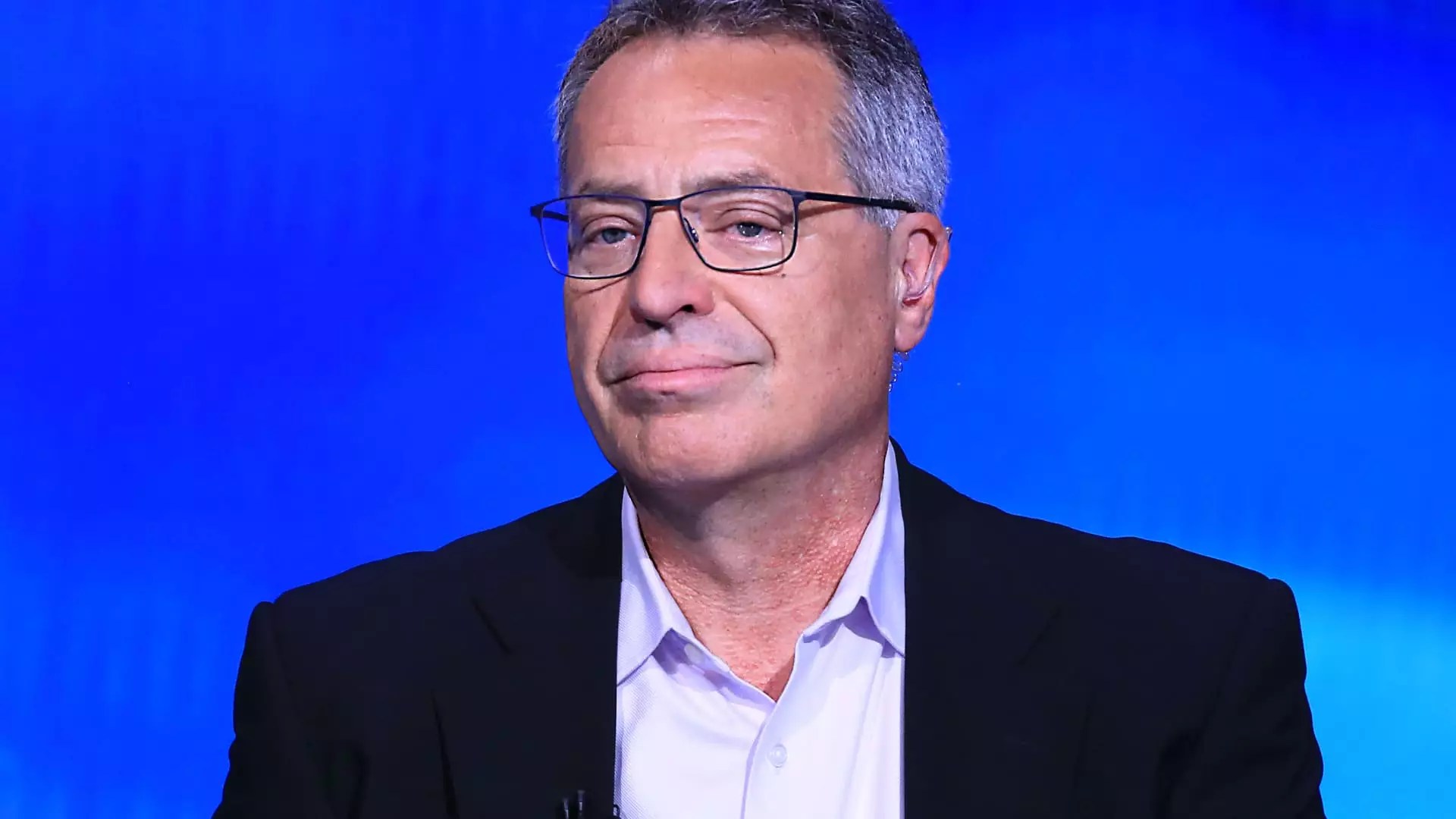

In today’s volatile financial landscape, investors constantly seek out undervalued stocks with promising fundamentals. Bill Nygren, a seasoned value investor and portfolio manager at Oakmark Funds, has highlighted Merck as an appealing candidate, particularly for those looking to add stability to their portfolios. Nygren’s confidence in Merck arises from its robust portfolio characteristics and the company’s intrinsic value, which he believes is currently mispriced in the market.

Merck has experienced a downturn this year, with shares plummeting by over 5%. Factors influencing this decline include a noticeable reduction in sales of Gardasil, its widely acknowledged human papillomavirus vaccine, particularly in China—one of its key markets. This has triggered concerns within the investment community. Nygren, however, views the situation as a value opportunity. He personally became interested in Merck earlier this year after engaging directly with its management team, including CEO Rob Davis, whose capabilities in melding financial and scientific perspectives impressed Nygren.

Nygren and his team decided to wait for a more opportune moment to enter the Merck market. The decision to purchase shares was made when the stock saw a further decline of approximately 8% in the third quarter, which offered a more attractive valuation. This strategic timing is critical in value investing, as it underscores the importance of patience and market comprehension. Nygren emphasizes that Merck’s established drug portfolio, particularly an extension of its successful Keytruda cancer treatment, positions the company well for recovery and profitability in the near future.

Interestingly, while Nygren remains bullish on Merck, he is simultaneously exploring investments in companies integrating artificial intelligence into their operations. Besides established names like Alphabet, he has pointed to Capital One and Charter Communications as emerging players that leverage AI to enhance efficiency and customer service. Capital One, for instance, is applying AI in its underwriting processes, significantly improving its decision-making capabilities. Charter Communications is utilizing AI to streamline operations in its call centers, thereby reducing costs while also enhancing the customer experience.

Nygren’s observations reflect a broader trend where traditional companies—often overlooked in the AI discourse—are becoming significant beneficiaries of technological advancements. These firms, much like Merck, offer potential upside as they adapt and leverage new technologies to improve operational efficiencies and customer engagement.

Bill Nygren’s focused approach emphasizes the value of thorough due diligence and a keen eye for both traditional and innovative investment opportunities. Merck stands as a testament to the potential rewards waiting to be reaped in the pharmaceutical sector, particularly when external market pressures create short-term volatility. Meanwhile, the rise of AI in established companies showcases the evolving investment landscape, where the intersection of technology and traditional sectors could yield considerable benefits for insightful investors. As the market continues to shift, those who adopt a strategic and patient investment philosophy are poised to find lucrative opportunities.

Leave a Reply