Last week, Federal Reserve Chair Jerome Powell announced a quarter-point interest rate cut, an action that reverberated through the stock market with immediate consequences. His hawkish tone, however, seemed to cast a shadow on investor confidence, leading to a temporary drop in stock prices, particularly in the technology sector. Notably, the decline catalyzed a significant sell-off but also laid the groundwork for a noteworthy rebound that unfolded days later, indicating the market’s resilience amid uncertainty.

Following the initial downturn, the market demonstrated a remarkable recovery, particularly evident in the Dow Jones Industrial Average, which surged almost 500 points on Friday. This rebound raises questions about the underlying strength of the market and whether this indicates the onset of what is often referred to as the “Santa Rally.” Historically, this term denotes a stock market increase that typically occurs during the final weeks of December, driven by holiday optimism and increased consumer spending.

While broad market conditions are pivotal, the semiconductor sector stands out as one that could benefit notably in this scenario. The recent fluctuations lead investors to reassess their positions and identify potential opportunities for growth, specifically in companies like Nvidia. This industry giant has been instrumental in driving advancements within tech and semiconductors, creating an optimistic buzz around it.

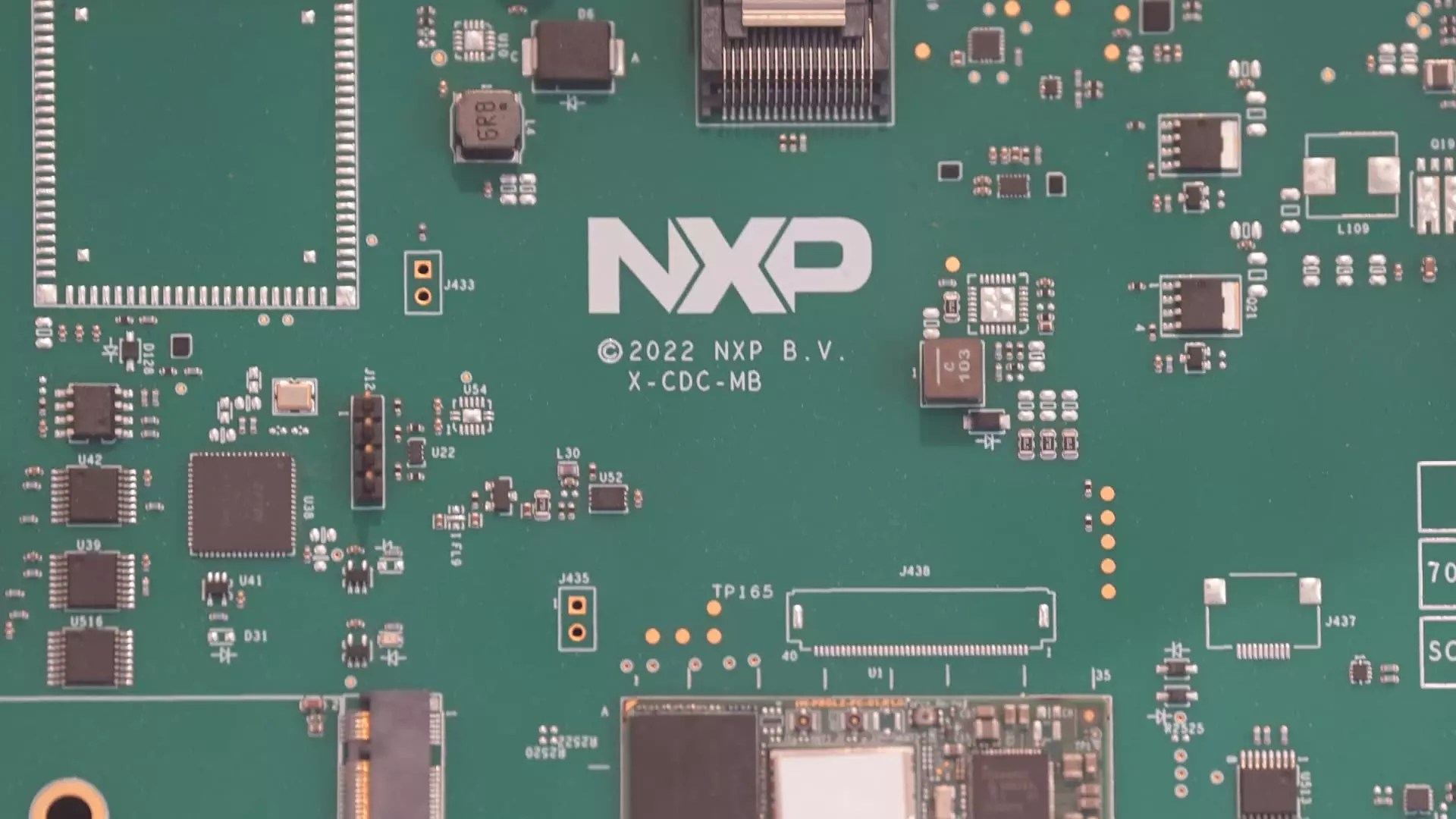

As the dust settles from recent market shifts, one company that warrants attention is NXP Semiconductors NV (NXPI). Emerging from a recent downturn, NXPI’s price action suggests potential for significant upward movement. After reaching a low point around $204, the stock has begun to create bullish indications, characterized by green candles and a reversal in the Relative Strength Index (RSI).

The technical indicators such as RSI and the Directional Movement Index (DMI) reinforce the idea that NXPI may be on the verge of a trend reversal. The DMI, which sheds light on prevailing market momentum, shows signs that the previously dominant downtrend is losing strength. The combination of these signals paints a promising picture for NXPI, positioning it as a prime candidate for investors seeking growth in the semiconductor space.

For investors considering entry into NXPI, leveraging options can be an effective strategy to balance risk and reward. The bull call spread strategy has been recommended by traders who see potential for upward price movement. This strategy involves buying a call option at one strike price – for instance, a $210 call – while simultaneously selling another call option at a higher strike price, such as $215.

The beauty of this approach lies in its defined risk parameters. By risking a total of $2,500 for a potential return of the same amount, investors can effectively capitalize on NXPI’s bullish momentum while limiting exposure to losses. If NXPI meets or exceeds the $215 mark by expiration, the return on investment could reach 100%. This structured method of trading accommodates cautious investors looking to participate in the market without exposing themselves to substantial downside risk.

As we navigate the unpredictable landscape shaped by Federal Reserve movements and economic indicators, the semiconductor sector presents intriguing opportunities for discerning investors. The trajectory of stocks like NXPI highlights the significance of both technical analysis and strategic trading techniques.

However, it’s crucial to acknowledge that investing in volatile markets carries inherent risks. Thus, market participants must conduct thorough research and consider their financial scenarios before making investment decisions. Professional advice tailored to one’s unique circumstances can provide invaluable clarity in an environment heavy with volatility and uncertainty. As the year draws to a close, staying informed and proactive could prove beneficial in seizing emerging opportunities in a recovering market.

Leave a Reply