In recent days, the municipal bond market has found itself navigating a landscape marked by pressure and volatility. As geopolitical uncertainties loom and macroeconomic indicators present mixed signals, the overall market sentiment has shifted distinctly. Investors’ focus has shifted toward the forthcoming payroll reports, which could introduce further variability in both equity and bond markets. The juxtaposition of recent economic data and changing investor sentiments has led to a nuanced environment for municipal bonds, with notable effects on yield curves and fund inflows.

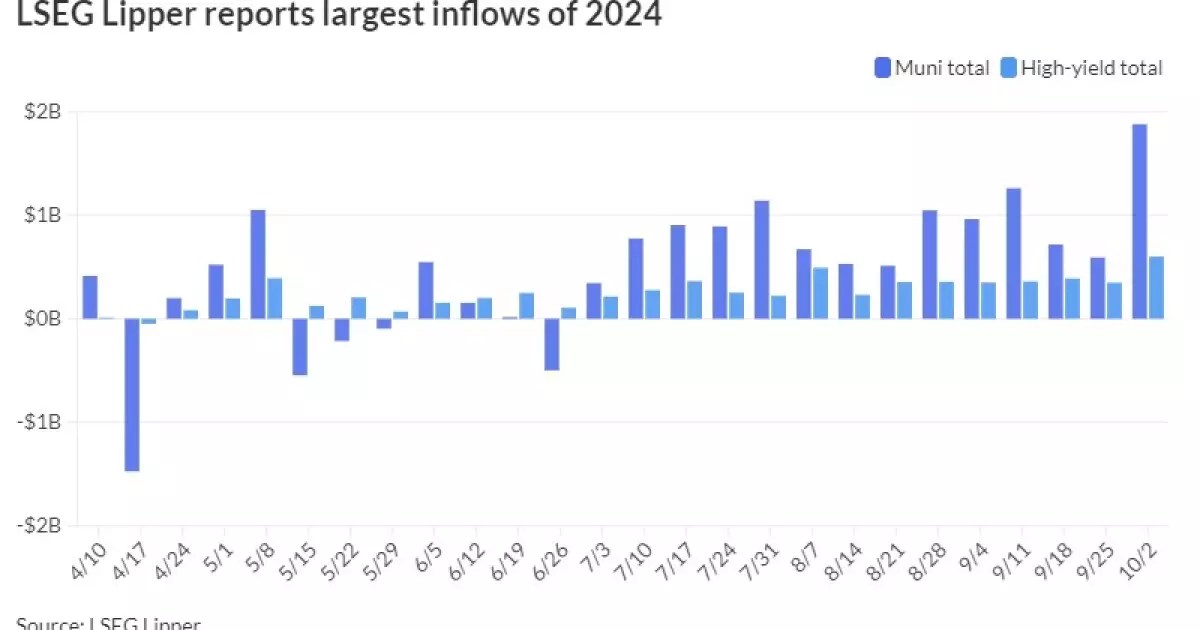

Recent statistics reveal that municipal bond mutual funds experienced significant inflows, totaling nearly $1.9 billion in the last week alone. This statistic marks the 14th consecutive week of positive inflows, underscoring a resilient appetite among investors for municipal securities. The data compiled by LSEG suggests that the inflow this week is the highest recorded for 2024, amplifying the trend of robust investor support. Such sustained inflow momentum is noteworthy, especially against the backdrop of rising interest rates and fluctuating risk perceptions in the broader markets.

LSEG Lipper’s report highlights a dramatic increase from the prior week, where inflows were merely $592.1 million. Notably, high-yield funds showcased a healthy uptick, with inflows increasing from $349.3 million to $602.3 million. J.P. Morgan’s strategists have observed trends indicating that long-term funds have been significant beneficiaries of these inflows, highlighting a potential shift in investor strategy towards longer duration securities.

Despite a 35.2% increase in new municipal bond issuance through the end of September, demand remains robust, resulting in many offerings being oversubscribed. The Bond Buyer’s 30-day visible supply climbed to $15.29 billion, denoting a healthy appetite among investors. While some adjustments to the yield curves were noted, the overall ability of municipal bonds to outperform U.S. Treasuries on certain days emphasizes the relative strength of this asset class amidst market fluctuations.

The recent environment has seen slight cuts in triple-A yield curves by a basis point in various sectors, signaling subtle shifts in pricing dynamics. Set against Treasuries, where yields have risen, municipal bonds’ outperformance highlights their appeal as a safe harbor during periods of uncertainty. The adjusted muni-to-Treasury ratios—the two-year muni-to-Treasury ratio standing at 61% and extending up to 83% for the 30-year bonds—reflect how investors are navigating yield discrepancies amid interest rate shifts.

In the primary market, activities such as the pricing of revenue bonds for San Antonio, Texas, demonstrate the continued engagement and strategic positioning by municipalities seeking to access capital. With offerings showcasing varied callable options and interest rate structures, investors remain active participants, keen on evaluating the balance between risk and expected returns. Similarly, Alexandria, Virginia’s competitive sale of general obligation capital improvement bonds reflects well-structured municipal offerings that cater effectively to investor needs in a fluctuating market.

The response to municipal bond offerings has been decidedly positive, with several new issues seeing repricing to lower yields—which could be indicative of persistent demand. Given this backdrop, it’s imperative for investors to evaluate market movements holistically, considering both the macroeconomic factors and local government fiscal health.

As attention pivots toward the anticipated employment report, the nuances of labor market data must be examined with an analytical lens. The recent ADP employment report signaled an increase of 143,000 private payrolls in September, marking a significant uptick. This surge poses upside risks to projections regarding the upcoming nonfarm payroll (NFP) figures. J.P. Morgan’s observations suggest that past discrepancies between initial estimates of the ADP and Bureau of Labor Statistics (BLS) estimates underscore the unpredictable nature of labor market forecasts.

The overall sentiment within the fixed-income markets indicates that the Federal Reserve’s evolving stance might prompt shifts in strategic positioning among investors, particularly concerning future rate ecosystems. Given that the market is absorbing new information and adjusting positions accordingly, the intertwining of labor market robustness with treasury yield performance merits close scrutiny.

In reflecting upon the recent developments within the municipal bond sphere, it is evident that the market is exhibiting resilience in the face of multifaceted challenges. With sustained inflows and active engagement in new issuances, the prospects for municipal bonds appear favorable, albeit with an awareness of the external variables that could disrupt the equilibrium. Investors must remain attentive to economic indicators and shifts in fiscal policy that could profoundly impact their strategies moving forward. As the market evolves, rich opportunities lie ahead, poised for those prepared to navigate the complexities of today’s financial landscape.

Leave a Reply