Municipal bonds have long been heralded as safe havens, especially for conservative investors seeking steady income exempt from federal taxes. Yet, what appears as tranquil stability in muni prices and yields often masks deeper structural tensions that threaten their reliability as an investment. Recent market data shows limited volatility and only marginal movement in yields, which may suggest a calm environment. However, beneath this surface lies a stagnant and cautious marketplace struggling to find its footing amidst broader economic uncertainty. The complacency of the muni market should not be mistaken for health; rather, it reflects a lack of strong catalysts propelling meaningful growth or outperformance.

A Growing Disconnect Between Munis and Treasuries

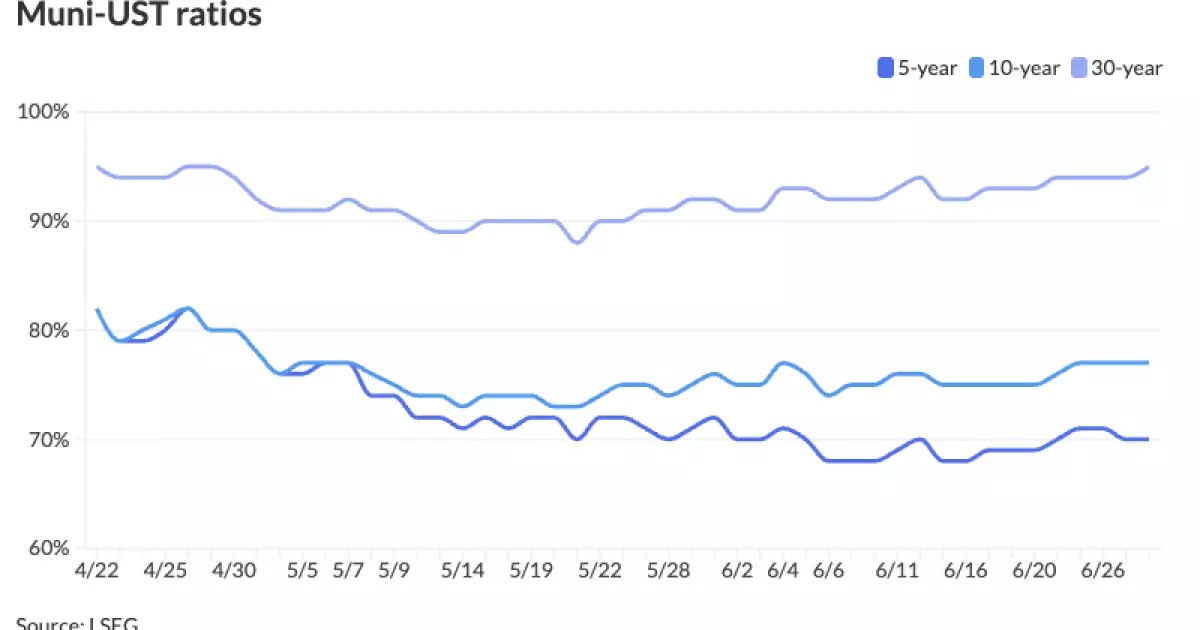

A conspicuous feature in the recent data is the widening ratio between municipal yields and U.S. Treasuries (USTs). With two-year muni-UST ratios lingering around the mid-60% to high-70% range, investors face an unusual disconnect. While Treasury yields have fallen by several basis points across maturities, muni yields have stubbornly held their ground or even inched up in some cases. This divergence signals a latent skepticism within the municipal market. Despite the generally lower credit risk of munis relative to corporates, the spreads and ratios remaining wide indicate investors are demanding higher compensation for perceived risks—whether credit, tax policy shifts, or macroeconomic headwinds.

Limited Demand Undermines Muni Momentum

The ongoing positive but modest net inflows into muni mutual funds—$76.9 million last week, barely a blip given the market scale—underscore a tepid appetite for munis despite the ninth consecutive week of inflows. Such restrained demand mirrors the market’s ambivalence. If fund flows were galvanizing, one would expect to see sharper price gains and tighter spreads. Instead, steady, incremental returns of around 0.19% weekly and a near-flat year-to-date performance highlight a lack of conviction. The brief and brutal downturn in early April, when the muni index declined over 5% in three days, is still a shadow over the market’s psyche, deterring many investors from fully embracing munis as a reliable source of return.

Structural Technicals: A Blessing or a Curse?

One of the few bright spots comes from the technical backdrop—large July reinvestment cash flows of around $40 billion in principal and $14 billion in interest are poised to reenter the market, providing a potential source of liquidity and demand. However, this influx is no panacea. While these cash returns might prevent a rout, they can also contribute to inefficiencies. Heavy redemptions in key states like California and New York—home to some of the largest and most complex muni issuers—could temporarily pressure certain sectors and cause price dislocations. Furthermore, the spread-out timing and relatively low volume of new issuance in early July reflect sobriety from issuers, who are not rushing to flood the market, thereby tempering opportunities for traders and retail buyers alike.

The Primary Market: Subtle Signs of Caution, Not Confidence

The primary issuance pipeline reflects a measured approach rather than aggressive expansion. Deals like California’s $1 billion in clean energy project revenue bonds and New York’s forthcoming multi-billion-dollar issuances underscore the slow return to scale. Yet, the absence of any state issuing over $1 billion immediately suggests caution reigns supreme. This restrained issuance might reflect officials and underwriters’ hesitation amid visible uncertainties, including rising interest rates and ambiguous federal policy directions. Given that munis rely heavily on governmental sources for repayment, political and fiscal dynamics directly impinge upon market vitality. These large bond sales, while sizable, are not enough to spark a genuine reacceleration of muni market enthusiasm.

After-Tax Yields: Enticing Yet Risky

A notable characteristic of the current muni landscape is the generosity of after-tax yields, especially in high-grade (HG) credits, where bonds are pricing above 8% on a tax-equivalent basis. This sounds enticing and may attract longer-term investors willing to weather volatility. However, such high yields often reflect embedded skepticism about future credit fundamentals or the prospect of tax changes eroding munis’ preferential status. In other words, the market is pricing in risks often ignored in traditional bullish narratives: state budget shortfalls, pension liabilities, and the potential for federal tax reform that diminishes munis’ advantage. Voluntary yield hunger must be balanced against these underlying realities, lest investors underestimate latent risks.

Why the Muni Market Matters to Conservative Investors and Policymakers

For conservative investors typically located in center-right portfolios, municipal bonds represent a cornerstone of risk-managed income strategies—often paired with equities to balance volatility. The current environment, while somewhat stable, is far from complacency-worthy. Policymakers must recognize that sustaining the muni market’s health is not merely about low interest rates but about credible fiscal governance and transparency at state and local levels. Without deliberate reforms and responsible borrowing, the allure of munis as “safe” investments will fade.

Furthermore, from a market efficiency perspective, investors should not be lulled by the veneer of minimal price action. It is the underlying shifts in ratios, fund flows, and issuance behavior that signal where true risks and opportunities lie. There is a critical need for more discerning analysis rather than passive acceptance of muni market inertia.

Municipal bonds are entering a phase where their conventional safety narrative is being tested by evolving financial realities—interest rate volatility, demographic pressures, and political uncertainties. Smart investors must acknowledge the nuanced challenges and recalibrate expectations accordingly rather than cling to dated assumptions of muni invincibility.

Leave a Reply