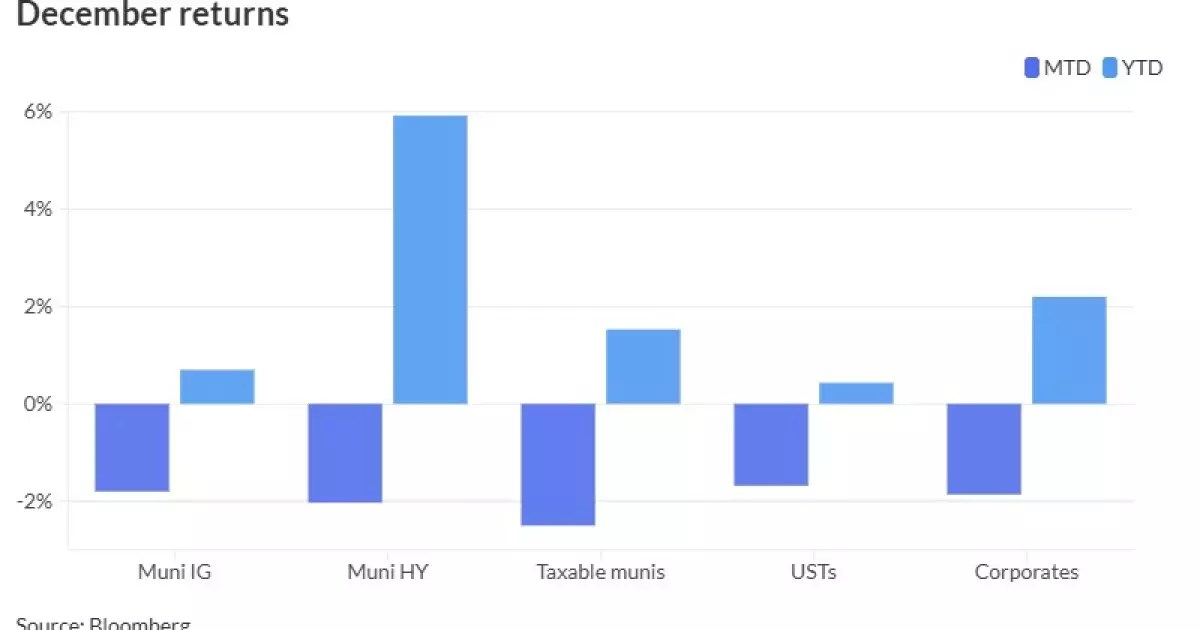

As we approach the year-end, the landscape for municipal bonds appears increasingly complex. Recent trading activity has shown a notable disconnection between the municipal bond sector and the tumultuous U.S. Treasury market. The lack of new bond issues adds to the wavering sentiment in the market. The Bloomberg Municipal Index is presently down by 1.80% for December. Currently, the dynamics surrounding high-yield, taxable munis, and short-duration municipal bonds paint a picture of mixed performance throughout this month as well as year-to-date figures.

Market analysts point to heightened volatility in the U.S. Treasury market as a significant factor weighing on munis. The 10-year UST has crossed the 4.6% mark, which signals investor unease and raises questions about future interest rate direction. Furthermore, high-yield munis have faced a downturn of 2.03% in December, although they are still yielding a respectable 5.92% return year-to-date. Taxable munis, on the other hand, witnessed a 2.50% loss this month but maintain a 1.53% gain when looking at the year as a whole.

Looking into the immediate future, the forthcoming weeks will emphasize the intricate relationship between supply and demand in the municipal bond market. The absence of large new issues on the calendar as we gear up for the new year has played a critical role in shaping investor expectations. According to market experts, the next 30 days will experience redemptions that pose a stark contrast to the anticipated level of supply, which currently stands at $5.55 billion in visible supply. This great disparity is raising flags, especially with the timing coinciding with another Federal Open Market Committee (FOMC) meeting, which could further impact yields and supply pressures.

January is traditionally a fruitful month for munis, and analysts expect an uptick in issuance. Notable upcoming offerings include Washington State’s $1.05 billion in general obligation bonds. Furthermore, several utility credits scheduled to be priced in mid-January, alongside local issuances from Texas nearing $1 billion, are likely to dominate conversations. However, uncertainty surrounding potential tax reform and economic policies might play a role in the timing and volume of these new issues.

The prevailing market sentiment suggests caution, given the volatility in Treasury rates and the shadows of broader economic reforms. While this year has seen mostly positive fund flows compared to prior years, experts warn of possible turbulence ahead. The fear of rising interest rates could spur investors to withdraw from municipal funds, sending ripples through the market. Importantly, Olsan from NewSquare Capital has highlighted that the consistent narrow trading range for yields has kept much of the investor base stable, deviating from the negative feedback loops evident in previous years (2022 and 2023).

Yield trends emerging in 2024 hint at an inconsistent trajectory, with lower-rated muni credits appearing to outperform higher-rated bonds so far this year. Such trends complicate the investment landscape and may lead to a reassessment of strategies for various risk attuned investors.

When analyzing performance metrics, the nuances are essential. Single-A rated general obligation bonds have exhibited strong returns this year, significantly outperforming broader indices and AAA-rated bonds. Notably, the difference in returns between revenue bonds and general obligation bonds has diminished—indicating investors’ growing confidence in the former despite generally challenging conditions in December.

The halt in rising spreads between A-rated and AAA-rated bonds, particularly in the 10-year range, brings to light the overall stability of spreads this year. The tight trading ranges showcase a level of investor confidence that could unravel if Treasury volatility persists, signaling a need for vigilant monitoring of future economic indicators and fiscal policies.

While the municipal bond market faces challenges amidst a backdrop of economic uncertainty, signs of resilience exist within specific sectors. Investors must remain astute and informed as the new year approaches, keeping a close eye on supply-demand dynamics, potential shifts in Treasury rates, and the broader economic climate. The confluence of these elements will shape the trajectory of municipal bonds moving into 2024, making the coming weeks crucial for strategic positioning. As always, understanding the shifts within the bond market is paramount for effective portfolio management in these volatile times.

Leave a Reply