In the ever-evolving landscape of municipal finance, it’s easy to get lost in the numbers and metrics. However, a closer examination reveals that trends in this sector carry significant implications for investors and taxpayers alike. The recent fluctuations in municipal bonds amid a backdrop of economic uncertainty are not just bearable disturbances; they echo deeper systemic vulnerabilities. This article delves into eight troubling trends that highlight the precariousness of municipal financing and, ultimately, how they should be approached.

Trend 1: Heightened Volatility and Yield Pressures

Recent market behavior has shown a marked increase in volatility, reflected in the recent shift of U.S. Treasury yields and municipal bond ratios. As monthly and daily trading averages ascend, this reflects an alarming trend: the rise of the risk premium linked to municipal debt. The 2-year ratio at around 80% and 30-year at 95% sends a clear message: municipal bonds are facing unprecedented pressure. This trend builds anxiety around investing in what used to be seen as relatively stable instruments, signaling that municipal risks can no longer be brushed aside.

It’s vital to consider how interest rates have impacted the condition of municipal securities. With trust eroding and returns stagnating, traditional investors may find themselves looking elsewhere, which would generate further instability.

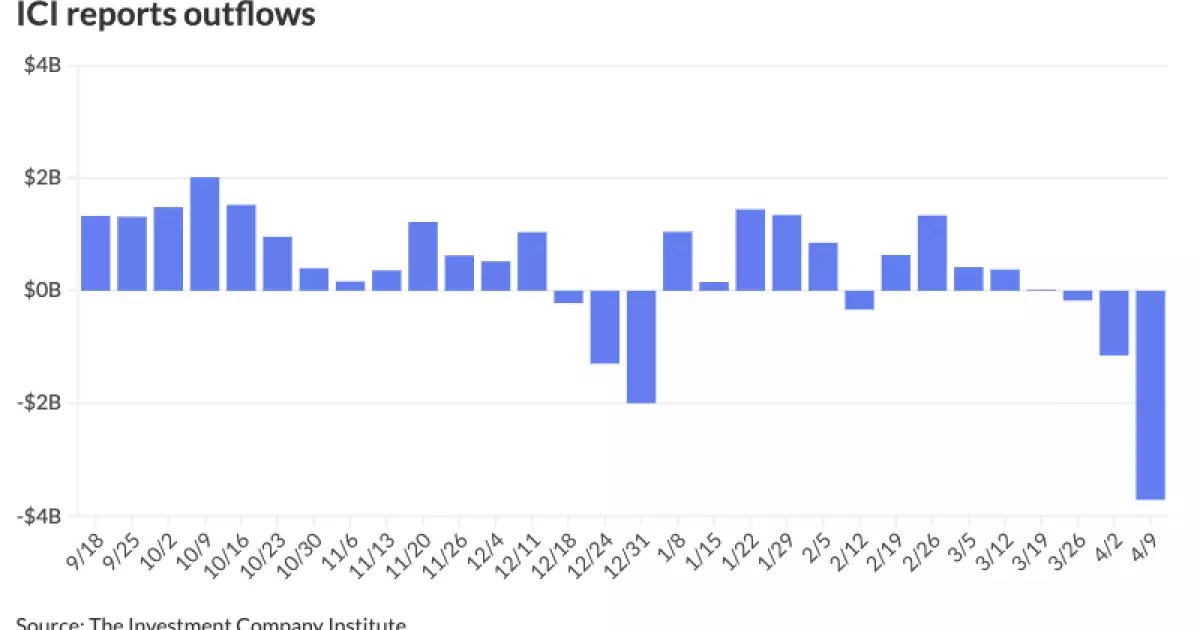

Trend 2: Ebbing Confidence Amid Outflows

According to the Investment Company Institute, outflows from municipal funds have exceeded $3 billion in a week. What does this reflect? A flagging confidence in the underlying value of municipal bonds. When seasoned investors pull their money out, it sends a message that the stability we once relied on is fraying. The noticeable retreat from high-quality municipal funds raises concerns about future capital influxes, which are essential for necessary budgeting at the local government level. It drives home the critical point: If investors lose faith, municipalities may struggle to secure funding even for essential services.

Trend 3: A Shrinking Pool of Bidders

As pointed out by experts, the pool of bidders in the municipal market is contracting. There’s been a noted decline in inter-dealer transactions, which often serve as a barometer for market health. With increased activity skewing towards dealer-to-customer business, this suggests a critical imbalance. Reduced competition means less favorable terms for municipalities seeking to raise funds, potentially pushing borrowing costs higher—inhibiting their ability to finance infrastructure improvements or public services.

Trend 4: Yield Dislocations and Market Absorption Issues

The recent uptick in competitive bond sales, while showing promise with North Carolina and Anne Arundel County seeing robust bidding, raises more questions than it answers. It suggests a fragmented landscape where yield dislocations are beginning to present acute challenges. Even as yields seem favorable relative to UST counterparts, the ability to absorb upcoming supply remains fraught with uncertainty. Investors must grapple with whether current ratios are sustainable or merely a mirage in shifting sentiment.

Trend 5: Tax Equivalent Yield as a Double-Edged Sword

With tax season fast approaching, the dynamics of ultra-short yields have shifted dramatically. The current yield above 3% translates to an effective tax equivalent yield (TEY) above 5%, offering an attractive but dangerous allure for high-bracket buyers. While this might seem inviting, investors must be cautious; such enticing returns often indicate greater underlying risk. The struggle between seeking yields and maintaining portfolio integrity remains precarious.

Trend 6: Quality Concerns Amid Ratios

The current concentration of AA-rated bonds dominating trading activity (55% of all trades) alongside a lack of participation from lower-rated bonds illustrates a troubling trend for municipal market stability. A significant reliance on higher-grade securities indicates a hesitance by investors to engage with riskier options, potentially stalling the momentum for risk-adjusted returns that municipalities desperately need for long-term projects. If lower-rated debt continues to languish, municipalities may find financing for essential services nearly impossible even when rates eventually stabilize.

Trend 7: The Role of Mega Deals

Upcoming mega deals from states like Connecticut and Massachusetts might seem like a necessary injection of capital. However, the underlying motivations prompt concerns. Are municipalities favoring large projects as a façade for deeper fiscal issues? Or are they genuine attempts to revitalize infrastructures? Either way, the sheer size of these deals must raise alarms about responsible spending amid tightening budgets.

Trend 8: Declining Identifier Requests as a Red Flag

Finally, the drop in CUSIP identifier requests is an alarming indicator of waning interest in new municipal securities. On one hand, the year-over-year increase in volumes could suggest resilience in the market. Conversely, a decline in requests shows a fundamental lack of enthusiasm for new issuances. This could signify a broader hesitation to engage with the market, portending even greater long-term instability. As municipal authorities adjust strategies to balance budgets and promote economic growth, less interest in new issuance could stifle innovation.

As we navigate the intricacies of municipal finance, it’s critical to keep a discerning eye on these trends. The evident need for balance between policy, economic realities, and investor confidence should guide us toward robust solutions that reinforce the long-term stability of municipal bonds while protecting taxpayer interests.

Leave a Reply