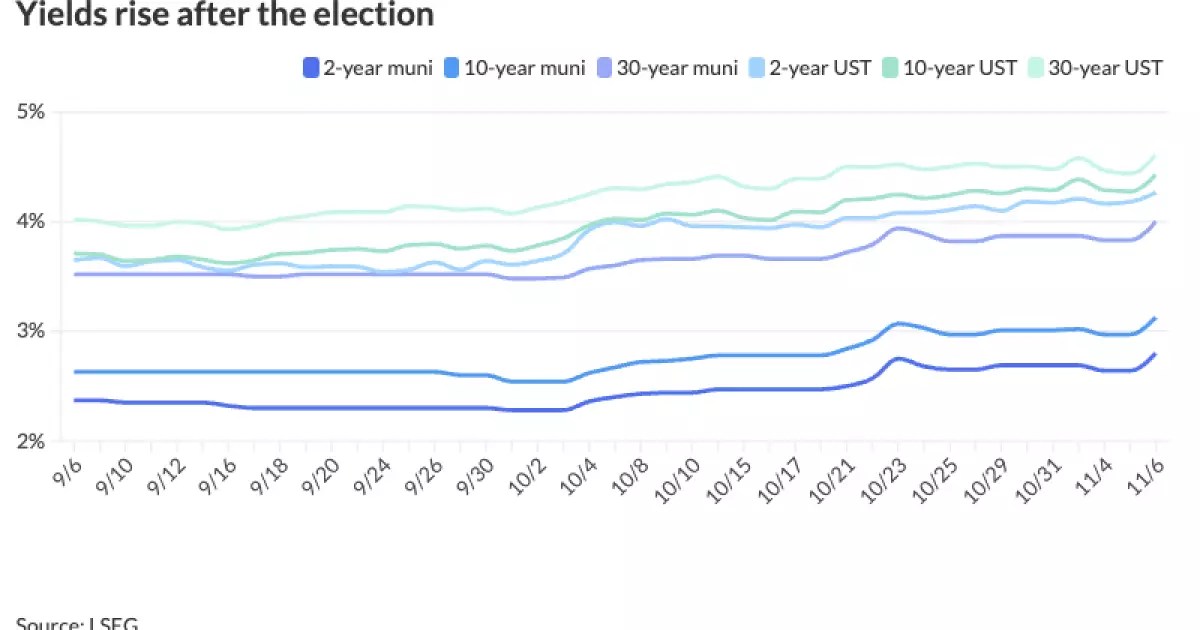

Recent political shifts in the United States, characterized by a significant electoral victory for former President Donald Trump and the Republican Party’s reclaiming of the Senate, have sent ripples through the financial markets, particularly impacting the municipal bond sector. This outcome has ushered in a climate of heightened expectations regarding fiscal policy adjustments, triggering a selloff in municipal bonds. On the day following the election results, municipal triple-A yields surged markedly, with variations between 11 to 17 basis points depending on the duration, closely mirroring movements in U.S. Treasury rates.

The implications of a Republican control over both the executive and legislative branches have led to a nervous atmosphere in fixed-income markets, with investors reevaluating their positions amid prospects of increased government spending and potential shifts in monetary policy. This market dynamic accentuates the intertwined nature of political developments and financial market reactions.

The immediate response from the municipal bond market reflects a robust correlation with U.S. Treasury securities. The selloff in municipal bonds, which resulted in a significant increase in yields, indicates investor apprehension towards future fiscal strategies anticipated under a Republican administration. According to market data, the yield ratios comparing municipal bonds to U.S. Treasuries revealed an upward trend, suggesting that municipal bonds are perceived as riskier investments in light of the projected economic landscape.

Notably, the two-year municipal to UST ratio stood at 66%, escalating to 87% for the 30-year bond, illustrating a flight to safety among investors who might prioritize U.S. Treasuries over riskier municipal securities. This significant shift in ratios underscores the prevailing uncertainty regarding credit risks and the future trajectory of inflation, as speculations mount over the potential fiscal deficits that could arise.

Analysts across various financial institutions have weighed in on how the recent political developments may reshape economic policies. BMO Capital Markets, for example, posits that the anticipated increase in government spending will likely drive real yields higher. With the intertwining factors of inflation and burgeoning public debt, yields on municipal bonds could face additional upward pressure in the foreseeable future. This notion suggests a complex interplay between fiscal expansion and the potential constraining impact on growth, as higher yields may dampen borrowing and investment activities.

Market participants are already contemplating the ramifications of higher deficits originating from potential tax cuts and increased tariffs. The relationship between fiscal policies and bond market dynamics is under scrutiny, particularly in light of how past precedents—like Trump’s first term—impact future outcomes.

Investment professionals are concerned about the likelihood that municipal bonds may continue to follow the trajectory set by U.S. Treasuries. As the market braces for another round of near-negligible issuance, concerns about liquidity and bond supply could exacerbate volatility. Strategists from institutions like J.P. Morgan emphasize the importance of monitoring ETF flows, as these will significantly influence municipals’ price movements.

James Pruskowski, the chief investment officer at 16Rock Asset Management, notes that the current environment invites opportunities despite market fluctuations. Indeed, the interplay between investor sentiment, government policy, and economic indicators suggests a fertile ground for both risks and rewards within the fixed-income space.

The Federal Reserve’s upcoming policy decisions will play a crucial role in shaping investor expectations going forward. Many analysts anticipate a 25 basis point cut in the federal funds rate in response to evolving economic conditions.

Andrzej Skiba from RBC Global Asset Management suggests that this may lead to a subsequent rate reduction if financial conditions remain conducive to economic growth. However, if inflation escalates as a consequence of fiscal expansions—or due to ongoing tariff issues—the Fed may find itself in a challenging position, balancing the need for stimulating growth against controlling inflationary pressures.

With the potential for a more hawkish stance, particularly in light of possible new tax cuts, the Fed’s strategic navigation of monetary policy will be integral in dictating bond market stability.

As the landscape of U.S. politics continues to evolve, so too does the municipal bond market. Investors are faced with a myriad of challenges characterized by inflationary fears, changing fiscal policies, and a responsive Federal Reserve. The recent electoral shifts have underscored the importance of agility in investment strategies, as the bond market can quickly react to political dynamics.

Ultimately, understanding these underlying forces will be crucial for investors looking to optimize their portfolios in a period marked by uncertainty and volatility. The intricate relationship between policy, market responses, and economic indicators will remain at the forefront of strategic investment considerations in the coming months.

Leave a Reply