As we approach the end of a pivotal legislative cycle, attention turns to the One Big Beautiful Bill Act (OBBBA), which proposes significant changes to the state and local tax (SALT) deduction cap. The House has made a concession to GOP representatives from high-tax states by raising the SALT deduction cap from $10,000 to $40,000 for individuals earning under $500,000. However, this move is not without contention. Despite the House’s intentions, the Senate shows a stark resistance, fueled by a distinct lack of prioritization for the SALT issue among Republican senators.

Senate’s Reluctance: A Political Landscape Shift

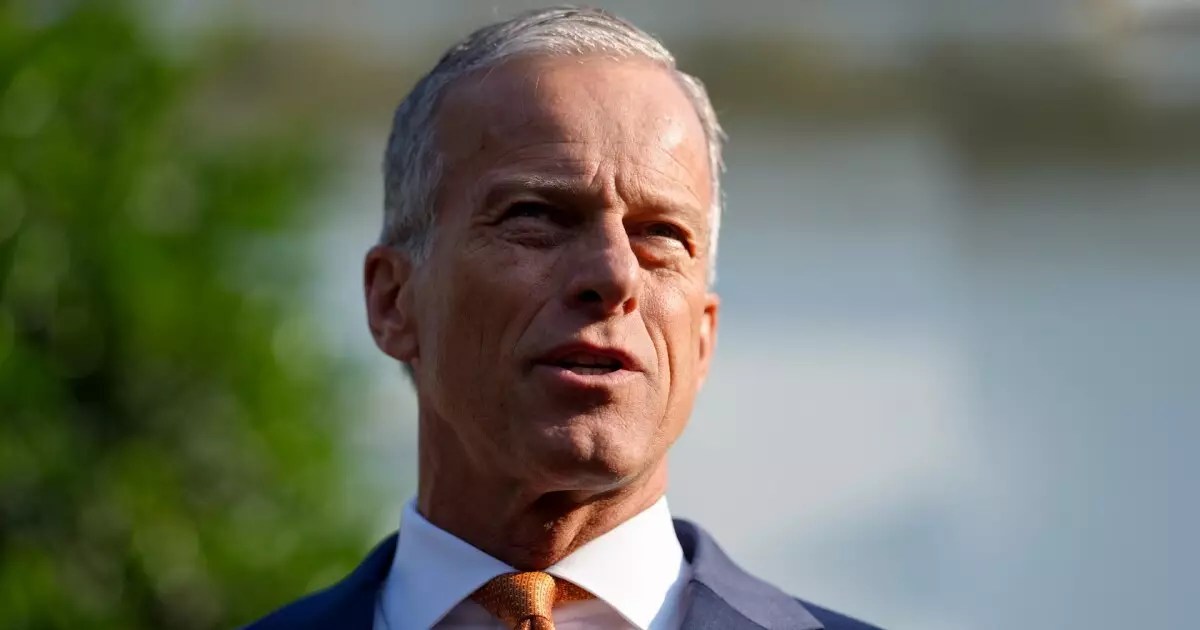

Senate Majority Leader John Thune’s remarks encapsulate the prevailing sentiment on Capitol Hill; the Republican Party appears unconcerned about SALT. This indifference is largely driven by the absence of Republican senators from high-earning states like New York, New Jersey, and California. This raises a crucial question: why should Senate Republicans invest political capital in a cause that offers little return on investment for them? They recognize that high-income tax states do not align with the interests of their constituencies, which lean towards fiscal conservatism and limited government intervention.

Moreover, this situation reflects a broader evolution within the GOP. Politicians who formerly championed tax reform with an emphasis on cutting local detriments are now carving out a distinct path that eschews the financial burdens imposed by SALT. It’s a radical departure from the past Republican consensus, indicating a potential ideological fracture over what it means to govern responsibly.

Budgetary Realities vs. Political Ideals

Garrett Watson of the Tax Foundation highlights a critical dilemma: the OBBBA’s proposed tax cuts could balloon the national deficit by about $2.6 trillion over the next decade. This alarming forecast raises the stakes—not just for the SALT provisions, but for fiscal conservatism as a whole. The SALT cap’s lift could inadvertently signal a willingness to accept an unrestrained budgetary philosophy. Should this conception prevail, it may dismantle the Republican argument for limited government and responsible fiscal management.

Critically, the math problem presented by the OBBBA isn’t merely about tax rates; it’s about the sustainability of America’s economic framework. How can the nation pursue significant cuts while concurrently raising expenditures? If leaders from both parties would prioritize sound tax policy over strategic concessions, we might foster a more robust economic environment.

Unpacking the SALT Caucus and Its Implications

The bipartisan SALT Caucus emerged as a major player in this debate, framing the higher deduction cap as a necessary legislative tool for gaining the votes required for passage of the OBBBA. However, this bargaining tactic brings forth significant complications, not least of which involves how it will impact municipal funding and taxation avenues.

Advocates argue that maintaining a higher deduction cap is vital for municipalities to generate revenue through taxes. Yet, by prioritizing these deductions, the caucus risks sidelining deeper issues in tax policy reform. Should we not be focusing on reducing tax burdens comprehensively rather than offering piecemeal solutions that cater to powerful lobbying groups?

Emerging Consequences for the Future of Tax Policy

The ongoing SALT discourse hints at broader implications for state-level tax policies. It is disconcerting how the cap can foster a reliance on pass-through exemptions, creating a convoluted structure that many states are leveraging to sidestep limitations. Experts warn that should the House’s version of SALT prevail, these workarounds could become obsolete, further complicating an already intricate tax landscape.

The question remains whether such concessions undermine not just the integrity of the current proposed bill, but the philosophy underpinning conservative governance itself. If policymakers become fixated on short-term electoral gains, they risk abandoning the long-term principles necessary for economy-wide reform.

While the OBBBA’s adjustments to the SALT deduction might seem like mere accounting tweaks on paper, they resonate far deeper through the political fabric, economic sustainability, and future governance of the nation. The ongoing debates present an opportunity to reassess what fiscal responsibility should look like in a rapidly changing world.

Leave a Reply