The municipal bond market has recently experienced notable fluctuations, particularly as we approach the end of the fiscal year. During the recent week, we witnessed significant adjustments in yield curves, with the triple-A rated municipal securities facing marked losses. This article will delve into the causes of these fluctuations, the market’s reaction to federal interest rate changes, and the implications for investors in the municipal bond space.

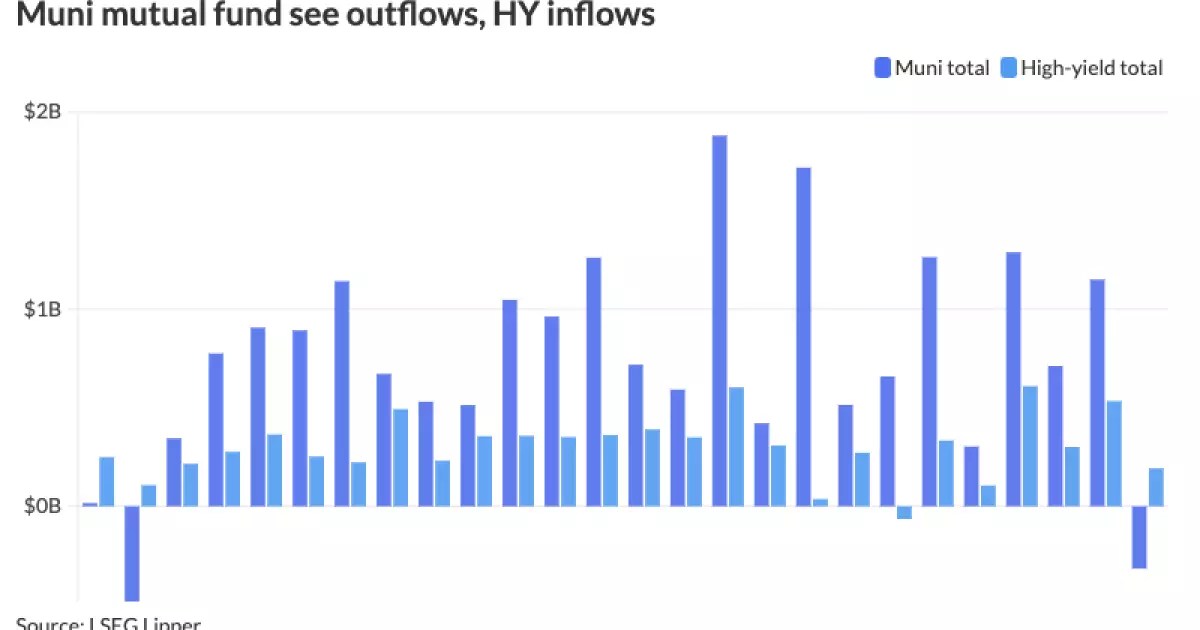

Over the past week, municipal bonds have faced a downturn, culminating in Thursday’s yield curve corrections. The market saw a decline in the value of municipal bonds, with yields being reduced by two to ten basis points. This downtick coincided with a rise in U.S. Treasury yields, which increased by four to seven basis points. Moreover, municipal mutual funds reported an outflow of $316.2 million for the week ending December 11, marking a significant shift after an uninterrupted inflow streak that lasted over 23 weeks. Just the previous week, outflows had reached a robust $1.15 billion.

Interestingly, while overall municipal bond funds faced outflows, high-yield municipal bond funds defied the trend, experiencing inflows of $192.3 million. This contrast raises questions about investor sentiment and market triggering factors, particularly in response to fiscal policy changes and anticipated interest rate adjustments. Mark Paris, the Chief Investment Officer at Invesco, highlighted that recent years have made the municipal market particularly susceptible to the movements within the federal interest rate scenarios. Even as the Federal Reserve contemplates rate cuts, the municipal bond market remains tethered to the fluctuations in Treasury rates.

The ratio of municipal bonds to U.S. Treasuries offers an insightful snapshot of market performance. Following the recent adjustments, the two-year ratio reached 62%, the five-year scaled to 64%, and the ten-year hit 66%. These ratios indicate the relative yield attractiveness of municipal bonds compared to their Treasury counterparts, affecting investor choices significantly. As Paris remarked, the prevailing question now is whether these ratios can maintain resilience as Treasury rates continue to decline.

As investors assess the potential for extended declines in Treasury yields, navigating the liquidity landscape is critical. The surge in “bid wanted” listings, reaching $2.41 billion, indicates heightened demand for cash. This volume is the highest observed in over two years, exacerbating the competitive nature of the municipal bond market. According to Kim Olsan, a senior portfolio manager at NewSquare Capital, the uptick is likely driven by cash-raising efforts and strategic positioning as the year-end approaches.

As we analyze the current financial landscape, we note a significant increase in volatility within money market yields, particularly municipal and taxable markets. For instance, tax-exempt municipal money markets witnessed capital outflows of $1.25 billion, reducing total assets to approximately $134.94 billion. In contrast, taxable money-fund assets had a significant uptick with $6.94 billion added. Such contrasts highlight the ongoing reallocation of investment strategies among diverse investor cohorts amid these changing dynamics.

Additionally, average yields for taxable funds have noticeably diverged, with yields reaching 4.28%, compared to tax-exempt funds falling to 1.83%. The implications of this yield spread underscore an essential aspect of asset allocation strategies for investors who need to adapt to prevailing conditions while seeking optimal returns.

Future Outlook for the Municipal Bond Market

Despite the recent setbacks, analysts anticipate a robust future for municipal bond issuance. Expectations signal that the 2024 issuance will potentially set new records, underpinned by market appetite and strategic investment decisions. Upcoming municipal bond offerings, including significant sums from entities like the New York City Transitional Finance Authority, reflect ongoing confidence in municipal financing.

However, as Paris points out, the actual momentum in issuance will hinge on multiple factors, including Treasury rate trajectories and overall market flows. The dynamic financial landscape has led to speculation about issuance levels potentially reaching $500 billion in 2025, should market conditions remain favorable.

In an environment marked by shifting rates and investor sentiment, navigating the municipal bond market requires astute awareness of both macroeconomic and sector-specific signals. As observed, while municipal bonds have recently experienced some turbulence, the fundamental outlook remains cautiously optimistic. Investors must remain vigilant in assessing how interest rates interact with their municipal counterparts and prepare for potential volatility as year-end strategies come into play. The interplay between federal financial policies and local bond markets will continue to shape investment landscapes in the months ahead.

Leave a Reply