The municipal bond market, often considered a bastion of stability in fluctuating financial waters, currently faces a mix of optimism and impending challenges. Recent trends indicate not only a slight weakening in municipal bond performance compared to rising U.S. Treasury yields, but also significant shifts in market dynamics that raise questions about the future outlook. As an astute observer of this landscape, I find it vital to analyze these developments critically and explore the implications for investors and stakeholders.

Fiscal Pressure: Are We Facing a Supply Overhang?

Despite a strong month of performance where municipals saw gains of almost 1% in February, experts suggest caution. Daryl Clements of AllianceBernstein notes an anticipated net supply increase of $7 billion in the current month, hinting that issuances might exceed coupon payments and redemptions. This situation creates an essential headwind against the market, opening the door for potential volatility. The influx of cash from tax season might temporarily alleviate this pressure, but it won’t erase fundamental concerns of oversupply as municipalities scramble for funding amid growing infrastructure needs.

Moreover, the urgency of addressing long-standing infrastructure issues cannot be understated, especially as we see federal-level funding initiatives shift gears. Experts argue that we may need to ramp up annual municipal bond issuance to the tune of $750 billion to $1 trillion to tackle such challenges fully. But will the market absorb this added supply without a hitch? History indicates that excess supply can lead to downward pressures on prices and yields, causing larger implications for investors who’ve relied on municipal bonds for stability.

Demand vs. Supply: The Tug of War Continues

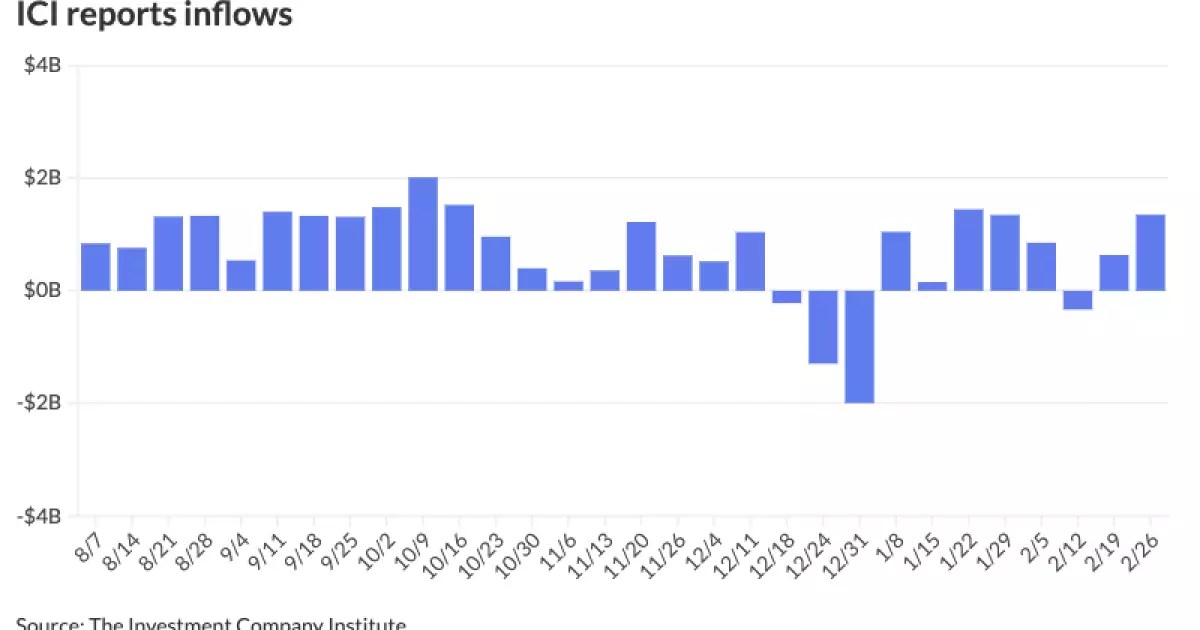

Despite the looming threat of oversupply, demand for tax-exempt income remains robust. The Investment Company Institute reports that inflows into the muni market have recently hit $1.35 billion and about $6.178 billion year-to-date. Yet, while the demand is present, it is unclear whether it will grow in tandem with a rapidly changing market landscape. The equilibrium of supply and demand is a delicate balancing act, and any misstep could send ripples that resonate throughout the broader economy.

Some proponents of the municipal bond space suggest that if issuance were to expand significantly, it might attract a broader class of buyers into the market. They argue that with increased supply, there could be a healthier pool of investment choices available, potentially invigorating slower-moving sectors. However, I remain skeptical. It seems rather like a pipe dream to assume that such measures will create a seamless transition without any fallout.

Valuation Concerns: Are We Comfortable with Current Levels?

Valuations in the municipal bond market remain at levels that some would deem precarious. While not radically different from prior months, some market analysts indicate that reliance on current standards may be misguided. The normalization of bond yields amid Fed tightening measures creates an uneasy footing, and any adjustments could lead to investor uncertainty. Persistent inflationary pressures only compound these worries, prompting a plausible reevaluation of what constitutes a “fair” yield in today’s market climate.

Moreover, the increasing disconnect between municipal bonds and U.S. Treasuries suggests that complacency surrounding these investments may not be justified. Investors who have become so accustomed to relatively stable returns might soon confront new realities that challenge their strategies. Simply put, the road ahead for municipal bonds may be far bumpier than many are prepared to acknowledge.

Impact of Technology: Is Innovation Helping or Hurting?

Recent technological advancements promise to transform the fixed-income landscape, including municipal bonds. Platforms like ficc.ai aim to democratize access to bond market data through blockchain and artificial intelligence, challenging the existing monopolistic pricing structures. While the potential for greater transparency and accessibility is commendable, one must be wary of the unintended consequences such rapid innovation may create.

Is the market equipped for this kind of radical change? Or are we leaping before we look? Innovations that disrupt existing systems can often result in periods of instability as participants scramble to adapt. The allure of cutting-edge technology must not distract us from the fundamentals of fiscal responsibility and long-term investment strategies necessary for navigating uncharted waters.

Market Sentiment: A Fragile Confidence

The overall sentiment surrounding municipal bonds is increasingly fraught with tension. Investors today face an array of obstacles, from inflationary pressures and potential recessions to concerns about excess supply. As experienced investors will tell you, confidence is a commodity that can evaporate quickly in the finance world. It’s essential to understand that even slight shifts in market conditions can drastically impact investor confidence and, consequently, the performance of municipal bonds.

In light of these factors, maintaining a bullish stance on municipal bonds requires a significant leap of faith. While the allure of tax-exempt income can be appealing, navigating the complexities of the current market necessitates a more cautious and nuanced approach.

As we forge ahead, it becomes apparent that the landscape for municipal bonds is anything but certain. Balancing supply and demand will be critical, and understanding the technological landscape will require thoughtful engagement. Ultimately, the hope rests on evolving dynamics that may just redefine the bond market in ways we can only begin to foresee.

Leave a Reply