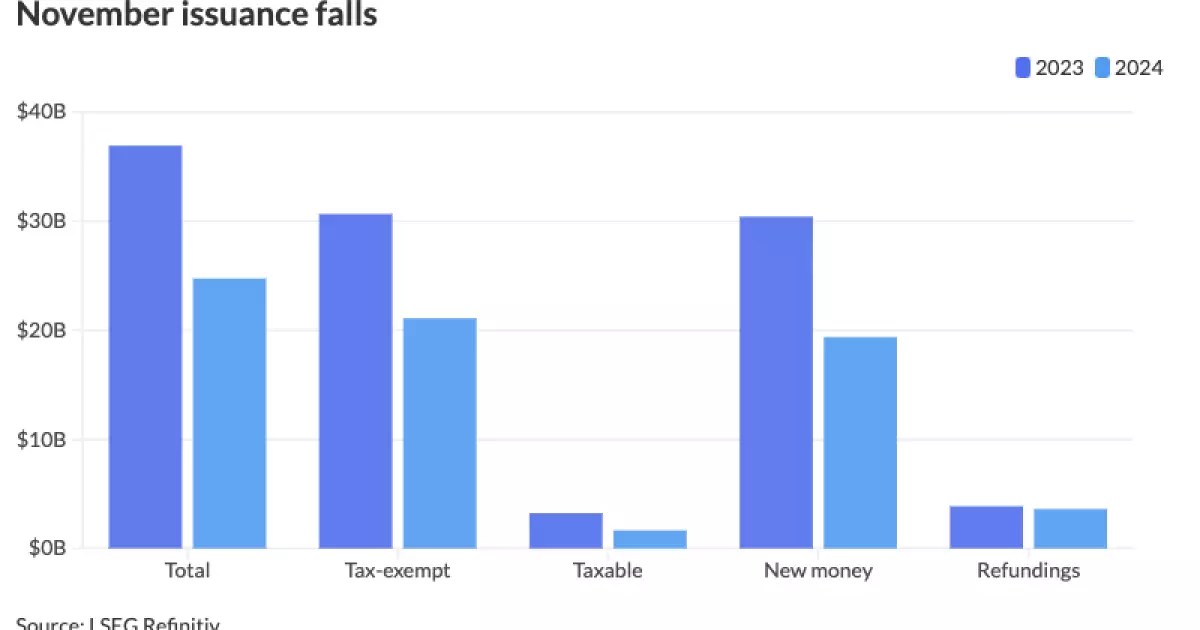

The municipal bond market faced a notable downturn in November, marking the first significant year-over-year reduction in issuance for 2024. The total issuance stood at $24.743 billion across 607 separate issuances, which indicates a striking 33% decrease from the $36.918 billion recorded in the same month of the previous year. This downturn is not just a trivial hiccup; it defies the overall upward trajectory that had characterized the municipal bond market throughout this year, with year-to-date totals amounting to $474.755 billion—an increase of 32.8% compared to 2023.

This decrease highlights an important point: even in a year poised to set new records for municipal bond issuance, fluctuations can occur due to external factors. Election-related uncertainties and a scarcity of operational days for issuing bonds contributed to this fall in numbers. As alluded to by Tom Kozlik, head of public policy and municipal strategy for HilltopSecurities, the calendar in November posed limitations for issuers. The mix of federal elections and Thanksgiving limited the opportunities for bond issuers to enter and capitalize on the market effectively.

Several distinct reasons account for the reduced issuance volume. Firstly, the timing of critical national events, such as elections, often generates market volatility that can deter issuers. The beginning of the month brought about both election-related jitters and a high-stakes meeting of the Federal Open Market Committee. Consequently, there was a lack of financial instruments being released in the early part of the month, and post-election market responses also contributed to this lull.

Moreover, a pair of high-value projects, namely the $1 billion gas project revenue bonds from Black Belt Energy Gas District and $1.1 billion of United Airlines’ Terminal Improvement Projects bonds, served as atypical highlights during an otherwise subdued month. However, these efforts could not compensate for the overall decline in issuance when juxtaposed with the broader trend in November.

A key component of this decline was the observed volatility in the markets. Although initial predictions suggested an overarching impact from political uncertainty, the actual repercussions turned out to be more nuanced. The immediate days following elections showed some variability in yields; however, these changes did not lead to a sustained impact on municipal pricing.

The Road Ahead: Projections for December and Beyond

Looking forward, the anticipated issuance levels for December are expected to rebound somewhat, with projections ranging between $20 billion and $30 billion. Yet, this upcoming performance must be contextualized against the uncertainty surrounding municipal bond tax exemptions. The historic precedent set in 2017, following the Tax Cuts and Jobs Act, reminds market players that significant legislative changes can precipitate a race among issuers to tap the market before they face new constraints. A similar rush is conceivable, considering the current narratives about potential tax reforms targeted at tax-exempt bonds.

Kozlik stands firm in his prediction for 2025, suggesting that issuances could soar to $745 billion due to legislative changes that may restrict or even eliminate tax exemptions for municipal bonds. This anticipated shift may alarm market participants, driving issuers to actively seek opportunities in 2025 ahead of potential restrictions in 2026.

In contrast to this bullish projection, analysts like Matt Fabian warn of repercussions stemming from any expedited changes to tax treatment, which could push issuance levels down to between $250 billion and $300 billion. These predictions highlight the ongoing contention between expectations for large issuances and the realities imposed by lawmakers.

Divergent trends were also seen at the state level, with California leading year-to-date issuance totals at $68.902 billion, up by 31.1% from 2023 figures. Other states demonstrated varied growth, from Texas (up 16.3%) to Florida (up an impressive 103.8%). These figures illustrate a dynamic that could impact future issuance as states adjust funding strategies and issuance practices to absorb any potential market shifts that arise from federal policy changes.

The variance in issuance numbers, both at the state and national levels, underscores the complexities of the municipal financing landscape. Municipal bond issuers will need to navigate the interplay of political uncertainty, market conditions, and legislative landscapes as they gear up for year-end financing or adjustments for the upcoming year.

The narrative surrounding municipal bond issuance in November 2024 serves as both a cautionary tale and a point of analysis for market observers. While the year is on track to break records, language around uncertainty—whether from election volatility, impending tax reforms, or fluctuating economic conditions—remains critical. As December unfolds, the market will be keenly observed for a possible resurgence in issuance and will provide valuable insights into how 2025 will shape up in a potentially restrictive environment for tax-exempt bonds.

Leave a Reply