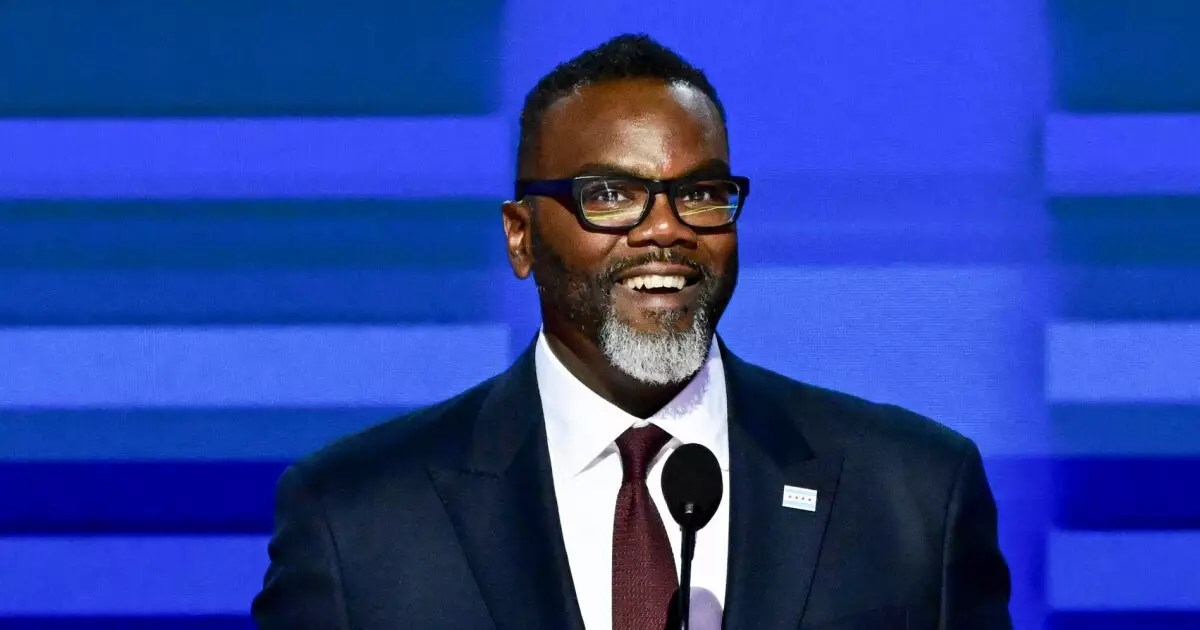

Chicago recently released a budget forecast indicating a significant increase in its corporate fund deficit in the coming years. The deficit is projected to grow from $222.9 million at the end of 2024 to a staggering $982.4 million in 2025. This forecast, provided by Mayor Brandon Johnson’s administration, paints a concerning picture for the city’s financial future. The downside scenarios outlined in the forecast suggest a potential gap between revenue and expenditures of $1.578 billion in 2026 and $1.928 billion in 2027. On the other hand, the upside scenarios offer some relief with gaps of $633.8 million in 2026 and $702.6 million in 2027, but the overall outlook remains grim.

The past few years have seen some improvements in Chicago’s fiscal situation, attributed to pandemic relief funding and increased pension contributions. However, the new forecast has raised concerns among investors and bond raters. The substantial deficit highlighted in the forecast poses a significant challenge to the market demand for city bonds. The ability to close such a large budget gap is not impossible, but it will require substantial efforts. The forecast points to underlying issues that demand long-term solutions rather than short-term fixes.

The forecast indicates that state-level changes, such as adjustments in how corporations report operating losses and shifts in tax revenue allocation, are key factors contributing to the revenue gap. In addition to these immediate concerns, future years’ projections point to a combination of revenue and spending factors driving the deficit. Despite being a vibrant economy with notable developments like the expansion of research facilities and corporate partnerships, Chicago is facing a complex fiscal challenge that requires careful navigation.

The forecast also sheds light on the challenges faced by essential public services in Chicago, including the Chicago Public Schools and the Chicago Transit Authority. Both entities are grappling with budgetary constraints and operational challenges that threaten their sustainability. The need for long-term planning and strategic decision-making is paramount to ensure the continued delivery of critical services to the city’s residents.

The forecast underscores various uncertainties that Chicago must address, including property tax valuations, pension funding, and revenue generation strategies. The city’s approach to these challenges will significantly impact its financial stability and long-term economic health. Balancing the budget, exploring innovative revenue sources, and implementing effective cost-saving measures will be crucial for Chicago to navigate its way out of the looming fiscal crisis.

Chicago’s fiscal forecast presents a sobering reality that demands immediate attention and decisive action. The city’s economic resilience will be put to the test in the coming years, requiring a careful balance of prudent financial management and strategic investments. By addressing the root causes of its financial challenges and embracing sustainable solutions, Chicago can chart a path towards a more stable and prosperous future.

Leave a Reply