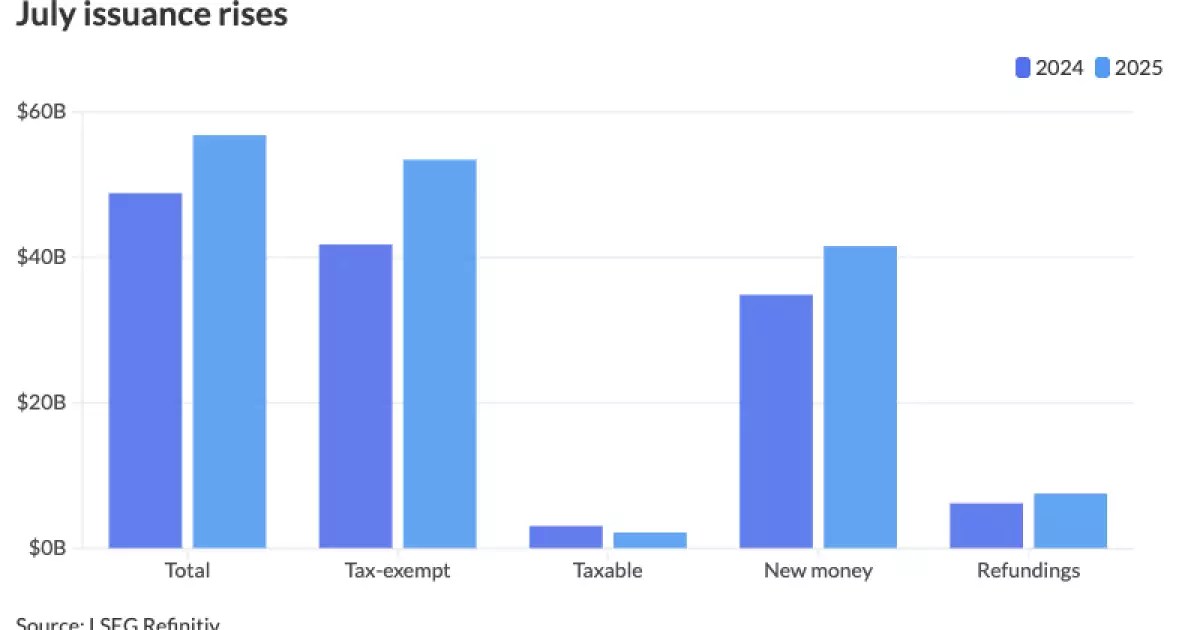

The first half of 2025 has witnessed an extraordinary escalation in municipal bond issuance, shattering previous records and signaling potential shifts in the fiscal landscape. With issuance soaring by over 14% compared to last year, reaching approximately $280 billion, the market’s ebullience warrants critical examination. While proponents might view this as a sign of robust investor confidence and healthy infrastructure development, skeptics should remain cautious about the underlying motivations and longer-term sustainability of such a frenetic pace.

This relentless wave of issuance largely stems from issuers and institutions rushing to lock in favorable market conditions amid growing political and economic uncertainties. The surge reflects not only a strategy to preempt potential tax policy changes—particularly threats to tax exemptions—but also an acceleration driven by volatile markets and a desire to capitalize on currently high demand. Such aggressive borrowing raises red flags about the soundness of this trend: Is it primarily a conservative move to safeguard assets in uncertain times, or a sign of overleveraging that could threaten market stability down the line?

Interestingly, the magnitude and speed of this issuance deviate sharply from historical norms. Traditionally, municipal markets experience a gradual build-up over several quarters, not an almost tumultuous burst of activity. The recent figures—weekly issuance frequently exceeding $10 billion, with peaks close to $20 billion—are unprecedented. While this can be framed as market vitality, another perspective considers the risks embedded in piling on debt during heightened volatility. This pattern suggests a fragile optimism, possibly unsustainable if market conditions shift or if broader economic indicators turn sour.

Political and Policy Factors Fueling the Rush to Borrow

One of the more compelling explanations for the current surge revolves around political jitters and legislative uncertainties. With headlines warning about the potential erosion, or even elimination, of key tax exemptions—especially private-activity bonds, hospital bonds, and financing for private universities—issuers have opted to frontload debt issuance to avoid future policy clampdowns. This tactic, although understandable, can backfire if the anticipated regulatory threats do not materialize, leading to an oversupply and potential bond market distortions.

Yet, recent developments offer some relief. The likelihood of outright repeal seems diminished as bipartisan consensus in Congress has left exemptions intact for now. Nevertheless, the shadow of uncertainty persists. Political debates about infrastructure funding, social programs, and tax reform continue to influence issuer behavior, prompting them to act decisively now rather than risk being locked out of advantageous tax treatments later. While this urgency can inject much-needed capital into critical sectors—particularly education, where elite universities have increasingly tapped the market—it raises questions about whether this rush is prudent or reckless in the long term.

### A Market Divided: Winners and Losers

State-level issuance paints a complex picture. California, unsurprisingly, remains the dominant player with over $45 billion issued—more than a quarter of the total for the nation—raising concerns about overdependence on debt to sustain growth and infrastructure. Texas, New York, and other large states follow, but the divergence in issuance patterns reflects differing regional economic climates and fiscal strategies. Notably, Pennsylvania’s staggering 88.5% increase indicates a possible shift toward more aggressive borrowing, perhaps driven by local needs or political impetus.

This uneven distribution begs the question: are these states collectively overextending themselves, or are they simply responding pragmatically to their unique infrastructural demands? The truth likely lies somewhere in between. A heightened borrowing environment could serve as an economic stimulant, yet it may also sow the seeds for future financial distress, especially if the underlying projects do not generate sufficient revenue or if market conditions deteriorate.

Implications for Investors and the Economy at Large

From an investment standpoint, the current scenario is both an opportunity and a cautionary tale. Higher interest rates—now in the vicinity of 30 to 40 basis points—offer investors a more attractive yield cushion that can help weather downturns. Still, the rapid influx of bonds escalates the risk of overcapacity, which can eventually lead to market saturation, a decline in bond prices, or increased default risks if projects fail to deliver value.

Moreover, the push to issue debt amid market volatility signals a potential misreading of risk. When issuers rush to lock in low interest costs today, they may be underestimating the impact of future interest rate hikes or economic slowdown. Such behavior is reminiscent of past bubbles—where exuberance in borrowing ultimately deflates with damaging consequences.

Financial institutions and market makers should also scrutinize the shifting landscape. The recent revisions in issuance forecasts—rising from $500 billion to over $600 billion—suggest that optimism is overriding caution. While increased supply does generate vitality and liquidity, it can also strain the system if investors become wary of overleveraged debt. Therefore, vigilant risk assessment and diversified portfolios should remain paramount.

The 2025 municipal bond market is currently riding a wave that is as impressive as it is potentially perilous. While the surge signifies economic resilience and strategic foresight, it demands a skeptical eye, especially from policymakers and investors. Without careful management, this enthusiasm might transform into an unmanageable debt burden, threatening the stability that has historically underpinned municipal finance.

Leave a Reply