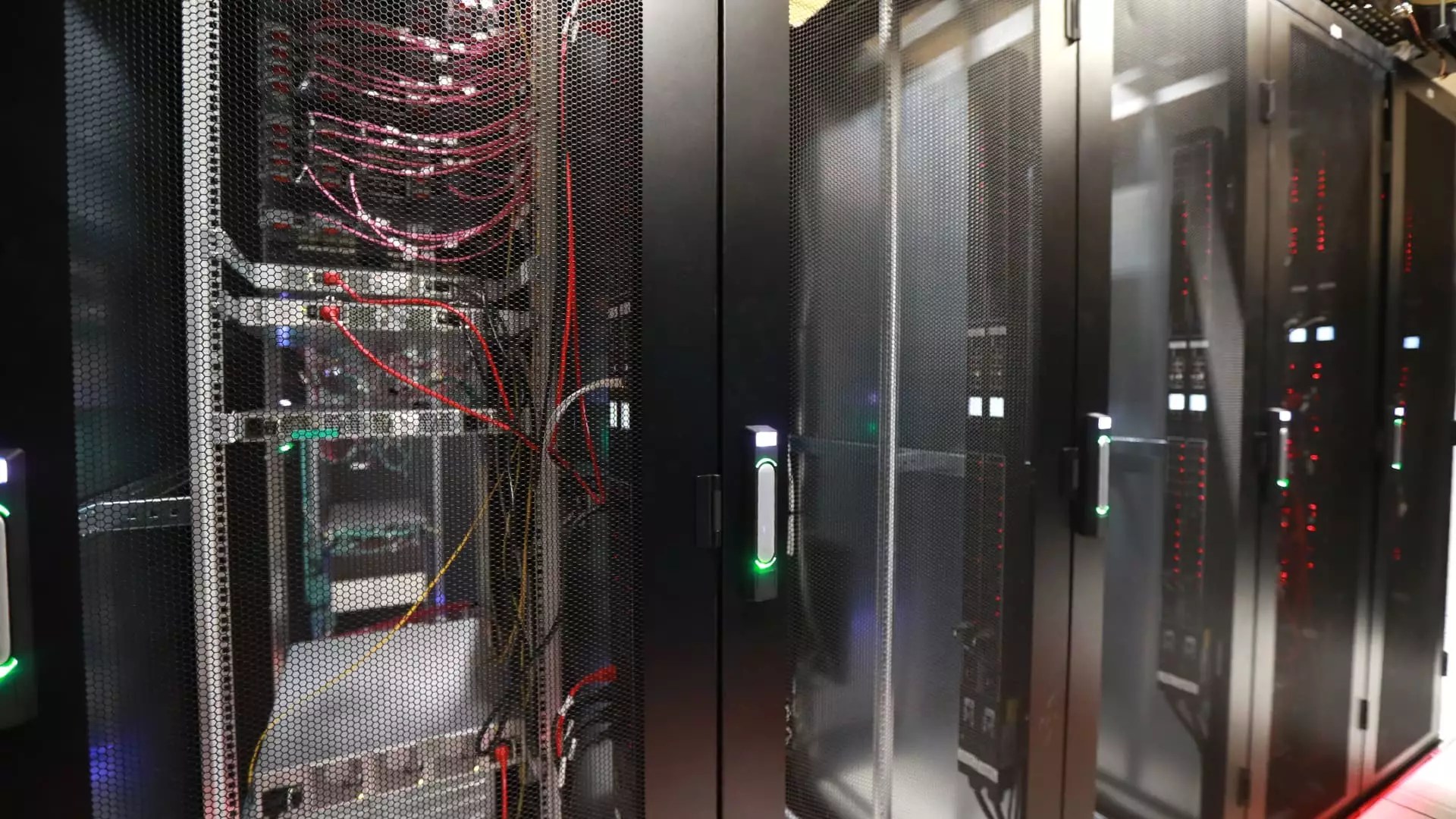

In a recent report by Moody’s Ratings, it has been highlighted that the demand for data centers is on the rise. This surge in demand can be attributed to the increasing computing needs of artificial intelligence and cryptocurrency, as well as the presence of large tenants such as cloud service providers and social media companies. Despite substantial growth in data center capacity in recent years, it has not been able to keep up with the escalating demand. Moody’s forecasts suggest that data center capacity will need to more than double by 2028 to meet the projected power consumption by data centers.

Digital Realty Trust and Equinix, two diversified data center landlords, are identified as key players well-positioned to benefit from this trend. Digital Realty Trust, with a year-to-date increase of over 9% and a 3.32% dividend yield, is actively investing in projects globally to meet the growing demand. On the other hand, Equinix has faced challenges, including being targeted by a short seller earlier this year. Despite this, Equinix remains a significant player in the market with a yield of 2.19%.

Both Digital Realty Trust and Equinix are increasing their use of joint venture arrangements and preleasing of capacity under construction to meet the demand for data centers. These strategies, coupled with good returns on new investments, are expected to help maintain their credit ratios and strong liquidity. Despite the risks posed by rapid technological innovations, Moody’s believes that these two REITs are better equipped than their peers to adapt to changes in the industry.

Digital Realty Trust and Equinix boast a substantial presence in key regions across the globe, with a total of about 71 million square feet of data center space combined. While Digital Realty generates a majority of its revenue from the Americas, Europe, the Middle East, and Africa, Equinix has a more balanced revenue distribution across these regions. Both companies have established relationships with hyperscalers and a diverse tenant base, which positions them well to attract data center tenants.

The real estate investment trusts are also expected to secure business from large hyperscaler clients expanding into new markets. Countries with strict data privacy and sovereignty regulations are likely to drive the demand for data centers located within their borders. This presents an opportunity for both Digital Realty Trust and Equinix, given their proven track records and global footprint.

The future of data centers looks promising, and real estate investment trusts like Digital Realty Trust and Equinix are poised to capitalize on this trend. Despite challenges and risks, these companies are well-prepared to meet the evolving demands of the data center industry and continue to attract tenants with their strategic investments and diverse portfolios.

Leave a Reply