The municipal bond market remained stable on Tuesday, as investors chose to adopt a wait-and-see approach ahead of two significant events: the much-anticipated election results and the Federal Open Market Committee (FOMC) meeting scheduled for Thursday. These events are expected to generate substantial market volatility, impacting not only immediate trading but also the broader economic policies that could shape financial conditions in the long term. Within this context, the behavior of U.S. Treasuries showed mixed results, while the equity markets exhibited an upward trend just before market closure.

Election Outcomes and Market Predictions

The uncertainty surrounding the election results contrasts sharply with the clear expectations for a potential interest rate cut from the Federal Reserve. Market participants have been keenly analyzing how various electoral outcomes could influence the markets and economic policy. As Erik Weisman, Chief Economist and Portfolio Manager at MFS Investment Management, explains, a Trump victory would likely lead to an inflationary climate, which could unsettle the municipal bonds markets. Conversely, the re-election of Vice President Harris would probably maintain the existing economic status quo, creating a more favorable environment for tax-exempt issuers.

The prevailing sentiment points towards a Republican sweep scenario, with betting markets estimating a 48 percent probability of unified GOP control. J.P. Morgan strategists have articulated the potential implications of such a sweep on municipal demands, particularly regarding corporate taxes and public spending. A scenario with Harris winning but lacking congressional support, projected at 26 percent, raises concerns about the passage of meaningful economic legislation.

Should the Congress remain divided, the ability to enact transformative legislation may be significantly hampered. Current tax provisions from the Tax Cuts and Jobs Act risk nearing expiration, which would culminate in rising taxes that could, paradoxically, amplify demand for municipal investments. J.P. Morgan’s analysts suggest that this complex interplay between taxation and legislative gridlock could lead to heightened demand for munis, even as tax rates are expected to climb.

However, market responses to these uncertainties extend beyond just taxation and debt issuance. The ongoing implications of inflation and Fed policy also weigh heavily on municipal bonds, as Andrzej Skiba of RBC Global Asset Management emphasizes. The outcome of the election is also likely to dictate the trajectory of monetary policy, with specific attention to how tariffs and trade issues may emerge under a Trump administration.

Inflationary Pressures and Fixed Income Dynamics

The potential for higher tariffs, particularly against nations like China, is a pivotal concern that Skiba identifies. Such actions could add as much as 1 percentage point to inflation rates, which would have a profound impact on the Federal Reserve’s decisions regarding interest rate cuts. The notion that a Trump administration’s trade policy could jeopardize the current bond market stability raises alarms for investors eager for lower rates amid a slowing economy.

In contradistinction, views expressed by Bryce Doty from Sit Investment Associates offer a different narrative. Doty contests that Trump’s economic policies historically correlated with low inflation rates and a resilient labor market. He elaborates on the critical issue of national debt, which is now eclipsing defense expenditures. The rising deficits pose challenges but also present opportunities for productive economic growth that could enhance tax revenues, suggesting that movement between lower and higher rates remains a nuanced conversation.

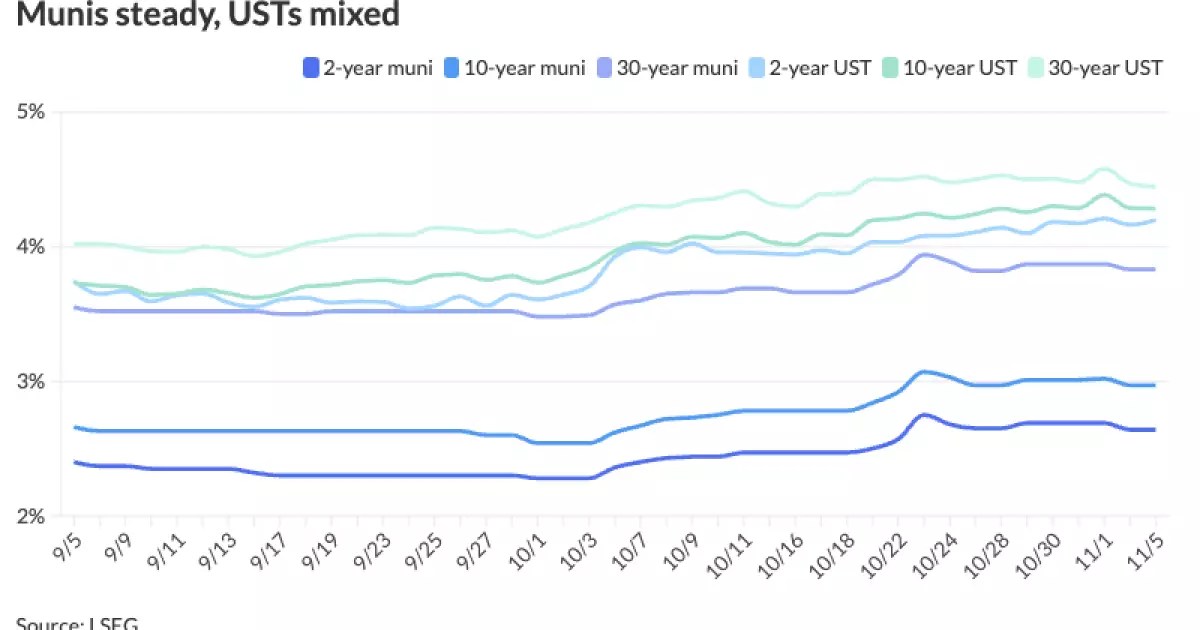

As all these dynamics unfold, the municipal bond market appears relatively unperturbed for now. Key indices such as Refinitiv MMD’s scale and Bloomberg BVAL have remained unchanged, reinforcing a sense of stability amidst uncertainty. Investors continue to closely monitor the yield curves, with one-year and two-year municipal costs hovering around 2.80% and 2.64%, respectively, while 30-year yields are positioned in the mid-3% range.

Looking ahead, the municipal bond market prepares for upcoming issuances, including significant sales from the Virginia Small Business Financing Authority and Fort Lauderdale’s water and sewer revenue bonds. These transactions illustrate ongoing market activity, signaling that despite uncertainties, there is still a healthy pipeline of municipal funding that could support project financing in the coming weeks.

The intersection of political variables, economic indicators, and financial market reactions will undoubtedly set the stage for the next chapter in monetary policy and municipal bond performance in the United States. Investors, aware of the delicate balance ever in flux, remain vigilant as the outcomes of the upcoming election and Fed meeting promise to bring change — and opportunity — to the municipal landscape.

Leave a Reply