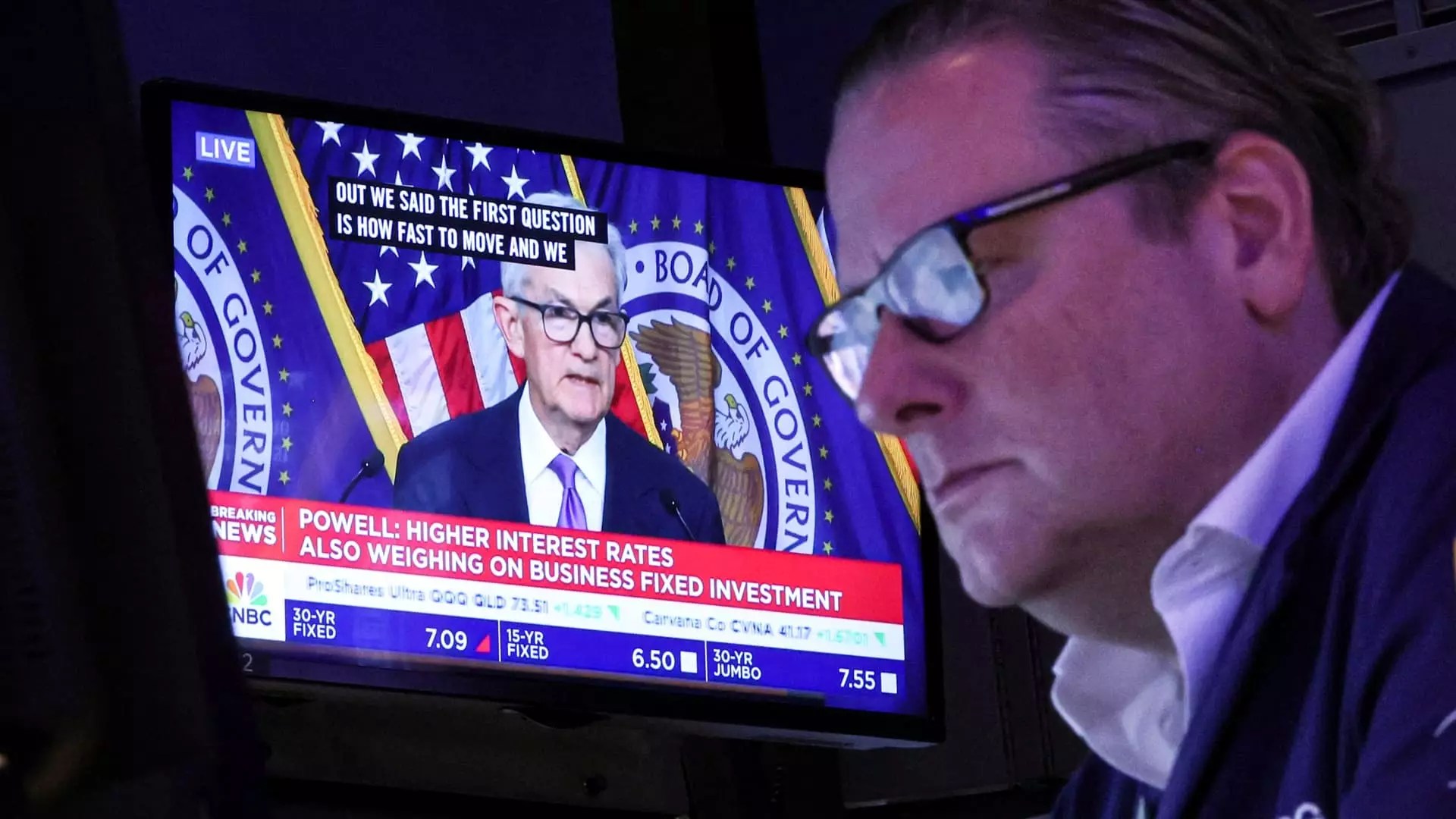

The Federal Reserve is poised to lower interest rates once again, a move that indicates a significant shift in monetary policy as it responds to economic pressures. On December 18, the conclusion of a two-day meeting will likely witness the third consecutive rate cut, reducing the federal funds rate from a range of 4.50%–4.75% to 4.25%–4.50%. This decision is rooted in the Fed’s cautious recalibration following a series of rate hikes implemented in response to alarming inflation levels that reached a 40-year peak. This article explores the potential effects of this anticipated decision on consumers and the broader economy, reflecting the complexity of the modern financial landscape.

The functions of the Federal Reserve extend beyond merely setting interest rates; they are integral to shaping the overall economic climate. When the Fed cuts rates, it aims to stimulate borrowing and spending by making loans cheaper. This dynamic becomes particularly significant as we reflect on consumer behavior trends in the wake of rising interest rates over the past few years. Analysts like Jacob Channel emphasize the essence of understanding the implications of fiscal policy changes—especially in the light of potential uncertainties surrounding the incoming administration.

By adopting a “wait-and-see” strategy, the Fed looks to gauge the implications of the future administration’s policies. Such caution reflects a broader awareness of the economic landscape that encompasses fiscal, consumer, and global factors. As the Fed considers its next steps, fluctuations in consumer borrowing costs create mixed signals for widespread economic recovery.

Interest rate adjustments do not uniformly affect all types of consumer borrowing. For instance, credit cards, which typically have variable interest rates, are often the first area where consumers feel the squeeze of rising rates. As reported by Bankrate, the average credit card rate has escalated to 20.25%, which is alarmingly close to all-time highs. Despite the Fed’s rate cuts starting in September, there’s a discernible lag in how credit card issuers adjust their rates, often taking months to reflect changes. In this context, financial advisors like Greg McBride recommend proactive measures such as transferring balances to lower-rate cards as a more effective strategy for managing debt.

Contrarily, fixed-rate products like mortgages are insulated from immediate rate cuts. With average rates hovering around 6.67% for 30-year fixed loans, consumers locked into lower rates prior to the hikes will see no change unless they choose to refinance. As economic conditions fluctuate, prospective homebuyers should remain vigilant about their financing options, as shifts in rates can in turn affect home affordability.

Auto loans exemplify another layer of complexity in consumer borrowing. Although these loans typically come with fixed rates, the persistent rise in vehicle prices has inflated monthly payments to staggering averages near $40,000. Even with favorable interest rates, the burden of high financing amounts makes the first-time car purchasing experience increasingly challenging. Experts suggest that while lower rates might eventually bring some relief, consumers should focus on the substantial overall price tags associated with new vehicles.

Similarly, student loans present a unique scenario. While federal student loan rates tend to remain static, fluctuations arise primarily in private loans, which may be tied to prevailing rates in the market. As the Fed cuts rates, borrowers with variable-rate private loans could benefit from decreased costs. However, refinancing carries risks, especially for those transitioning from federal loans to private lenders, as they would lose critical safety measures offered by federal agreements.

Interestingly, even in a climate of falling interest rates, there remains a silver lining for savers. Online savings accounts currently boast yields that approach 5%, marking a period of robust returns for consumers willing to stash away their cash. McBride posits that this scenario represents a crucial opportunity for consumers, highlighting how this saving context coexists amid broader economic turmoil.

With these complex financial elements in mind, it’s vital for consumers to fully grasp how interest rate decisions interplay with their daily financial decisions. From managing credit card debt to evaluating mortgage options, the Fed’s actions can send ripples across various segments of the consumer economy. The anticipated rate cuts signal not only a response to inflation pressures but also an attempt to foster a more sustainable economic environment amid a backdrop of uncertainty. As the meeting approaches and decisions are made, future implications for consumers will remain a critical area of focus in understanding our ever-evolving economic landscape.

Leave a Reply