The municipal bond market is currently experiencing seemingly peaceful waters, recovering slightly from the frenetic oscillations of the previous week. However, it would be foolhardy to look at these minor improvements as a definitive sign of stability. As U.S. Treasury yields rise and equities show mixed signals, municipal yields also increased, with bumps up to five basis points in some areas. The municipal market’s performance, characterized by a quick rise and fall, can leave potential investors feeling misled. The apparent calm following a storm of volatility poses actual risks for investors who may naively believe that the worst is behind them.

The statistics that define this current environment—such as the two-year ratio sitting at 80% and the 30-year at 93%—can easily create a façade of security. But beneath these numbers lies an unsettling truth: volatility is still a rampant issue. Experts from Bank of America have aptly described this week’s market as transitioning to a “normal mode,” marked by a sharp decline followed by a corresponding rise in yields. Investors need to recognize that this sort of pattern is less about stability and more about an ongoing game of whack-a-mole with economic indicators that hint at larger problems looming in the backdrop.

Tariffs and Inflation: The Unsung Threats

Federal Reserve Chair Jerome Powell’s consistent emphasis on price stability against the backdrop of impending tariffs paints a rather ominous future. While discussions on tariffs are ongoing, the potential long-term impacts on inflation remain significantly underappreciated. The expectation of rising tariffs does not only hold immediate financial implications; it also leads to fears of a recession, particularly as we move into the latter half of the year. The economic environment is fraught with uncertainties, and stakeholders should not ignore the perilous intersection of trade disagreements and inflationary pressures.

Notably, this is where the center-right perspective can shine, advocating for policies that prioritize fiscal responsibility while also supporting growth initiatives. The concerns aren’t merely conjectures; the anticipated economic repercussions due to tariffs could derail the fragile recovery and undercut the very foundation of the municipal bond market. Reckless governance can exacerbate this precarious situation, further jeopardizing investor confidence.

Investor Sentiment: A Blunt Reality Check

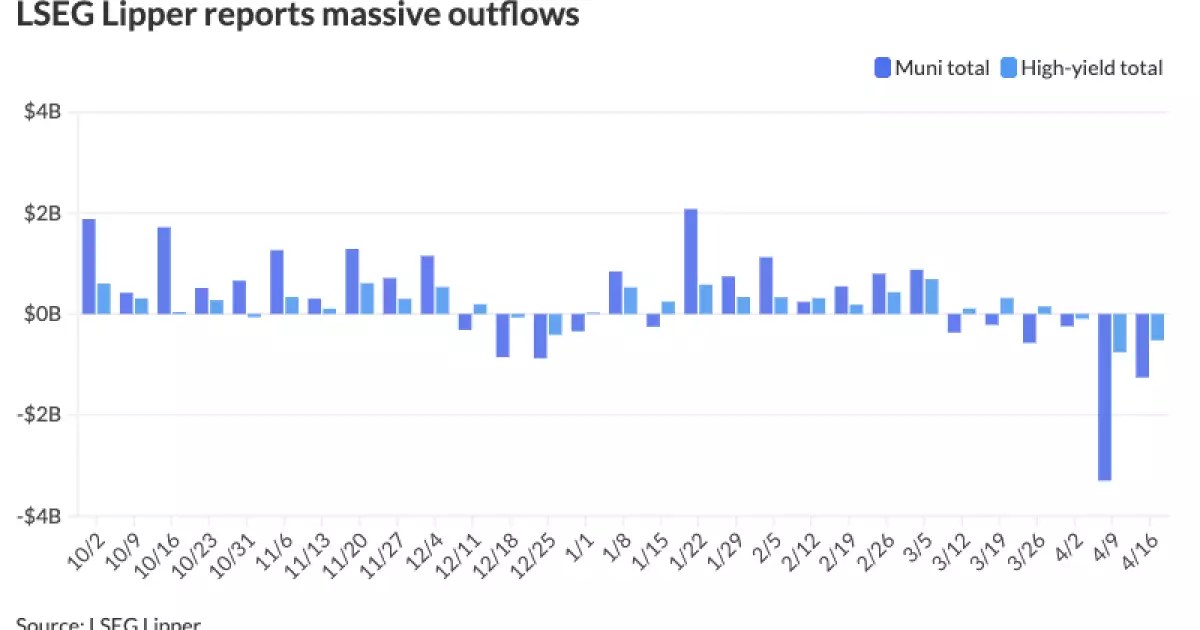

Recent data shows a staggering outflow of $1.258 billion from municipal bond mutual funds, following an already worrisome $3.302 billion the week before. This marked a full six weeks of continuous pulling back from municipal investments, indicating a severe lack of confidence in what should be considered a stable sector of the financial market. The trends towards higher yields in tax-exempt and taxable money-market funds further suggest a shift in where investors perceive value.

The jury is still out on whether high-yield funds are experiencing outflows simply due to short-term anxiety or whether a deeper systemic issue is affecting investor sentiment. The institutional approach needs to pivot quickly; otherwise, we may witness a crowding-out effect where only the most resilient investments emerge intact. It’s vital that we understand this sentiment shift not just as noise but as a critical signal about the revitalization and trustworthiness of the municipal bond market.

Supply and Demand: A Tricky Equation

The current new-issue calendar features numerous large deals and competitive bids, all amid a backdrop of rising supply. Connecticut leads the charge with $1.651 billion of general obligation bonds, yet the increased availability of these instruments does not automatically translate into an attractive investment environment. Investors must consider how the principles of supply and demand are interplaying under these circumstances. While a growing supply could ostensibly serve to stabilize the market, it also could dilute the demand, leading to a rise in yield that ultimately makes these bonds less appealing.

Barclays’ strategists have indicated that we are not positioned for an excellent performance of munis in the immediate term, especially as we navigate through a historically high visible supply. A looming question arises: how does one justify financial exposure in a market that is so intricately bound to external variables, particularly the infamous volatility of the Treasury market?

While municipal bonds may appear to be on a recovery path, deeper analysis reveals that this is more of a façade than a solid recovery. There is an urgent need for clarity among investors, as the fear of inflation combined with continuous uncertainty in fiscal matters creates a toxic mix that can lead to perilous outcomes. Amid ongoing challenges in municipal markets, a proactive and vigilant approach is not just advisable but essential.

Leave a Reply