The municipal bond market is undergoing some interesting yet complex changes, reflecting a mix of stability and fluctuation as market participants navigate the latest developments. As of Thursday, short-term municipal bonds appeared to gain a slight edge, fueled by increased inflows into municipal mutual funds. This activity occurs against a backdrop of rising U.S. Treasury yields and a decline in equity prices, creating a delicate equilibrium within fixed-income investments. According to Refinitiv Municipal Market Data, the two-year muni-to-Treasury ratio was reported at 64%, demonstrating a gradual, albeit cautious, optimism among investors considering their bond portfolios.

These dynamics highlight an essential aspect of the municipal market: the correlation between municipal bonds and the broader financial landscape. Even though municipal yields are rising in tandem with Treasuries, the increased inflows into mutual funds reflect investors’ continued trust in the relatively stable credit qualities inherent in municipal bonds.

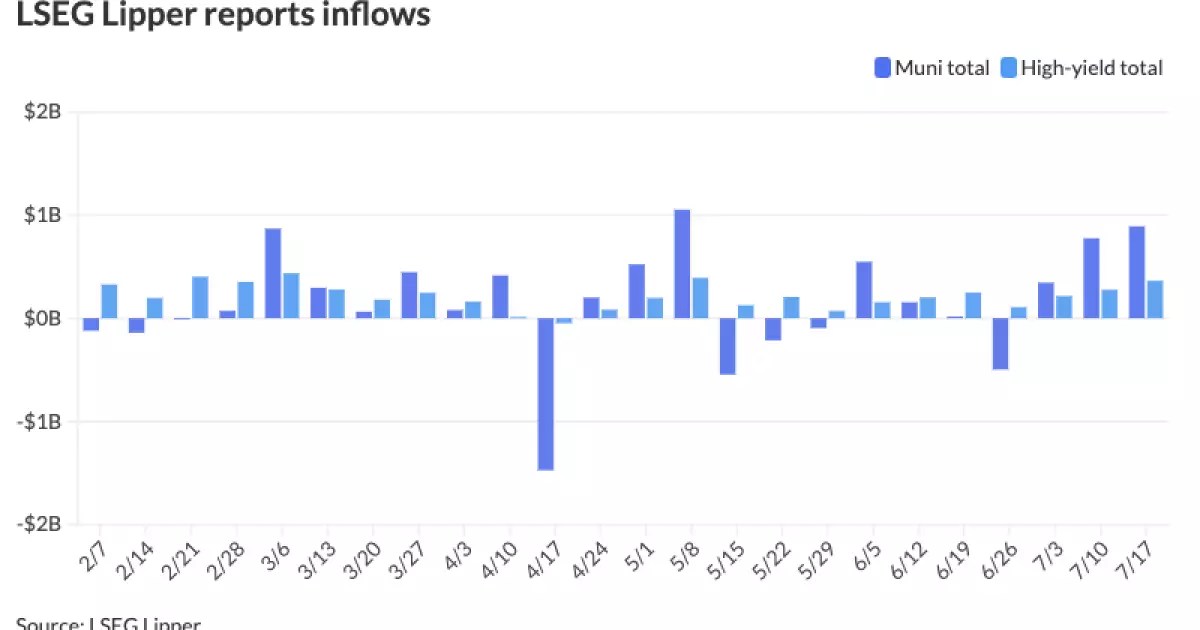

The recent statistics illustrate a notable surge in investor confidence, characterized by substantial inflows into municipal bond mutual funds. The data reveals an inflow of $891.4 million, a significant rise from the previous week’s $775.3 million. The high-yield segment of municipal bonds continued to demonstrate strength, registering inflows of $364.4 million after a $276.4 million uptick the week prior. Such momentum positions the municipal market favorably, indicating robust investor sentiment towards high-yield securities.

Strategists from GW&K Investment Management have noted that the outlook for munis has improved markedly throughout the second quarter of the year, which can be attributed to both absolute yield levels and the relative value ratios that have begun to ease from tight positions. This uptick in optimism suggests a maturity in the market that may provide resilience against the looming volatility often presented by Treasury yields.

Experts observe that July typically stands out as one of the best-performing months for municipal bonds, driven by seasonal influences, which can be crucial for investors developing strategies for the summer months. Analysts from BlackRock suggest that while some performance results may have advanced into June, prevalent factors such as favorable interest rates, attractive yields, and the overall seasonal nature of supply should bolster bond market stability and performance in July.

Market activity shows signs of a favorable influx of money from municipal bonds as it enters the traditional “summer blend” period characterized by increased reinvestment flows and a slowdown in new issuance. However, analysts caution that despite this optimism, one must recognize the risks tied to this steady growth. Any disruption in economic factors could challenge the performance metrics observed thus far.

Despite recent volatility, the municipal bond issuance landscape remains active, particularly with several large-scale deals anticipated shortly. A recent issuance by Morgan Stanley for San Francisco’s Public Utilities Commission and other notable transactions, including BofA Securities’ issuance of green bonds, underscore the ongoing commitment to sustainable investment strategies.

The current environment of high-quality issuance reinforces the idea that the market is absorbing incoming investments, maintaining a deep liquidity backdrop. Craig Brandon, co-head of muni investments at Morgan Stanley, articulates that though market indices have remained flat year-to-date, this stagnation should not be misconstrued negatively. Instead, it highlights the existing supply and demand imbalance that characterizes the high-yield segment.

Future Outlook: Caution Amidst Opportunities

As we anticipate future developments, the impending presidential elections could introduce market volatility, with potential shifts in investor sentiment driven by political headlines. GW&K strategists recommend a cautious approach, noting that while current fundamentals appear robust, substantial compression of spreads could limit opportunities for significant gains.

The future trajectory of municipal bonds may also depend significantly on macroeconomic factors, particularly actions by the Federal Reserve regarding interest rates. Brandon suggests that a potential shift towards longer-dated securities might favor municipal bonds as investors seek more risk-reward profiles. A coordinated response to changes in monetary policy dynamics and economic conditions will be crucial in shaping the municipal bond landscape.

The intricacies of the municipal bond market reflect broader economic narratives, with current trends indicating both challenges and opportunities. As the market continues to evolve, robust financial strategies grounded in analysis will be essential for navigating these complex waters.

Leave a Reply