Recently, the municipal bond market exhibited a slight uptick in firmness, particularly highlighted by the upsizing of the Triborough Bridge and Tunnel Authority’s (TBTA) bond issue, which reached an impressive $1.6 billion. This increase in issuance coincided with a rebound in municipal mutual fund inflows, suggesting a renewed interest from investors. In contrast, U.S. Treasury yields experienced a decline, and equity markets ended the day on a downward trend. This mixed bag of asset performance signals a complex balancing act in today’s financial landscape.

Data from Municipal Market Data (MMD) revealed the ratios between two-year, five-year, ten-year, and thirty-year municipal bonds and U.S. Treasuries (UST). The two-year and five-year municipal bonds held a ratio of 67%, while ten-year and thirty-year bonds recorded ratios of 69% and 84%, respectively. It’s interesting to note how the slight firmness in municipal bonds reflects broader market trends. According to Kim Olsan, a senior portfolio manager, the reactions in the municipal market were somewhat subdued in relation to the prior day’s taxable bond rally, suggesting market participants are cautiously optimistic but restrained.

In a constructive shift, there appears to be robust engagement within various maturities along the yield curve. Olsan noted that buying activity has surged as investors are increasingly attracted to the higher yield ranges offered by quality credits. Yet, despite this positive environment, yields on municipal bonds remain at their highest levels in over a year. Following the release of favorable producer and consumer price index data, the demand was particularly noted in shorter maturities, with significant buying observed in the one- to three-year segments.

Conversely, a notable vendor activity was recorded, with dealer sales in various maturities exceeding usual volumes. Reports indicated that sales reached 65% or higher in certain sectors, reflecting an active dealer-customer exchange. Particularly, in the shorter end of the curve, the yield differentials indicating meaningful pick-ups declared the attractiveness of short-call instruments. One striking example included the acquisition of Ohio State general obligation bonds with a favorable spread compared to non-callable options.

Heightened market volatility is a focal point drawing attention from investors and analysts alike. Olsan emphasized that such conditions may lead to increased selling pressure, warranting careful observation as this could have implications for future rate direction. Despite a rise in bids-wanted transactions, the current levels do not yet present a cause for alarm. However, a marked increase could signal deeper underlying issues.

A particularly noteworthy aspect of recent trading includes select Los Angeles Department of Water and Power debt instruments, which widened by approximately 10 basis points. This shift occurred in conjunction with an S&P downgrade, demonstrating the market’s sensitivity to credit quality fluctuations and the potential implications for investor sentiment.

The primary market has been active, with recent pricing for significant bond issues reinforcing investor interest. For instance, the TBTA priced its $1.6 billion in real estate transfer tax revenue bonds, garnering considerable interest and showcasing the entity’s resilience in a fluctuating economic environment. Significant yield adjustments were observed, with various maturities reflecting a spread ranging from (-10) to (-21) basis points, indicating a willingness among investors to lock in returns despite market uncertainties.

Other notable issuances included bonds from the Regents of the University of Colorado and Yale University, each attracting strong demand. With yields on university enterprise bonds reflecting market trends with careful adjustments, it is evident that investors are watching closely for opportunities.

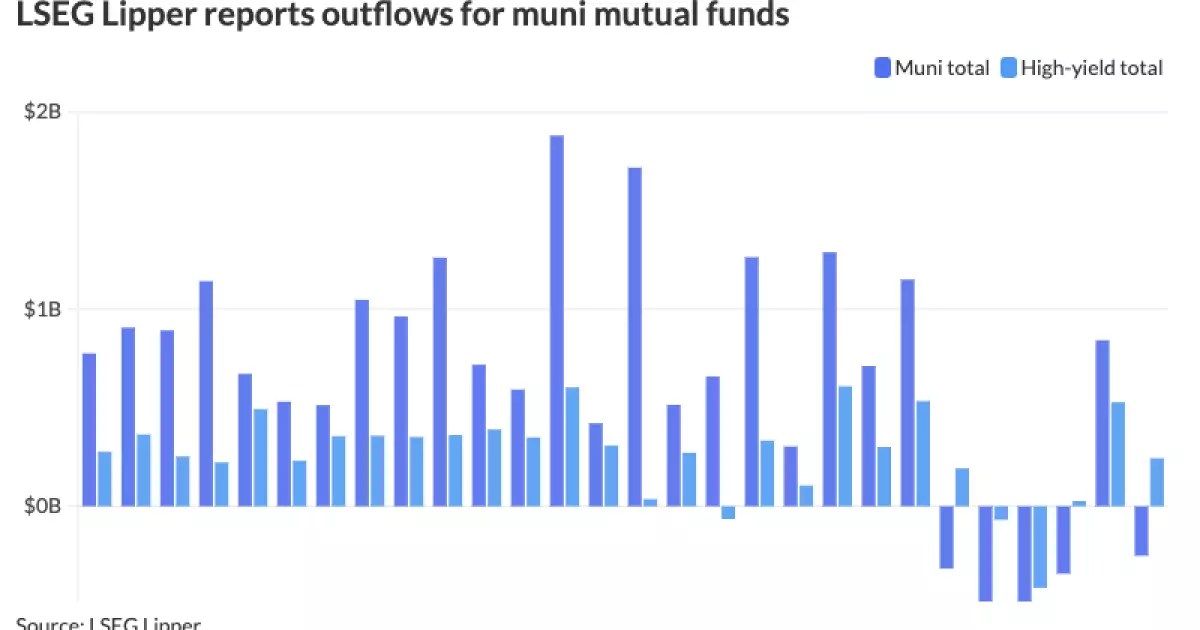

Investors’ sentiment can be somewhat volatile, as highlighted by the municipal bond mutual fund outflows observed over the past week. A significant withdrawal totaling $251.2 million occurred, following an even larger outflow of $841.6 million the week prior. Yet, high-yield funds appeared to attract inflows, suggesting a nuanced investor preference pointing towards higher-risk opportunities. Tax-exempt municipal money market funds witnessed significant outflows totaling $1.56 billion, reflecting broader liquidity adjustments within the market.

In terms of yield adjustments, it was noted that the average yield for tax-free and municipal money-market funds saw a decline, aligning with broader downward trends in Treasury rates. The SIFMA Swap Index increased notably, suggesting a potential shift in interest rate expectations.

Overall, the municipal bond market finds itself at a critical juncture filled with opportunities aligned against the backdrop of rising volatility. As investors navigate these waters, the careful observation of trends and indicators will be essential in making informed investment decisions moving forward.

Leave a Reply