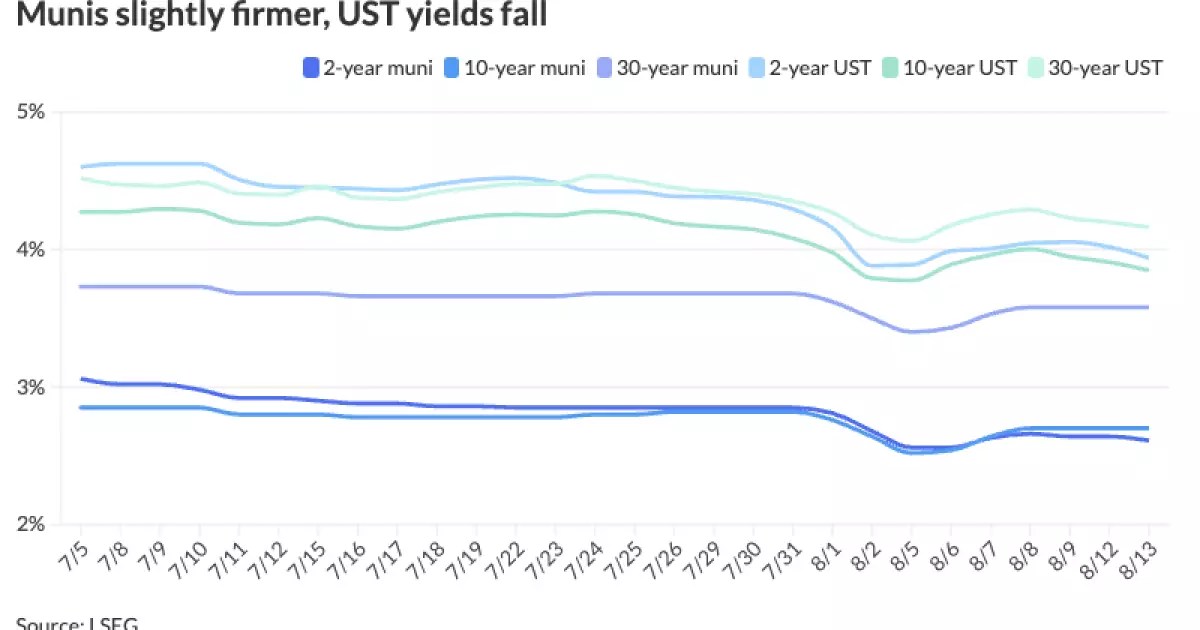

The municipal market saw a decrease in yields on Tuesday due to the primary market activity, while municipal bonds performed less well compared to the U.S. Treasury market amid positive movement in equities following favorable inflation data. The two markets experienced varying basis points movements, with the short end of the municipal curve displaying better results. However, it is essential to note that muni to UST ratios remained relatively stable throughout the day. This stability in ratios signifies a complex interplay between market dynamics and external factors.

Issuance and Reinvestment

AllianceBernstein strategists pointed out the significance of a specific date that may cause the market to react disproportionately. Despite this, the overall outlook for the week appears positive, primarily due to a lighter new-issue calendar. With a projected total issuance of $7.4 billion for the week and an expected reinvestment of approximately $21 billion on August 15, the market is likely to experience increased liquidity. However, it is crucial to acknowledge the challenges posed by evolving demand patterns and potential shifts in interest rates, both of which can influence market dynamics significantly.

The municipal market has already processed nearly $300 billion in issuance this year, setting the stage for a potential total volume exceeding $450 billion by the end of 2024. This growth trajectory, coupled with changing patterns in demand from various market participants, highlights the evolving nature of municipal market dynamics. Matt Fabian from Municipal Market Analytics, Inc., emphasized the impact of demand from banks, insurance companies, mutual funds, and exchange-traded funds on market transactions. As the market continues to adapt to these shifting demand dynamics, underwriters face increasing pressure to structure primary offerings attractively while also managing spread risks effectively.

In the negotiated market, notable pricing activities included transactions by J.P. Morgan Securities LLC for the University of Houston, J.P. Morgan Securities LLC for the El Paso County Hospital District, Wells Fargo for Ohio, and BofA Securities for the South Carolina Greenville-Spartanburg Airport District. These transactions underscore the importance of strategic pricing in navigating the competitive landscape of the municipal market. Underwriters must carefully assess market conditions, investor preferences, and regulatory implications to optimize pricing strategies and ensure successful bond issuances.

Market Yield Curves and Trends

Various market indicators, including Refinitiv MMD’s scale, ICE AAA yield curve, S&P Global Market Intelligence municipal curve, and Bloomberg BVAL, provide insights into yield movements across different maturity points. The performance of these yield curves reflects the broader trends in interest rates, market sentiment, and investor behavior. As Treasuries experienced improvements in yields across different tenors, municipal bonds faced the challenge of maintaining competitive pricing structures while meeting investor demands for attractive returns.

Overall, the municipal market continues to evolve in response to changing economic conditions, regulatory requirements, and investor preferences. As market participants navigate the complexities of issuance, pricing, and demand dynamics, critical analysis of market trends and performance metrics becomes essential for informed decision-making and risk management. By carefully monitoring market developments and adapting to new challenges, stakeholders can position themselves for long-term success in the dynamic landscape of municipal finance.

Leave a Reply