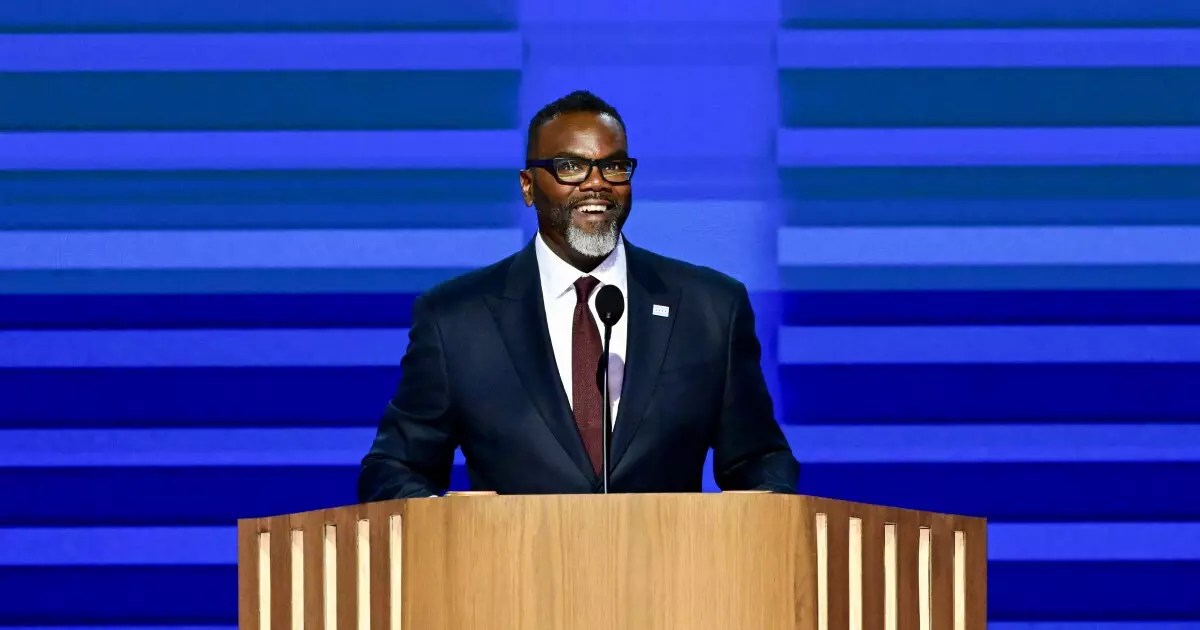

In a critical turn of events this week, Kroll Bond Rating Agency (KBRA) announced that it has placed the City of Chicago’s A general obligation bond rating on a “Watch Downgrade” status. This decision coincides with the City Council’s upcoming vote on a contentious $300 million property tax increase, spearheaded by Mayor Brandon Johnson as part of his proposed budget for 2025. As the city grapples with a projected corporate fund shortfall of approximately $982.4 million, the financial implications of this rating watch beckon scrutiny and could have substantial repercussions for Chicago’s economic future.

The Nuances of Fiscal Responsibility

The KBRA’s assessment is layered with concerns about Chicago’s financial health, primarily arising from its reliance on one-time solutions to bridge budgetary gaps. Such a tendency could signal deeper issues within the city’s fiscal framework, contributing to a so-called structural deficit that is becoming increasingly burdensome. The context is essential: Chicago’s revenue sources are notably sensitive to economic fluctuations, further exacerbating its financial woes. Moreover, the protracted budget process and the late initiation of discussions adds urgency to the city’s need for robust financial planning, given the significant deficit looming ahead.

Despite being rated A, KBRA is poised to resolve the downgrade watch status by early January, depending on how the city addresses its budgetary challenges. Linda Vanderperre, a senior director at KBRA, underscored the need for a fiscally responsible budget that adequately addresses the structural deficit without falling back on transient revenue or savings measures. This underscores an essential tension between short-term financial maneuvers and long-term fiscal sustainability, a balancing act that the city must navigate with precision.

Mayor Johnson’s budget plan proposes a mix of 80% structural solutions and 20% one-time funding sources. However, the controversial property tax hike stands out as a major pivot from the mayor’s campaign promise, wherein he suggested a cautious approach to increasing taxes. This financial decision is particularly noteworthy following a Civic Federation report advocating that property tax increases should be viewed as a last resort. Critics of the proposed tax hike argue it may alienate constituents and provoke discontent within the City Council, especially given the breakdown of initial support for the measure.

Interestingly, major rating agencies like Fitch Ratings and S&P Global Ratings have lauded this tax increase as a pragmatic move that could create a steady revenue stream to mitigate the budget gap, however, its feasibility remains in question. The dynamics at play hint at deep-seated political negotiations, with many City Council members recently calling for separate discussions around the tax increase, as reports suggest it may be significantly scaled back in favor of reallocating federal stimulus funding.

The Importance of Sustainable Solutions

The KBRA report underscores the vital need for consensus between the city administration and the City Council to determine alternative solutions for balancing the budget. Vanderperre’s remarks emphasize the city’s reserve levels and diverse economic base but also stress the potential pitfalls of deviating from established financial policies. One key element is the city’s budget stabilization policy, which serves as a safety net to maintain fiscal integrity during tumultuous economic periods.

Negotiations over a $1.5 billion debt refinancing plan further complicate the financial landscape. With nearly all savings from this refinancing structured to occur in the immediate fiscal years, it points toward an acute strategy focused on short-term relief rather than addressing underlying structural issues. Such an approach could be a double-edged sword; while it offers immediate respite, it risks creating a precarious situation for future budgets.

As the City of Chicago stands at this critical juncture, the implications of the rating watch and fiscal strategies employed will resonate for years to come. The interplay of political powers, budgetary strategies, and evolving economic challenges will require not only foresight but also adaptability. The upcoming months will necessitate vigilant monitoring of city actions and the collective will to embrace more sustainable financial practices.

In essence, Chicago’s path forward hinges not only on immediate fiscal decisions but also on the broader commitment to financial health and transparency. As the City Council and Mayor Johnson work towards a consensus, the hope remains that Chicago can steer toward a more balanced budget that fosters stability and revitalizes its commitment to long-term fiscal responsibility.

Leave a Reply