The municipal bond market is undergoing notable transformations fueled by shifts in U.S. Treasury yields and broader economic fluctuations. As government bonds fluctuate in response to various economic indicators, municipal bonds have continued to capture the attention of investors, particularly amidst volatile market conditions. In this article, we will explore the current state of municipal bonds, the performance of various issuances, and the implications for future supply and investor behavior.

Understanding Recent Trends in Municipal Yields

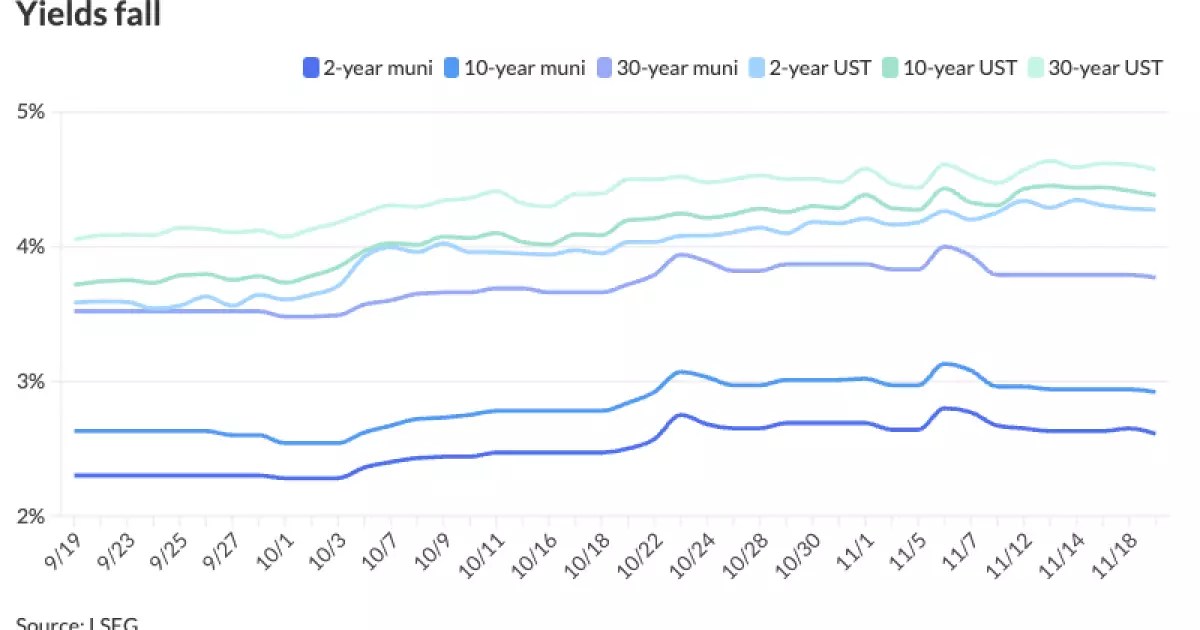

On a recent trading day, municipal bonds showed improvement, characterized by varying yield movements across the curve. The Triple-A municipal bond yields varied from one to six basis points as market dynamics shifted. In contrast, U.S. Treasury securities also exhibited minor gains, particularly notable for longer-term bonds, signaling an intriguing interplay between municipal and government debt markets. This environment has established a backdrop where municipal bonds consistently outperform their U.S. Treasury counterparts, primarily due to heightened investor demand and the favorable yield differentials.

One of the significant findings is that retail investors are increasingly gravitating towards smaller transactions, a reflection of their desire for stable income amidst economic uncertainty. Analysts have pointed out that ratios comparing short-term municipal loans to other securities have reached what could be considered “uniformly rich levels,” suggesting a compelling investment opportunity, especially for short-term maturities.

The municipal bond market is also witnessing a robust appetite as pent-up demand from investors begins to surface post-election cycles. Notably, this week has seen a solid representation of new issuances, including a noteworthy $1 billion project focused on high-yield United Airlines’ terminal improvements in Houston. The demand for such significant offerings indicates a backdrop of investor confidence, which companies are leveraging to finance expansive projects.

Industry experts such as Chris Brigati have remarked that while the upcoming weeks may offer a lighter calendar in terms of new issuances, the prevailing demand suggests that recent offerings will be readily absorbed by the market. The tight ratios and significant investor interest in these offerings highlight a strategic engagement from retail investors, eager to secure a piece of premium debt.

The Role of Mutual Funds and Inflows

Interestingly, this renewed investor enthusiasm extends to mutual funds and exchange-traded funds (ETFs), which have reported modest inflows recently. This momentum could be indicative of a broader trend, leading to approximately $30 billion of inflows predicted for mutual funds by the end of the year. Over a 15-year timeline, this forecast positions the current year as one of the top five in terms of mutual fund performance.

However, there is caution in the air. Analysts express uncertainty regarding whether mutual funds can maintain this positive trajectory through the year’s conclusion. Increased supply towards year-end could significantly affect performance, contingent on the interest rate dynamics and broader market sentiment influenced by inflation concerns and credit apprehensions.

Market sentiment remains intricately tied to how economic data unfolds in the coming weeks. Analysts warn that for the municipal bond market to sustain current levels of attractiveness, yields must stabilize or face incremental increases to accommodate potential risk factors attributed to external economic pressures. The projection of a total supply nearing $500 billion for the year indicates a serious commitment from issuers and reflects confidence in upcoming market engagements.

As various entities move forward with significant project funding, including initiatives tied to green energy and essential infrastructure, investors will likely face a myriad of opportunities. With competitive pricing and structures emerging in the municipal bond sector, the ability to secure favorable terms remains high, enticing a diverse investment audience.

Looking Ahead: Opportunities and Challenges

As we look ahead, the municipal bond market will continue to navigate an array of challenges and opportunities. The interplay of investor appetite, yield fluctuations, and potential economic turmoil will shape the future dynamics of this sector. Should primary market conditions remain favorable, we could witness increased complexity and competition in how these bonds are structured and marketed.

With a robust issuance pipeline, excellent liquidity conditions, and an engaged retail investor base, the municipal bond market is poised for an interesting phase ahead. The demand for high-quality, yield-bearing assets remains a priority, reinforcing the critical role that municipal bonds play within an investor’s diversified portfolio. As the economic landscape evolves, it will be crucial for market participants to adapt strategies that respond to changing conditions while capitalizing on emerging opportunities.

Leave a Reply