As we enter the latter part of the year, the municipal bond market is facing a mix of challenges and opportunities amid fluctuating U.S. Treasury yields and changes in the equity market. Understanding the dynamics at play is crucial for investors looking to navigate this complex landscape effectively. This article delves into the current state of municipal bonds, examining yield trends, market performance, and the anticipated headwinds and tailwinds that could shape the market over the next year.

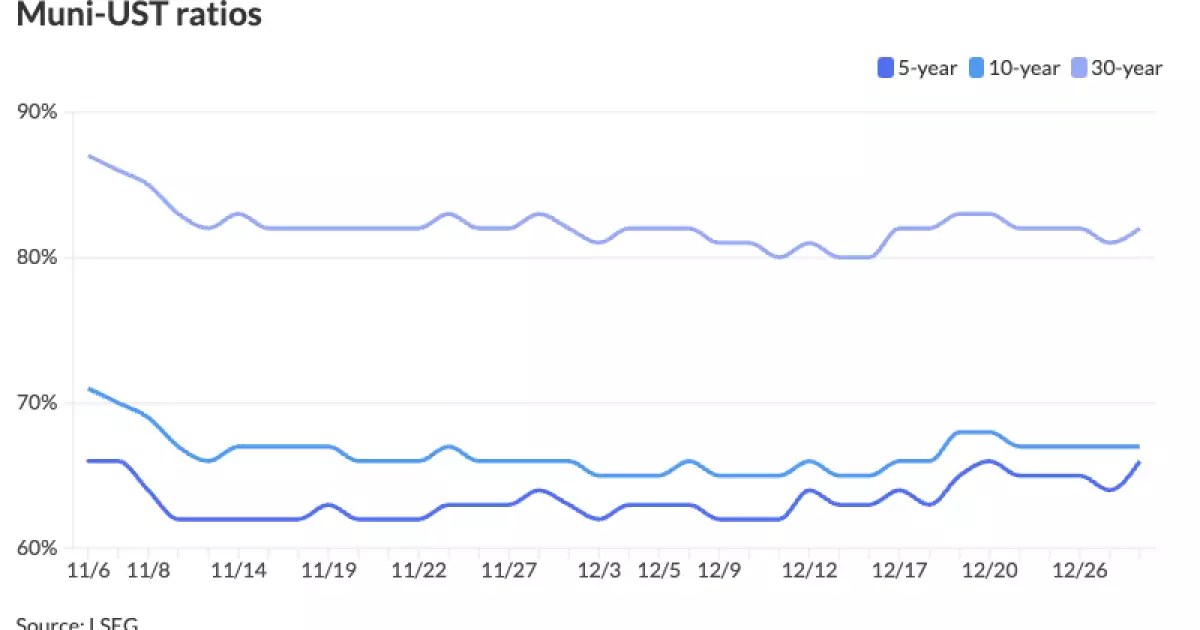

Municipal bonds have displayed a modest uptick in strength, primarily influenced by a slight decrease in U.S. Treasury yields. Reports indicate that municipal yields have risen by up to four basis points depending on the maturity length, while U.S. Treasury yields dropped significantly—between five to nine basis points. Of particular note, the two-year municipals are showing a ratio to Treasury yields of 66%, while longer durations like the 30-year munis are at 82%. These ratios reflect investor behavior and sentiment, revealing a continued preference for the safety and tax advantages of municipal bonds.

Despite a slight underperformance when compared to U.S. Treasuries, municipal bonds have nevertheless outperformed taxable bonds this year, showing a return of 0.73% year-to-date in contrast to U.S. Treasuries, which stand at 0.23%. This divergence is significant, suggesting that municipal bonds are currently viewed as a more favorable investment option amidst a relatively turbulent financial landscape.

Looking forward, Barclays strategist Mikhail Foux points out that the trajectory of interest rates remains a critical factor for the municipal market. Investment-grade indices enter 2024 at levels that some consider excessively rich, with minimal buffers to absorb any future rate increases. Such tight margins may expose investors to considerable risks, especially in light of December’s sell-off in U.S. Treasuries, which negatively impacted investment-grade returns.

High-yield bonds are also feeling the pinch, having lost 1.97% this month, even as they maintain a compelling overall return of 5.98% for 2024. Foux notes that while the market is poised for a level of stability due to carry benefits, both high-yield and investment-grade bonds face challenges from the broader economic landscape, including supply issues and potential policy changes.

One of the most significant pressures anticipated for the municipal bond market in the upcoming year is supply. Market players forecast an oversupply between $450 billion to $500 billion in issuance, driven by the need for updated infrastructure and dwindling pandemic relief funds. Holtz from Income Research and Management emphasizes that the substantial issuance could lead to demand struggles, particularly if investor appetite fails to keep pace.

Complicating these dynamics are potential threats to the tax-exempt status of municipal bonds. The previous administration’s moves, particularly the Tax Cuts and Jobs Act, demonstrated how

Leave a Reply