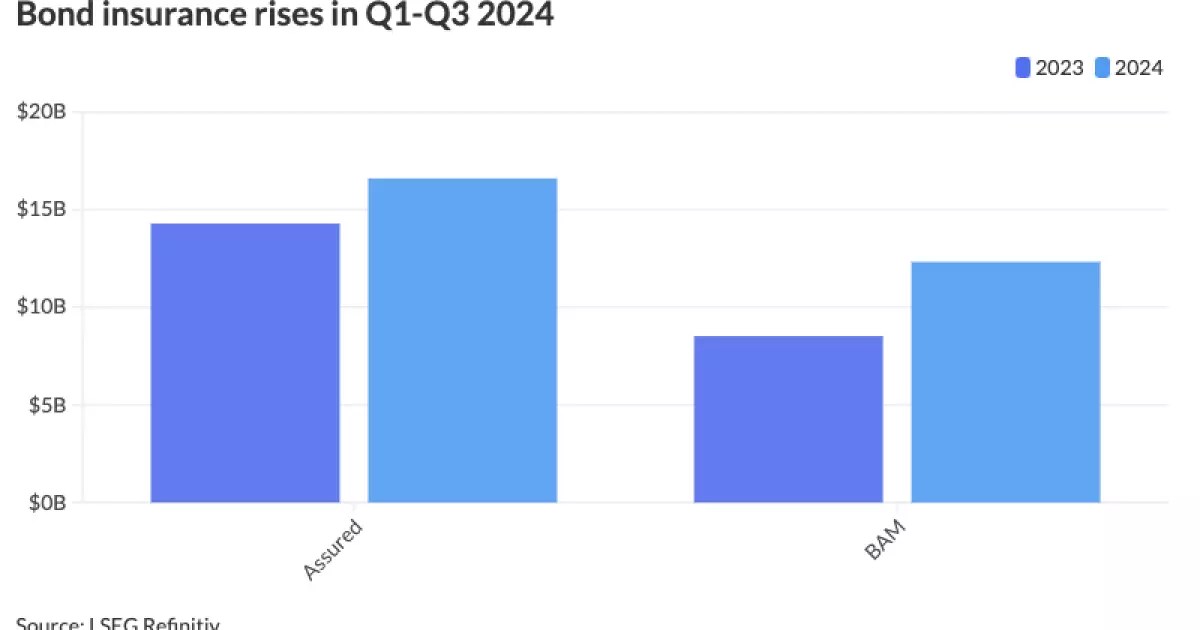

The competition among bond insurers has intensified, with major companies like Assured Guaranty and Build America Mutual (BAM) seeing substantial year-over-year growth. Assured Guaranty, for instance, has insured $16.599 billion across 561 deals, securing 57.4% of the market share. This marks a decrease from a 62.6% market share in the first nine months of 2023. However, such figures represent the second highest primary market par amount for Assured Guaranty in the past decade, illustrating its resilience and ability to adapt to market changes.

On the other hand, BAM has experienced an even more dramatic growth trajectory, with its insured debt rising to $12.322 billion in 656 deals, capturing 42.6% of the market share. This is particularly impressive, considering it compares favorably with BAM’s total insured verifications from the entirety of 2023, evidencing a strategy positioned for aggressive growth.

Examining the specifics, Assured Guaranty has taken on significant projects, such as $1.1 billion for the Brightline Florida passenger rail project and $800 million for the new terminal at JFK Airport. Notably, they focused on insuring a greater number of high-value deals, including 33 transactions exceeding $100 million this year. This trend not only demonstrates the firm’s commitment to large-scale projects but also reflects the growing appetite among investors for reliable insurance coverage in significant ventures.

BAM, aligning with similar strategic objectives, accrued 23 new-issue sales exceeding $100 million in the first nine months of 2024, up from just 18 for the entire previous year, highlighting an increasing trend towards larger deals with substantial insurance requirements. Their diversification strategy, involving a mix of credits and various sectors, showcases their adaptability and an acute understanding of market needs.

The demand among institutional investors remains a pivotal factor in the bond insurance market’s health. Both Assured Guaranty and BAM have acknowledged that robust interest from institutional entities has underpinned their growth. The importance of this demographic cannot be overstated; institutions tend to require insurance for larger, higher-rated transactions, which directly impacts the success of bond insurers.

In an environment marked by geopolitical instability and unpredictable economic factors, the assurance provided by bond insurance is increasingly appealing to these investors. Firms like Assured and BAM are not only meeting the demand for safety and reliability but are also enhancing overall financing cost efficiencies for issuers. This dual focus on protecting investors while providing cost savings reflects the evolving role of bond insurers in modern finance.

As we move further into 2024, the bond insurance sector appears well positioned for continued growth. The impressive figures for the first three quarters highlight a robust demand for insurance products, driven by strategic financing needs and strong institutional interest. Both Assured Guaranty and BAM have demonstrated their ability to adapt and thrive in this competitive landscape. Moving forward, the bond insurance market’s resilience may increasingly contribute to broader financial stability, particularly in times of economic uncertainty.

Leave a Reply