The municipal bond market has recently experienced noteworthy shifts, revealing interesting dynamics that may influence future investment strategies. As observed last Wednesday, a sharp correction led to a significant rise in yields across the board. With yields on municipal bonds adjusting upward—as much as 18 basis points in certain segments—these changes signal a need for investors to carefully reconsider their positions and strategies within this asset class.

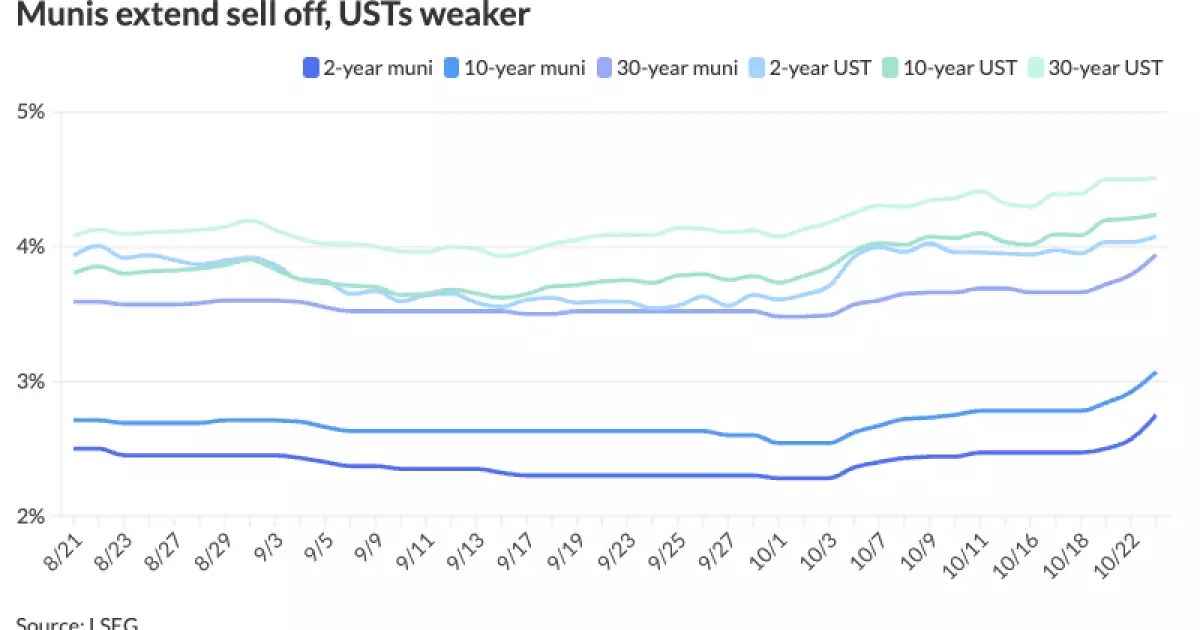

This correction in the municipal bond market appears largely as a necessary response to the yield movement of U.S. Treasuries. Historically, muni bonds will often track Treasuries, which serve as a benchmark for fixed-income securities. Following a period of outperformance that left ratios appearing ‘too rich’, the market has had to recalibrate. Yield increases pushed the 10-year municipal bond yield above 3% for the first time since July, suggesting a shift in investor sentiment as they reassess the risk-reward profile in light of worsening ratios.

The Municipal Market Data indicated that as of 3 p.m. EST, the ratios comparing municipal yields to U.S. Treasury yields were climbing, suggesting that the cost-effectiveness of purchasing municipal bonds relative to Treasuries diminished. This rising trend in ratios can act as a warning sign to investors—a signal that it may be time to scrutinize their portfolios closely.

Multiple external factors currently bear down on the municipal bond market. For instance, the anticipation of a potential Republican victory in upcoming elections has cast uncertainty over fiscal policies, triggering fears of inflation and escalated deficit spending. These predictions drive Treasury rates higher, subsequently influencing municipal yields.

Investor reactions to political dynamics, such as reduced liquidity and ramped-up anxiety levels, become key themes that capture the underlying sentiment. James Pruskowski, a chief investment officer at 16Rock Asset Management, has pointed out that an increase in issuance is evident as issuers scramble to lock in favorable funding before potential policy shifts. Such actions can, however, lead to market oversaturation, which could further complicate the municipal landscape.

Another critical dimension to unravel is the push and pull between supply and demand in the current market scenario. The inflow of capital into municipal bonds has remained strong, with the Investment Company Institute reporting over $1.5 billion of inflows recently. While this consistent inflow—marking 11 straight weeks—is a positive sign, it must be viewed against a backdrop of rising yields. Demand is tempered by the reality that cash is piling up, as many investors seem hesitant to deploy it optimally amidst a turbulent landscape, leading to increased inventory levels.

This backdrop creates a paradox: while there is money awaiting investment, issuer behavior may inadvertently flood the market, forcing yields even higher. The recent adjustment in debt pricing, notably around large bond issues—like the New York City Transitional Finance Authority’s recent issuance—reflects this sentiment, resulting in significant yield resets across the board.

As market dynamics shift, the importance of re-evaluating investment strategies becomes paramount. Investors should consider potential repositioning in light of the correction. The current environment may offer opportunities for those seeking value, especially as municipal bonds become more attractive with wider credit spreads and more favorable price points.

The strategies discussed by investment experts suggest a cautious reevaluation of investment positions may be prudent. With municipal rates likely to keep pace with U.S. Treasury movements, inflow trends present an intriguing opportunity for investors willing to navigate the complexities inherent in the market.

In the coming weeks, municipal bond market participants would do well to stay alert to shifts in both macroeconomic trends and issuing behaviors. As the environment evolves amid external pressures from political uncertainties and yield recalibrations, emphasizing diversification and a focus on quality will be vital.

Ultimately, understanding these dynamics is critical for navigating this changing landscape. The municipal bond market holds potential opportunities for savvy investors, but careful analysis and a proactive stance will be essential for capitalizing on them in an increasingly complex environment. The conversation must shift from merely observing the market to engaging critically with its undercurrents to foster informed investment decisions.

Leave a Reply