The municipal bond market showcased a notable surge in growth during the third quarter of 2024, fueled by an increase in supply and a significant uptick in interest from various types of investors. According to recent data from the Federal Reserve, ownership among mutual funds, exchange-traded funds (ETFs), and foreign buyers has grown markedly. However, a deeper examination reveals that the overall municipal holdings of institutional investors, particularly banks, have seen a stark decline, leading analysts to project a challenging landscape for the upcoming year. This article will dissect these trends in the municipal market and their implications for investors.

Despite the expansion in the market size—with the total face value of munis outstanding increasing to $4.171 trillion—institutional investor participation, especially from banks, remains troubling. Barclays strategists highlighted a drop in bank holdings of munis to $497.2 billion, a 0.3% decline from the preceding quarter and a more significant 4.3% decrease compared to Q3 2023. Such contraction can largely be attributed to ongoing deposit outflows experienced by smaller and medium-sized banks, alongside regulatory pressures that have constrained their investment capabilities.

The latest projections indicate that bank demand for municipal assets appears to be waning, primarily due to a diminished deposit base which has shrunk the balance sheets of these regional banks. Wells Fargo strategists attribute this situation to both increased scrutiny of large bank sizes and concerns around regulatory compliance. While larger banks were expected to bolster their deposit bases post-turmoil, this has not translated into a corresponding increase in balance sheet expansion, posing further challenges for muni asset acquisition.

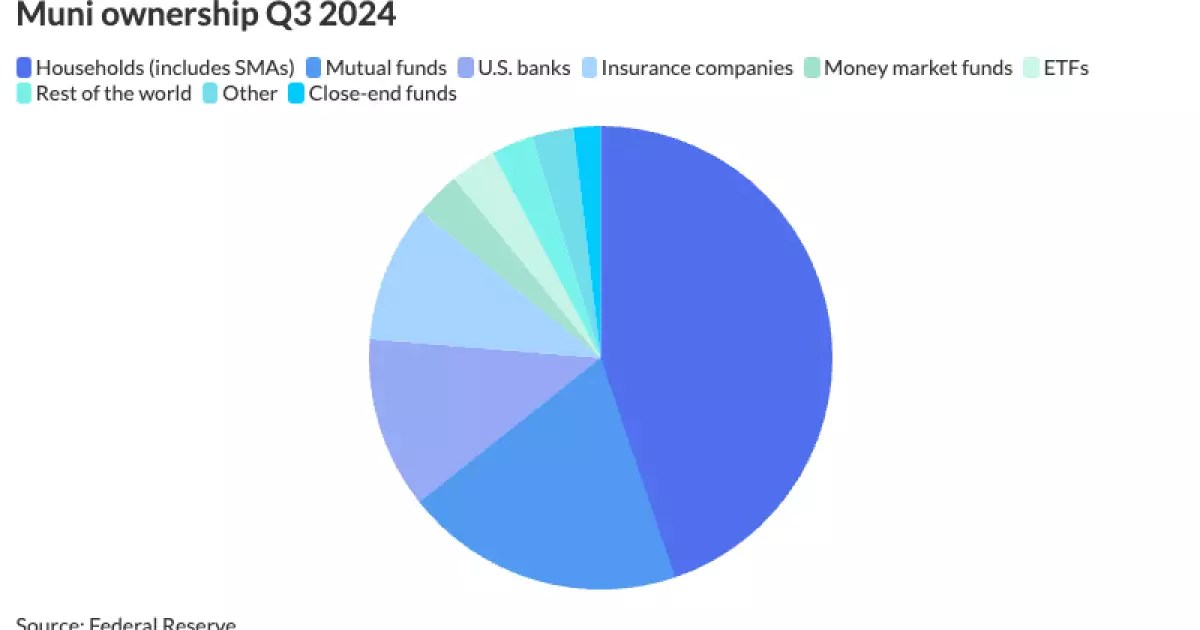

Amidst the decline in institutional investor engagement, individual households have become the largest holders of municipal bonds, representing 44.8% of total ownership. This category saw a significant growth surge, particularly due to the expansion of separately managed accounts (SMAs), which have reached $1.63 trillion by Q3 2024. Their sustained interest in municipal bonds underscores the growing appeal of this asset class among retail investors seeking stable income amidst economic uncertainties.

Foreign investment in munis is also on the rise, currently amounting to $121.5 billion, which has increased by 12.3% since Q3 2023. This uptick may reflect these investors’ search for yield in a low-interest global environment. However, as more foreign capital flows into the municipal market, it raises questions about dependency on external buyers and how they may react to changing market conditions.

A curious trend has emerged in the municipal investment landscape: the growing dominance of ETFs over traditional mutual funds. In Q3 2024, municipal ETFs surged to $133.3 billion, marking a growth of 23.4% compared to the same quarter last year. This trend has been fueled by a variety of factors, including lower trading costs and the appeal of passive management strategies among investors. With trading costs becoming a pivotal factor in investor decisions, ETFs are often perceived as having more favorable transaction costs than individual bonds, making them a more attractive option in the municipal market.

Mutual funds, while still significant at approximately $810.9 billion in assets, have also benefited from the influx of new capital, though to a lesser extent compared to their ETF counterparts. Notably, investment activity this year reflects a more robust commitment to mutual fund strategies, contrasting sharply with the previous year. As market conditions evolve, the trend toward passive investing appears to be solidifying, with indications that investors may prefer ETFs due to their resilience amid fluctuating credit conditions.

Looking forward, the municipal bond market stands at a crossroads. While there are signs of a committed buyer base among households and foreign investors, the fundamental decline in institutional interest—particularly from banks—poses significant risks for the market’s future. Moreover, the anticipated deregulation could shape the investment landscape by alleviating some constraints on bank capital and potentially enhancing demand for high-quality debt.

However, experts caution against expectations of the explosive growth witnessed in earlier years. The absence of tax-loss harvesting strategies and heightened competition from equities suggest a leveling off for municipal bond investments. Therefore, market participants should brace for variability as the municipal bond sector navigates through these complexities, addressing both the ongoing challenges and opportunities on the horizon.

Leave a Reply