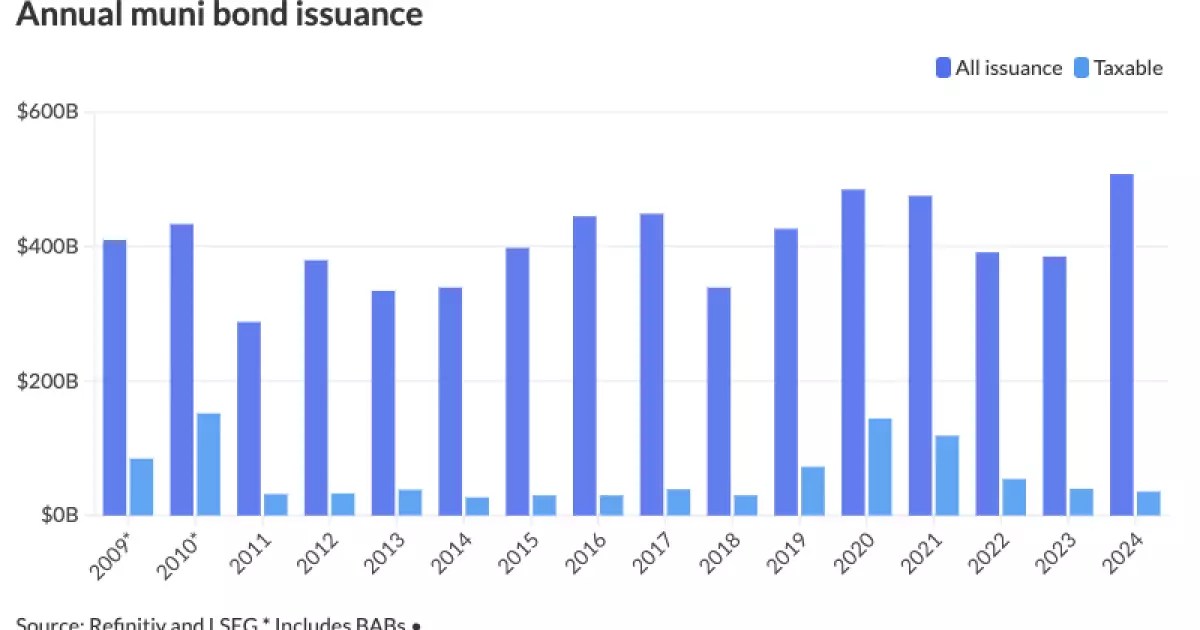

In 2024, the municipal bond market experienced a seismic shift as issuances hit an astonishing $507.585 billion, a significant leap from the $385.061 billion recorded in 2023. This 31.8% increase not only set a new benchmark but also shattered the prior record of $484.601 billion set in 2020. Various factors converged to catalyze this surge, encompassing infrastructure expenditure needs, political dynamics surrounding the 2024 elections, and an influx of mega deals that prompted issuers to flood the market. The sharp rise in tax-exempt bond issuance, which saw a 36% growth, indicates a vigorous demand for such instruments, despite a decline in taxable issuance. This article dives into the elements steering this monumental increase, the implications for different stakeholders, and forecasts for the coming years.

The substantial uptick in issuance can be attributed largely to the waning federal aid that had previously provided municipalities with liquidity, allowing them to defer bond issuance. As federal stimulus from prior years dissipated, a pressing need arose for regions to secure funding for critical infrastructure projects, such as roads, hospitals, and educational institutions. This urgency led municipalities to re-engage with the bond market to meet their infrastructural demands, particularly in rapidly expanding regions like the Southwest and Southeast United States, where urban growth is demanding immediate infrastructure improvements.

Chris Brigati, Chief Investment Officer at SWBC, emphasizes how issuers maintained cash reserves thanks to earlier stimulus packages, but with those resources drawing to a close, the need to issue bonds became imperative. With 2024 being a “Goldilocks year” for issuers, characterized by viable yields for both buyers and sellers, the environment for municipal bonds proved fertile. The high yield range created a favorable condition for issuers to enter the market without fearing unsustainable costs. According to Kim Olsan, a senior portfolio manager at NewSquare Capital, despite market volatility, the trading landscape allowed for effective placements, signaling overall positive sentiment towards issuance.

The phenomenon of mega deals—I.e., bond issuances surpassing the billion-dollar mark—gained momentum in 2024, indicating a shift in issuer confidence and market receptiveness. Ten years ago, the acceptance of such large-scale deals was uncertain, but this year’s positive reception underscores a growing market sophistication. These significant deal sizes contributed to higher liquidity, thus attracting a broader spectrum of buyers.

Moreover, the upcoming presidential elections also played a consequential role. As seen in previous election cycles, a surge in issuances typically occurs in the months leading up to elections as issuers seek to preempt any potential market disruptions. The issuance figures in October—reaching a record $64.643 billion—illustrate this pattern. Market participants sought to lock in rates before the unpredictability surrounding elections could affect conditions.

December 2024 marked a notable conclusion to the year with issuance figures of $31.646 billion, reflecting a 14.6% increase from December 2023. Tax-exempt and new-money issuances led this spike, underscoring a strong year-end performance. Significantly, refunding volumes experienced a decline, underlying a possible shift in strategic financial planning among issuers who are increasingly pursuing new projects rather than refinancing older debts.

California emerged as the frontrunner in terms of issuance, with a notable $71.601 billion—a growth of 31.4% from 2023. Texas and New York followed suit, demonstrating regional variances in bond market dynamics. Florida’s remarkable leap of 103.3% underscores the vibrant economic conditions in the state, which may pave the way for more aggressive issuance in the future.

The outlook for 2025 is optimistic, with projections suggesting issuances may range from $480 billion to as high as $745 billion. Most analysts agree that a continued influx of funding is necessary to meet ongoing infrastructure and operational needs, suggesting that the pace set in 2024 may very well persist. However, potential changes in tax policy and macroeconomic factors such as inflation and interest rates could ultimately determine the extent of municipal borrowing in the upcoming year. The expectation of a stimulus to address $4 trillion of funding needs from the expiring Tax Cuts and Jobs Act indicates that municipal authorities could strategically leverage the bond market to fulfill budgetary requirements.

As the municipal bond landscape continues to evolve in response to economic, political, and infrastructure needs, stakeholders should remain vigilant. The confluence of these factors makes the upcoming year crucial for municipalities aiming to finance pressingly needed projects and navigate the potential volatility of a changing economic landscape.

Leave a Reply