Municipal bonds have historically served as a sturdy investment vehicle for risk-averse investors, especially during periods of market volatility. As we delve into the developments of the municipal bond market in early 2025, we witness an intricate interplay between investor behaviors, yield dynamics, and macroeconomic factors set against a backdrop of forthcoming changes in fiscal policy.

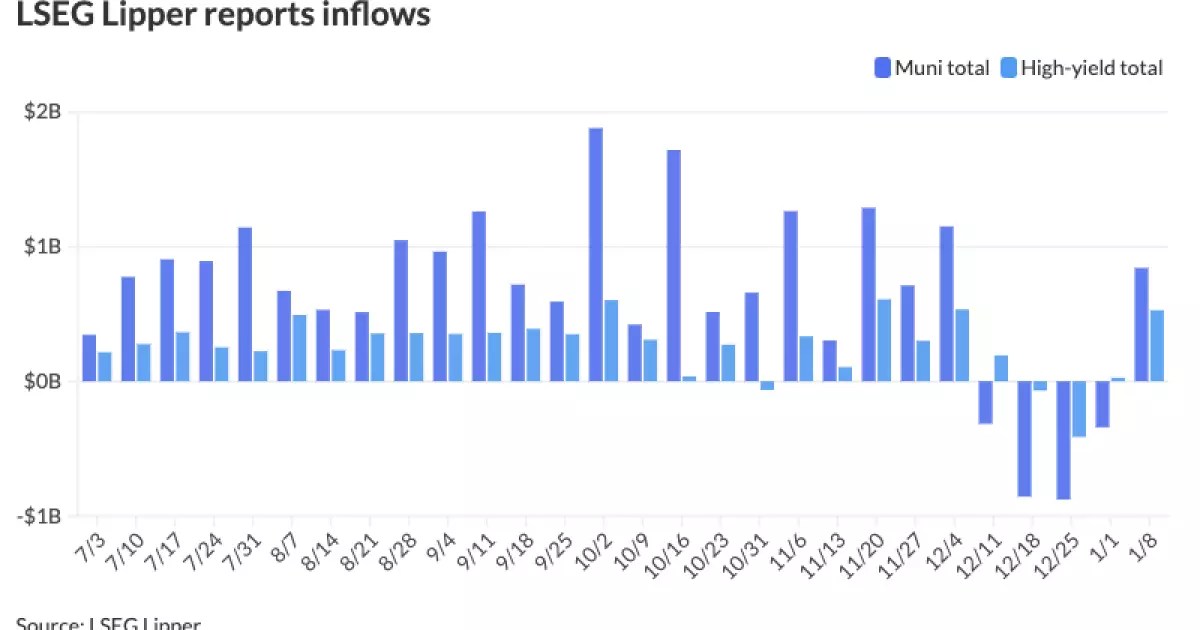

The opening week of 2025 marked a notable shift for municipal bond mutual funds, which saw inflows totaling $842.4 million. This came after a four-week streak of outflows, reflecting renewed confidence among investors in this segment of the fixed-income market. The trend suggests that, despite challenges faced towards the end of the previous year, there remains significant liquidity and interest in municipal securities. According to data from LSEG Lipper, high-yield funds also reflected a resurgence, recording inflows of $527.1 million, a stark contrast to the relatively muted inflows of just over $26 million the week before.

James Welch, a municipal portfolio manager at Principal Asset Management, encapsulated this sentiment by stating, “The muni story this year is pretty strong.” His assertion holds weight as yields hit their highest levels in a year, with many investors recognizing this as an opportune entry point. Yet, despite the favorable signs, there is an evident caution in how the market responds to changing economic and political factors.

The yield landscape for municipal bonds is critical for investment decisions. Recent data from Municipal Market Data revealed ratios hovering at approximately 65% for two-year and five-year maturities, with the 30-year ratio settling at a robust 81%. These figures indicate a relatively steeper yield curve, prompting investors to examine their strategies closely. Enhanced taxable equivalent yields—ranging between 7% to 8% depending on credit and maturity—play a significant role in attracting investment despite the market’s complexities.

Furthermore, as infrastructure needs balloon, there is an anticipation of larger bond issuances. A slew of significant deals, including a $1.3 billion offering by the Triborough Bridge and Tunnel Authority and multi-billion dollar issues from institutions like the University of California, are expected in the coming weeks. This growing trend towards larger financing needs highlights a structural change in the way municipal bonds may operate moving forward.

While investor confidence is tentatively positive, undercurrents of uncertainty loom, especially with the anticipated socioeconomic shifts prompted by the new presidential administration. Speculation surrounding potential changes to the tax-exempt status of municipal bonds adds a layer of anxiety among market participants. Welch indicates that while the municipal market appears relatively healthy for the early part of the year, legislative and legal challenges in implementing major policy changes can create volatility in bond markets.

The hearsay concerning the administration’s approach to higher education financing may further complicate the outlook. As stakeholders closely monitor developments in Washington, the potential for policy changes can significantly shape the attractiveness of municipal bonds as an investment option, potentially leading to increased volatility and market adjustments.

Bridging municipal bonds with broader economic indicators, the minutes from the December Federal Open Market Committee (FOMC) meeting served to underline current inflation concerns while also hinting at potential rate cuts in early 2025. With the economy navigating through inflationary pressures, market expectations suggest the Federal Reserve could implement incremental rate cuts. Economic indicators point to a nuanced view of inflation that seems lower at the beginning of the year but may face upward pressures later due to evolving trade policies.

Leading economists project quarter-point rate cuts by March and June, aligning with better-than-expected inflation metrics. However, the divergence in sentiments among FOMC members speaks to the complexities of the current economic environment. The interplay between municipal bond yields and overall monetary policy will invariably shape the landscape for investors in 2025.

The municipal bond market’s journey in early 2025 reveals both promising opportunities and significant uncertainties. With fresh inflows and strong yields, many investors are reigniting their interest. Yet, looming legislative changes and inflation concerns compel a detailed analysis of risk and potential rewards. As the market evolves, attentiveness to both local developments and broader economic trends will be essential for those navigating this ever-changing landscape.

Leave a Reply