As we approach the end of the year, the municipal bond market is experiencing notable fluctuations, largely influenced by selling pressures this past Friday. Despite a general downturn, the performance of municipal securities has outshone that of U.S. Treasuries during this turbulent period. This relative strength is noteworthy given the current supply constraints projected for the coming weeks, which are expected to stabilize this asset class heading into 2024.

The recent trend indicates that municipal bonds have incurred some losses, pushing returns into negative territory for the month. However, they still significantly outperform U.S. Treasuries and corporate bonds. A rise in yields, particularly within the triple-A rated segment, was observed, with fluctuations ranging from three to eight basis points according to various financial analyses. Meanwhile, U.S. Treasuries recorded losses in a similar range. As municipal bonds continue to adjust, ratios comparing them to U.S. Treasuries reflect this shift, with two-year munis estimated at 61% relative to Treasury instruments, further illustrating the changing dynamics in this sector.

Market Resilience Amidst Supply Adjustments

Analysts from Barclays have highlighted the resilience of municipal bonds even amidst significant supply influxes. There are signs of market fatigue as investors begin to reduce their exposure, indicated by a notable spike in bid-wanted transactions. This growing trend suggests that even though there is a marked supply of bonds, investor sentiment is wavering, prompting strategic repositioning.

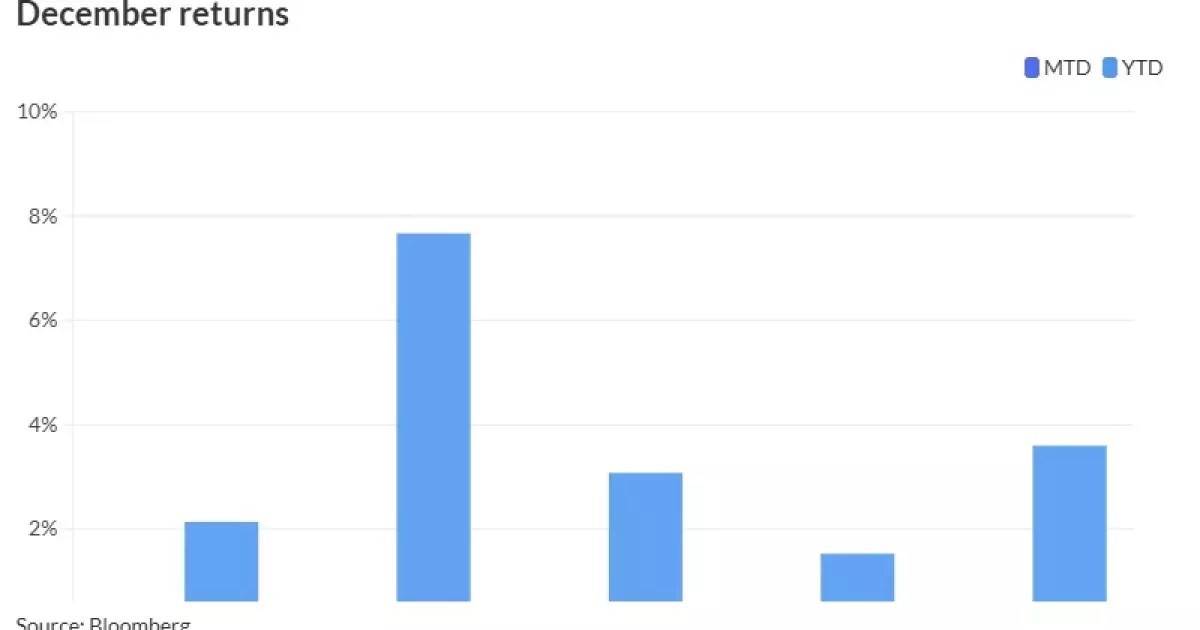

As of the latest data aggregated, the Bloomberg Municipal Index registered a slight decline of 0.40% for the month, juxtaposed with a year-to-date positive return of 2.14%. Comparatively, high-yield municipal indices, though similarly declining in December, still reported robust gains year-to-date. Tax-exempt municipal bonds have faced intense pressures, recording negative returns for the month, but they still hold a considerable return for the year, emphasizing their potential as stable long-term investments.

Looking ahead, many experts are predicting a potential rally in municipal bonds following the upcoming Federal Reserve meeting. Strategists from Bank of America Global Research are optimistic about a resurgence in the muni market dynamics following adjustments in new issuance patterns, particularly after the significant movement seen post-election. The anticipated reduction in new issuances may result in a tightening of the market, setting the stage for a possible rebound.

This optimism is underscored by the resilient post-election rally, which has perpetuated a more favorable environment for municipal securities when compared to their taxable counterparts. Notably, the performance of municipal high-yield bonds has remained strong, offering a counterbalance in the face of broader market instability.

Suggestions for investors navigating this current landscape veer towards caution, particularly in light of the existing uncertainties. Mikhail Foux, head of municipal strategy at Barclays, emphasizes a prudent approach in light of the expected fluctuations in yields and market conditions. He advises against aggressively pursuing high returns at this juncture, suggesting that investors may fare better by lightening their holdings as year-end approaches.

The upcoming auction schedule illustrates a tepid outlook, with a primary focus on specific featured transactions, including notable issues from entities like the New York City Transitional Finance Authority. It remains crucial for investors to maintain awareness of market conditions, including the implications of Fed policy shifts, as these factors will greatly influence the performance trajectory of municipal bonds going forward.

The municipal bond market stands at a crossroads as we conclude 2024. Given the recent challenges, it is vital for market participants to closely monitor both macroeconomic indicators and market sentiment. While the potential for recovery exists, it is clear that strategic positioning and careful management of risk will be instrumental in capitalizing on forthcoming opportunities. The coming weeks will be critical as the market settles into a new phase of dynamics propelled by impending economic policy adjustments and evolving investor sentiment. As the year draws to a close, careful analysis and strategic foresight will determine the viability and direction of municipal investments in 2025.

Leave a Reply