The municipal bonds market experienced weakness on Thursday, accompanied by a rise in U.S. Treasury yields and a rally in equities. This scenario has led to increased volatility in both markets, bringing about fluctuations in triple-A yields by two to seven basis points and USTs by four to five points. Jennifer Johnston, the director of research of municipal bonds at Franklin Templeton, described the recent trading sessions as exhibiting “crazy volatility,” emphasizing the market’s current state of uncertainty and unease.

Following a prolonged market rally leading up to Monday and a subsequent selloff until Wednesday, the market has essentially returned to its starting point. As Johnston aptly put it, the market had a sudden surge in one direction, followed by a retracement back to a more balanced position. However, the question remains whether this equilibrium will be sustained in the coming days amidst several significant upcoming events.

The unfolding events in the political landscape, such as the assassination attempt on former President Donald Trump and President Joe Biden’s withdrawal from the race, have added another layer of complexity and uncertainty to the market dynamics. Johnston highlighted the unique political environment leading up to the upcoming election, raising concerns about potential market reactions driven by these uncertainties.

The increased market volatility prompted Chicago to withdraw its planned deal of $643.11 million of General Obligation bonds, an indication of issuers’ caution in the current climate. It is likely that more issuers will follow suit and delay their deals as they wait for the market to stabilize. With the Federal Reserve’s September meeting approaching, issuance is expected to slow down as issuers tread cautiously.

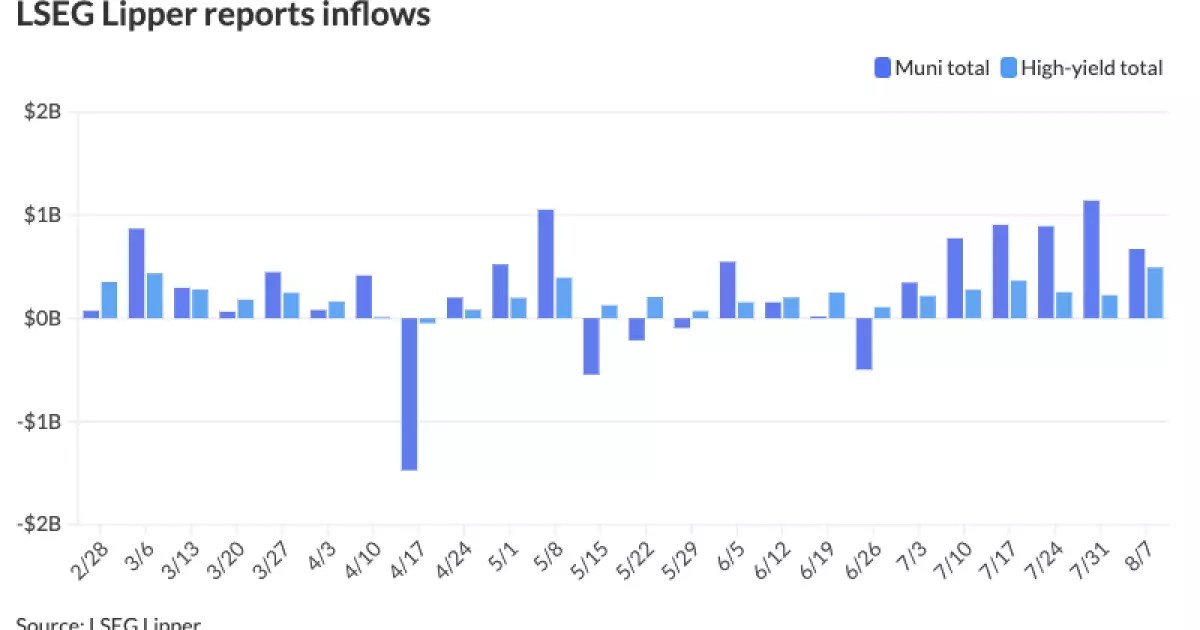

As the market environment remains unpredictable, investors are questioning the future demand for municipal bonds. While there has been some growth in separately managed accounts, the return of funds to open-ended mutual funds remains uncertain. The potential decline in rates may impact the yield curve, potentially influencing investors’ decisions in the coming period.

Despite the rise in yields, the relative value of bonds within the 10-year range continues to be on the lower side. The Muni to UST ratios are within a stable range, reflecting the current market conditions. The primary market activity on Thursday saw significant bond issuances by various entities, indicating ongoing financial operations despite the market fluctuations.

The municipal bonds market is facing heightened volatility driven by a combination of political, economic, and global factors. Issuers, investors, and market participants are navigating through uncertain times, making strategic decisions based on the evolving landscape. As the market continues to fluctuate, it is crucial for stakeholders to stay informed, adapt to changing conditions, and proactively respond to emerging trends in the municipal bonds market.

By critically analyzing the market trends and dynamics, stakeholders can position themselves strategically to mitigate risks and capitalize on opportunities as they arise in the municipal bonds market.

Leave a Reply