In recent months, the market landscape surrounding Build America Bonds (BABs) has become increasingly complex due to a confluence of volatile market conditions, elevated interest rates, and shifting investor confidence. As of now, a notable slowdown in BAB redemptions can be observed. Yet, despite these hurdles, various issuers have signaled their intent to redeem outstanding BABs before the end of the fiscal year. According to J.P. Morgan data, approximately $14.9 billion in BABs have already been called back in 2024, while an additional $938.3 million is anticipated. So far this year, 39 different issuers have executed refinancing deals for their existing BABs, illustrating a persistent interest in navigating this challenging market environment.

Earlier forecasts had indicated that nearly $30 billion of outstanding BABs had the potential to be called back through extraordinary redemption provisions (ERPs), especially after a favorable legal ruling for issuers. However, the economic rationale behind refunding these bonds rests heavily on the prevailing interest rates. As Nick Venditti from Allspring noted, issuers will only pursue refundings when current rates justify this decision. With the 10-year U.S. Treasury bond hovering around 4.27%, the financial calculus for many BABs becomes significantly more complicated.

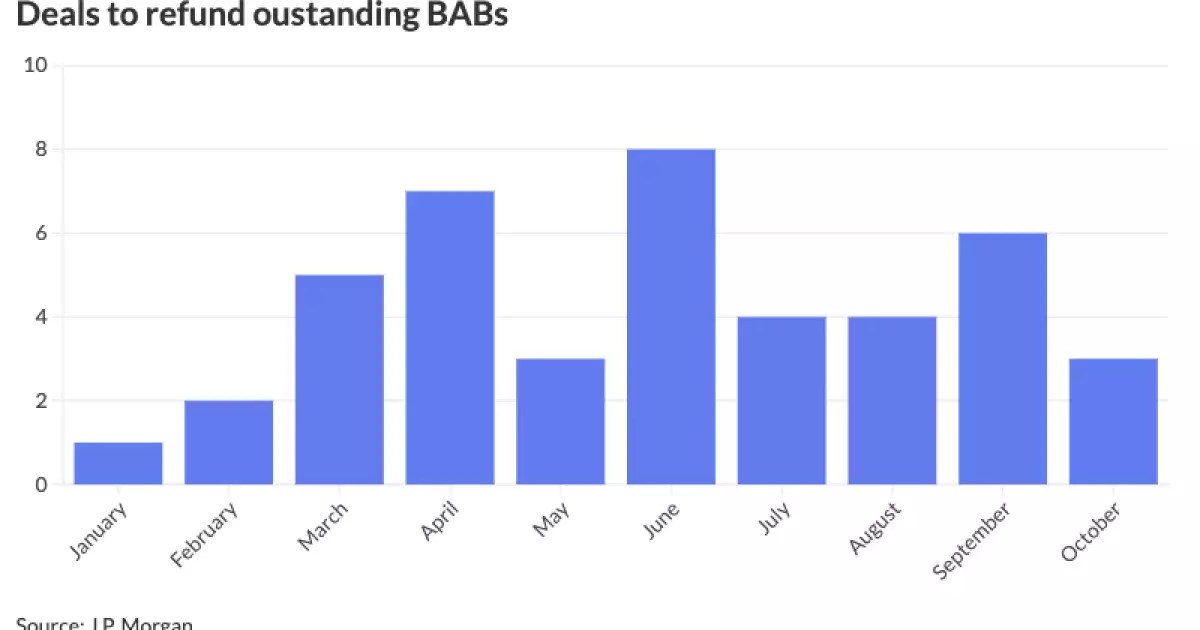

The movement in BAB refundings demonstrates pronounced seasonal patterns. Initial transactions saw a sluggish pace, with the first quarter of 2024 generating limited activity. However, a marked increase occurred in the second quarter, only for the market to slow down again in the third quarter. Notably, June emerged as the peak month with eight transactions for BAB refundings, eclipsing April’s seven deals. In contrast, January experienced the least activity with just one deal. This fluctuation in activity may reflect broader market trends and seasonal investor behavior.

The most significant refunding transaction occurred when the Los Angeles Unified School District executed a remarkable $2.9 billion General Obligation (GO) refunding bond in late April. Moving forward, the sentiment around BAB refinancings appears to have diminished as rising interest rates have raised the barriers for issuers to consider refunding their bonds. James Pruskowski of 16Rock Asset Management emphasized the prevailing anxiety among both issuers and investors regarding the implications of ERP language in bond indentures.

An instance illustrating the current market volatility involved the Ohio Water Development Authority, which was forced to withdraw a planned issuance of $102.02 million of Fresh Water Revolving Fund refunding revenue bonds that were intended to refund previous BABs. The executive director of the authority, Mike Fraizer, indicated that the prevailing market conditions potentially rendered the net present value (NPV) savings negligible, if not entirely wiped out. This action underscores the reluctance of issuers to execute refundings in a turbulent environment, favoring a wait-and-see approach until the market displays signs of stabilization.

Despite these challenges, certain issuers persisted with their plans. For instance, Ballard Spahr recently engaged in a $177 million BAB refunding for Baltimore County and noted no significant concerns from bondholders during the transaction. This reflects a cautious but resilient approach to executing refunding deals, prioritizing clear communication and due diligence throughout the process. Meanwhile, the volume of inquiries regarding BAB refundings has notably decreased as firms like Nixon Peabody have reported a reduction in interest from potential clients.

Given the current economic landscape, outstanding BABs are increasingly perceived as “super cheap,” attributed largely to investor apprehension regarding potential call risks. There appears to be a significant shift in institutional interest, with many investors now favoring taxable municipal bonds for their investment strategies. As Venditti pointed out, the implications of callable bonds can lead to suboptimal performance outcomes for investors; thus, they are understandably cautious when considering BABs.

Historically, sequestration prompted many issuers to redeem their BABs due to the diminished value of the federal interest rate subsidies. Moving forward, the long-term outlook for BABs and similar instruments could hinge on the introduction of more favorable legislative frameworks that bolster investor confidence. Presently, BABs are viewed as nearly uninvestable amid ongoing uncertainties, highlighting the need for clarity in both market dynamics and policy landscapes.

As the landscape for Build America Bonds continues to evolve, stakeholders must adapt to the quickly changing conditions, leveraging informed strategies to navigate the complexities that lie ahead. Only time will tell whether these bonds can regain their former allure within the municipal bond market.

Leave a Reply