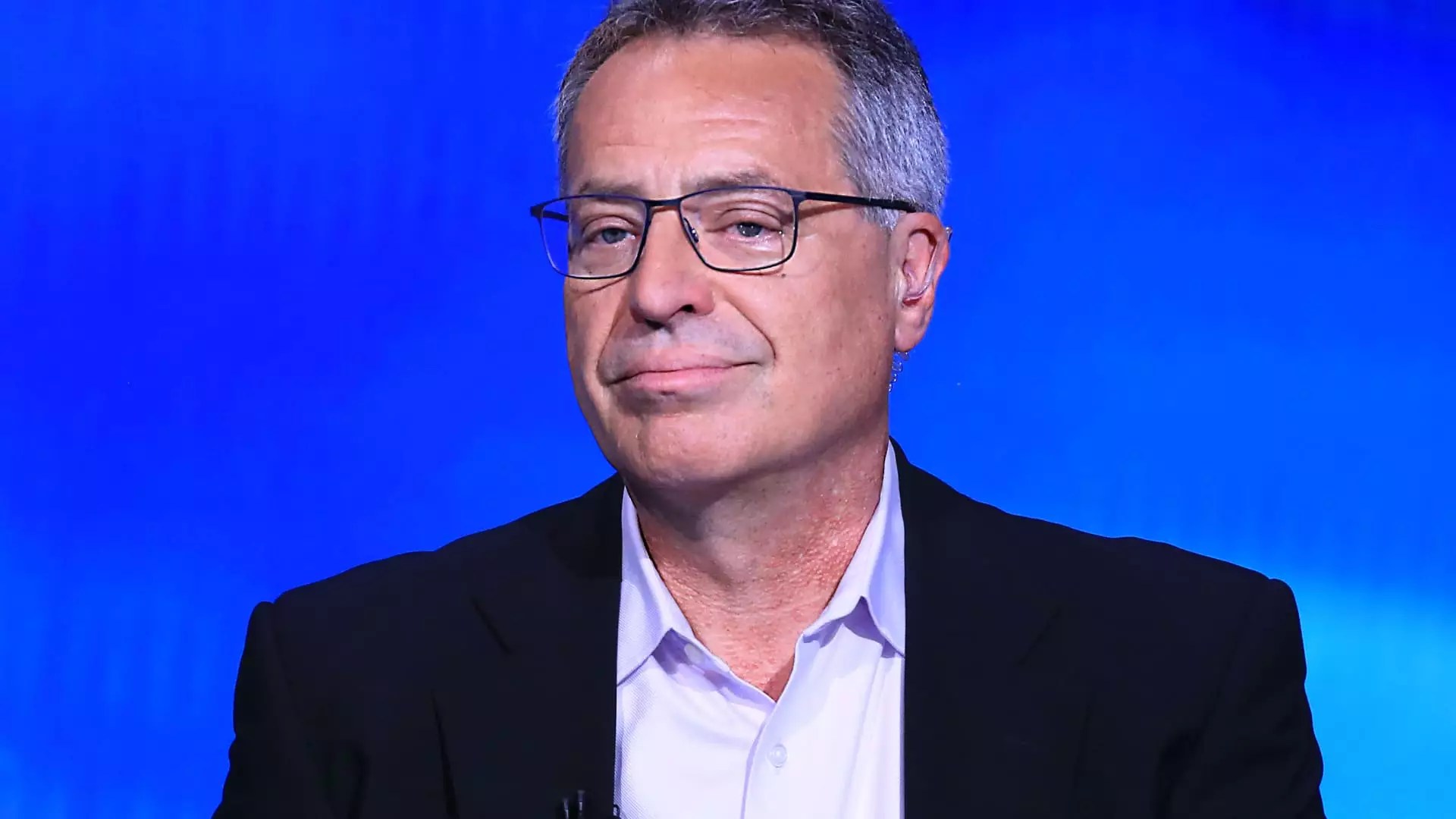

In the landscape of modern investing, legendary value investor Bill Nygren signals a concerning trend regarding the S&P 500 index. Traditionally heralded as a bastion of diversification, Nygren emphasizes that this widely followed benchmark is increasingly concentrated within a select group of technology giants. During a recent interview on CNBC’s “Squawk on the Street,” he pointed out that a mere 25 companies, predominantly in the tech sector, make up approximately half of the entire index’s value. This shift denotes a critical alteration in the fabric of the S&P 500, challenging the notion that investing in this index equates to a diversified, low-risk strategy.

The current market climate presents a paradox. While the S&P 500 has surged nearly 20% to establish new record highs, this rally has been predominantly fueled by a handful of megacap tech companies like Nvidia and Meta Platforms. Such a narrow leadership raises red flags for many investors, suggesting a fragility within the ongoing bull market. The concentrated gains indicate that should these tech titans falter, the broader index could suffer disproportionately. Nygren’s perspective prompts investors to reassess their reliance on the S&P 500 as a holistic measure of market health and as a gateway to lower risk exposure.

With the tech sector’s dominance casting a shadow over other investment opportunities, Nygren has strategically shifted his focus toward undervalued stocks beyond the tech realm. He asserts that the prevailing negative sentiment surrounding value stocks has created a ripe environment for discerning investors willing to dig deeper for opportunities. In this pursuit, he emphasizes the significance of companies engaging in substantial stock buyback programs. By actively repurchasing shares, these companies can drive their stock prices higher independently of external market pressures, which positions them as attractive investment prospects.

One prime example from Nygren’s investment playbook is Corebridge Financial, a relatively under-the-radar company worth noting. Spun off from American International Group (AIG), this $15 billion player in the retirement and life insurance sector is being traded at approximately $28 per share. Nygren’s analysis forecasts that Corebridge’s stock could appreciate significantly, projecting a book value of $50 by 2025 or a valuation of four to five times its earnings. With the potential to repurchase 20% of its outstanding shares annually, Corebridge exemplifies the type of strategic action Nygren believes can empower less recognized companies to unlock value without relying on broader investor enthusiasm.

As investors navigate this evolving financial landscape, Nygren’s insights serve as a crucial reminder to rethink traditional investment strategies. The increasing concentration of power within the S&P 500’s tech sector and the potential pitfalls of a market heavily reliant on a select few stocks urge a broader exploration of undervalued opportunities. By embracing a more discerning investment approach and paying attention to companies committed to enhancing shareholder value through buybacks, investors may find refuge from the apparent vulnerabilities of today’s bullish tendencies.

Leave a Reply