The landscape of bond insurance is witnessing a notable revival as it continues to capture the attention of both issuers and investors. The first half of 2024 has showcased a robust increase in the amount of debt insured, indicating a favorable trend in the bond market. This article delves into the current state of the bond insurance industry, evaluating its growth, market dynamics, and future prospects.

Significant Growth in Insured Bonds

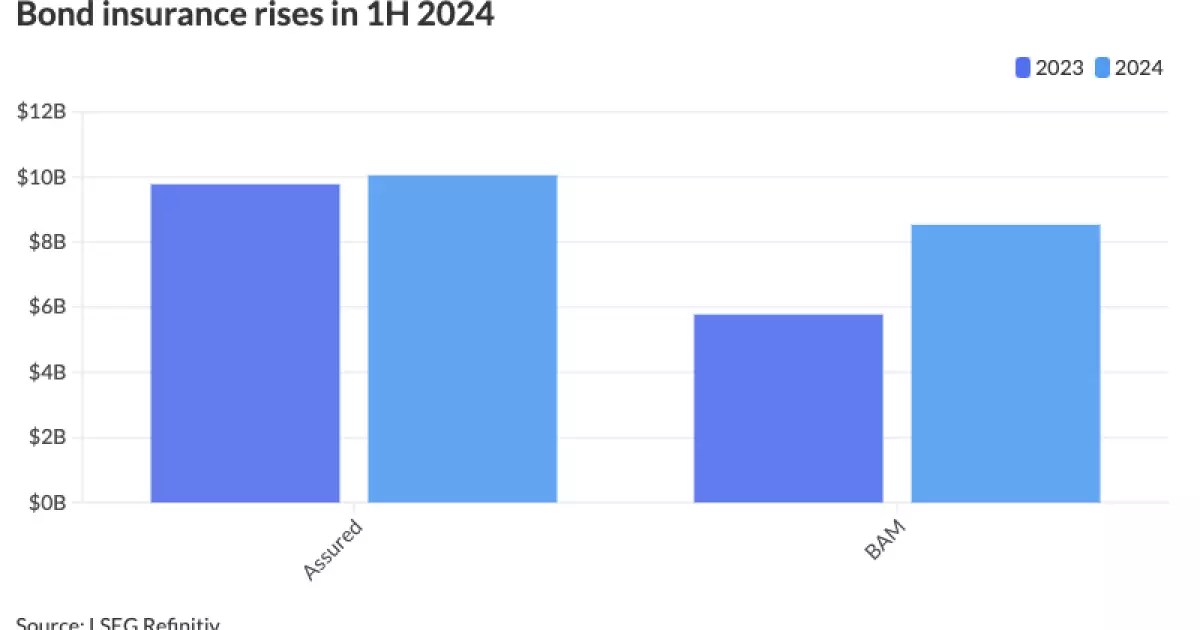

Recent data illustrates a striking 19.5% surge in the amount of debt wrapped by bond insurance, amounting to $18.592 billion in the first half of 2024. This figure reflects an increase from $15.561 billion in the same period of 2023, as reported by LSEG. The heightened activity can be attributed to a higher number of deals, with 762 transactions in 2024 compared to 622 in the previous year. This trend indicates a solid demand for bond insurance, suggesting that issuers increasingly recognize its value in enhancing investment security and market liquidity.

Market Leaders: Assured Guaranty and Build America Mutual

Assured Guaranty remains a formidable player in the bond insurance industry, handling a substantial $10.055 billion across 327 deals in the first half of 2024, thereby securing a dominant market share of 54.1%. This performance, while impressive, reflects a slight decline from the previous year, where it held a market share of 62.8%. Conversely, Build America Mutual (BAM) has shown remarkable growth, covering $8.537 billion in 435 transactions, a significant leap from $5.785 billion in 2023. The year-over-year improvement for BAM signifies a shifting dynamic in the competitive landscape of bond insurance.

This shift indicates a growing reliance on BAM among issuers, particularly in larger transactions, further corroborated by a 47.6% increase in its business volume. Both companies have managed to maintain strong year-over-year growth; however, the fluctuation in market shares suggests an evolving trend in how bonds are insured.

The increasing reliance on bond insurance can be traced back to its dual role—offering safety and bolstering market liquidity. Robert Tucker from Assured Guaranty noted that a broader spectrum of transactions is now utilizing bond insurance. Investors are recognizing its potential not only for safeguarding their investments but also for stabilizing prices during volatile market conditions. This insight underscores the evolving perception of bond insurance within the investing community.

Mike Stanton from BAM highlighted the pivotal role of retail investors, who have exhibited a consistent preference for insured bonds. This trend is proportionally matched by institutional investor demand, enhancing the insurance sector’s robustness. The combination of retail and institutional interest is expected to sustain a solid environment for bond insurance, even as we transition into the latter half of 2024.

Large Transactions and Institutional Interest

One of the key drivers influencing the bond insurance market is the burgeoning interest in larger transactions, particularly from institutional investors. In the first half of 2024, Assured Guaranty reported 21 transactions exceeding $100 million, indicating a strong appetite for substantial bonds. This momentum is likely to continue, given the ongoing demand for security in higher-value issues.

The significance of notable projects, such as Assured’s backing of the $1.13 billion Brightline Florida passenger rail initiative and the $800 million New Terminal One at JFK Airport, underscores the importance of bond insurance in facilitating critical infrastructure developments. These high-margin transactions not only attract institutional interest but also reinforce the protective qualities of bond insurance in navigating credit risks.

Expanding Horizons: Healthcare and Education Bonds

BAM’s diversification into new sectors was marked by its entry into the healthcare bond market, securing deals such as the $100 million Marshfield Clinic Health System transaction. Additionally, significant investments in public higher education, covering institutions like Florida State University and the University of Oklahoma, point to an expanding range of applications for bond insurance. The appeal of these sectors highlights an increasing trend of using bond insurance not only as a safeguard but also as a strategic tool for attracting investment.

As we look forward, the bond insurance industry exhibits promising growth potential. With a steady market penetration rate of 8.2% and increasing utilization across various sectors, the environment for bond insurers remains optimistic. The effective application of bond insurance to enhance creditworthiness in diverse transactions signifies a maturing market that is increasingly regarded as essential for facilitating financing in a broad spectrum of public and private initiatives.

The ongoing elevation of bond insurance as a critical financial instrument reflects its versatility and resilience in an ever-evolving economic climate. As both individual and institutional investors continue to embrace this protective measure, the industry is well-positioned for sustained growth and innovation in the coming years.

Leave a Reply