In a noteworthy development within the financial markets, municipal bonds exhibited a marginal decline on Wednesday, marking the fourth consecutive day of weakness amidst fluctuating trends in U.S. Treasuries and equities. This gentle retreat in municipal yields— which were noted to decrease by approximately three basis points—came alongside an increase in Treasury yields, which rose by four to five basis points. The two-year U.S. Treasury yield has now surpassed the 4% threshold for the first time since late August, illustrating a significant shift in investor sentiment.

The latest figures reveal that the two-year municipal-to-Treasury yield ratio stood at 61% on Wednesday, indicating a strong relative positioning for munis in different maturity ranges. As observed by Refinitiv Municipal Market Data, other ratios for three, five, ten, and thirty-year munis were recorded at 60%, 62%, 67%, and 84%, respectively. This demonstrates some resilience in the municipal market against the backdrop of rising government bond yields.

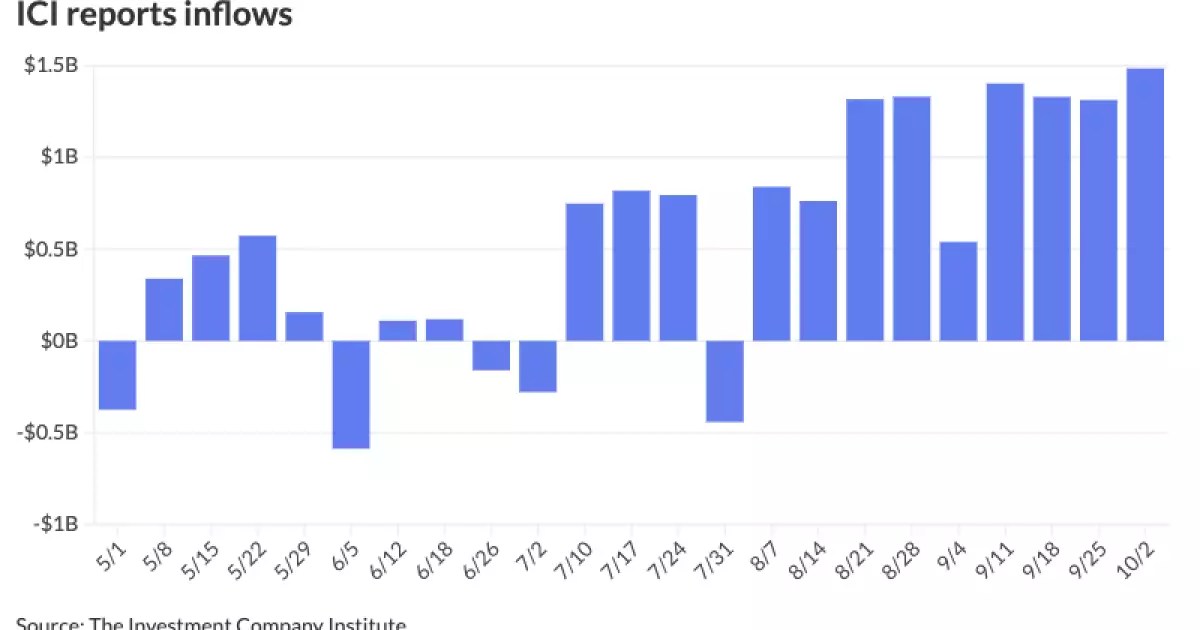

A recent report from the Investment Company Institute underscores the sustained investor interest in municipal bonds. For the week ending October 2, inflows into municipal bond mutual funds reached a notable $1.484 billion, following a robust $1.312 billion inflow the previous week. This marks a noteworthy trend, as it signifies nine consecutive weeks of inflows, with the last four weeks exceeding the billion-dollar mark. Additionally, exchange-traded funds bolstered their standing with inflows of $810 million, a sharp increase from the prior week’s $109 million.

Such inflows may indicate a burgeoning confidence in the municipal bond market as it heads into the fourth quarter. Analysts like Jeff Lipton, a market strategist, point out that while the market faces challenges—including reduced stimulus and refinanced Build America Bonds—it remains bolstered by strong demand coupled with favorable yield ratios. The confluence of these factors appears to be driving elevated allocations towards municipal funds, particularly as investors align their portfolios ahead of anticipated economic shifts.

Despite the positive inflow figures and a robust appetite for municipal bonds, experts caution that the market is not without its hurdles. The technical backdrop continues to be a defining element for 2024, as issuers rush to front-load their deals, particularly in light of the approaching presidential election. Such strategic maneuvers may lead to increased tax-exempt supply that could potentially overwhelm the market if not managed carefully.

The rapid pace of issuance, characterized by weekly supplies consistently breaching the $10 billion mark, suggests a newfound baseline in municipal market dynamics. However, as Daryl Clements, a municipal portfolio manager at AllianceBernstein, notes, the increasing relative valuations could compel investors to adopt a more selective approach moving forward. This implies that while opportunities abound, the current market landscape demands a level of prudence from institutional and retail investors alike.

Looking ahead, the supply of municipal bonds is expected to undergo a phase of adjustment in the pre-election period. Analysts such as Lipton project a potential “subside” in supply as the election unfolds, with a possible resurgence trending toward the latter part of 2024. Given that the Federal Reserve is likely to adopt a tempered strategy in light of recent economic data, the municipal bond market may find itself at a crossroads—striking a balance between yield attractiveness and supply-demand constants.

Moreover, as the market grapples with the ongoing implications of substantial inflation and mixed economic signals, buying opportunities may materialize as ratios continue to shift. With contained reinvestment needs and ample supply through the end of Q4, discerning buyers could benefit from recalibrated ratios that present appealing relative values.

The municipal bond market is currently navigating through a complicated economic terrain marked by shifting yields, fluctuating investor appetite, and a bevy of upcoming issuance strategies. The ongoing inflows signal persistent demand, yet the market must remain vigilant in managing supply, particularly in the context of an upcoming presidential election and economic uncertainties.

While municipal bonds continue to present a viable investment avenue, it will be essential for participants to stay attuned to macroeconomic trends and shifts. The coming weeks will be critical in shaping the market’s trajectory as investors brace themselves for potential recalibrations amid evolving financial conditions. The duality of opportunity and caution will undoubtedly define the narrative of municipal bonds as 2023 draws to a close and the new year looms on the horizon.

Leave a Reply