The municipal bond market saw minimal movement on Thursday, with the final large deals pricing and mutual funds experiencing outflows. U.S. Treasury yields decreased, while equities showed an uptick towards the end of the day. The ratios between municipal bonds and Treasury securities varied across different timeframes, highlighting the uncertainty in the market.

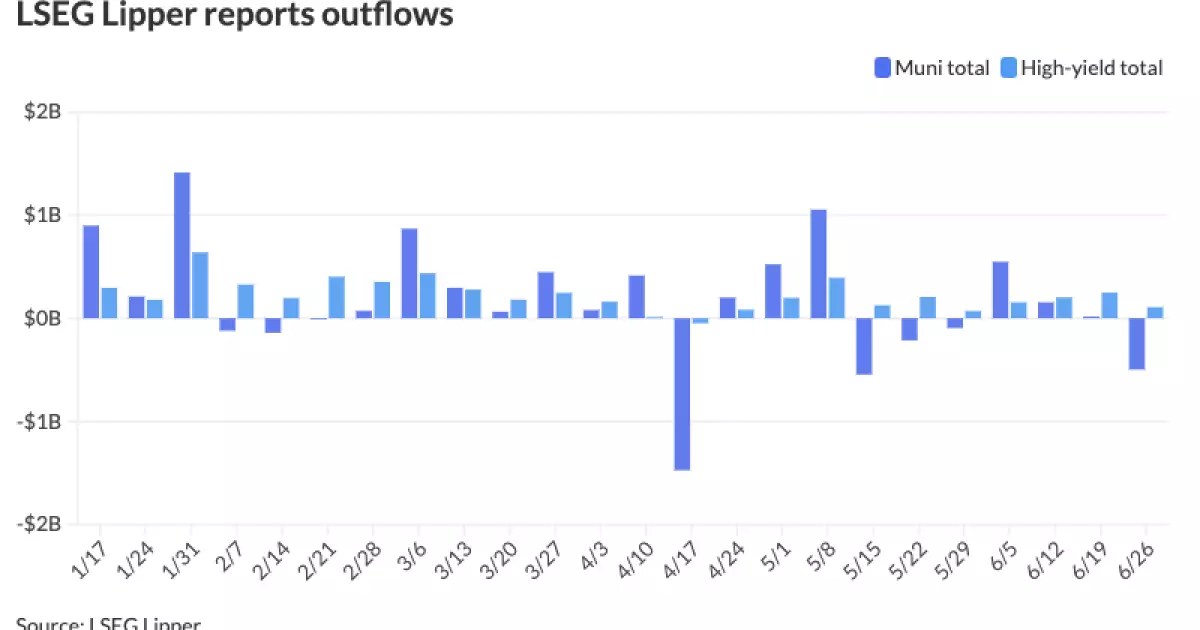

Municipal bond mutual funds witnessed significant outflows as investors withdrew $498 million, following a week of $16 million in inflows. The outflows were primarily driven by long-term funds, signaling a shift in investor sentiment. Despite this, high-yield bonds continued to attract investments, with $107 million flowing into the sector. This contrast underscores the divide in demand within the municipal bond market.

The recent Federal Open Market Committee meeting and the shortened trading week preceding the current one have distorted the market dynamics, making it challenging to gauge investor demand accurately. According to experts like Pat Luby, the head of municipal strategy at CreditSights, the slowdown in investment activity is expected given the timing in the financial calendar. The market witnessed an unusual surge in demand during last week’s $2.55 billion deal for the John F. Kennedy International Airport New Terminal One Project, driven by unique features and high demand for AMT paper.

In the primary market, notable deals were closed, such as Morgan Stanley’s issuance of $1.086 billion senior sales tax bonds and Jefferies’ $130.665 million revenue refunding bonds for the State Building Authority of Michigan. These transactions reflect the continued activity in the municipal bond space, despite the overall market uncertainty. Companies like Siebert Williams Shank and RBC Capital Markets also facilitated significant bond issuances, emphasizing the diversity of offerings in the market.

Preliminary data for June indicates a 4% increase in issuance compared to the previous year, showcasing the resilience of the municipal bond market. Looking ahead, the market anticipates a slowdown in new-money borrowings after the Fourth of July holiday, with a potential focus on refundings. This strategic shift is evident in the June figures, where new-money issuances decreased while refundings surged, indicating a shift in investor preferences towards more stable avenues.

J.P. Morgan strategists project a favorable outlook for the market in the coming weeks, citing the influx of reinvestment capital post-July 4th. The timing of reinvestment activities is crucial, with significant payments scheduled for July 1st, providing a boost to market liquidity. Conversely, July 15th marks a period of lower payments, highlighting the ebb and flow of capital movements in the market. These dynamics, coupled with additional refunding capital expected in the following months, are expected to sustain market activity through July and August.

The municipal bond market continues to navigate through periods of volatility and uncertainty, driven by changing investor sentiments and market conditions. While outflows in mutual funds raise concerns, the resilience of high-yield bonds and the sustained primary market activity reflect underlying strength. As the market heads into the summer months, strategic considerations around new-money borrowings and refundings will shape the investment landscape. With reinvestment capital playing a pivotal role in sustaining market liquidity, the coming months present opportunities for investors to capitalize on evolving market trends.

Leave a Reply