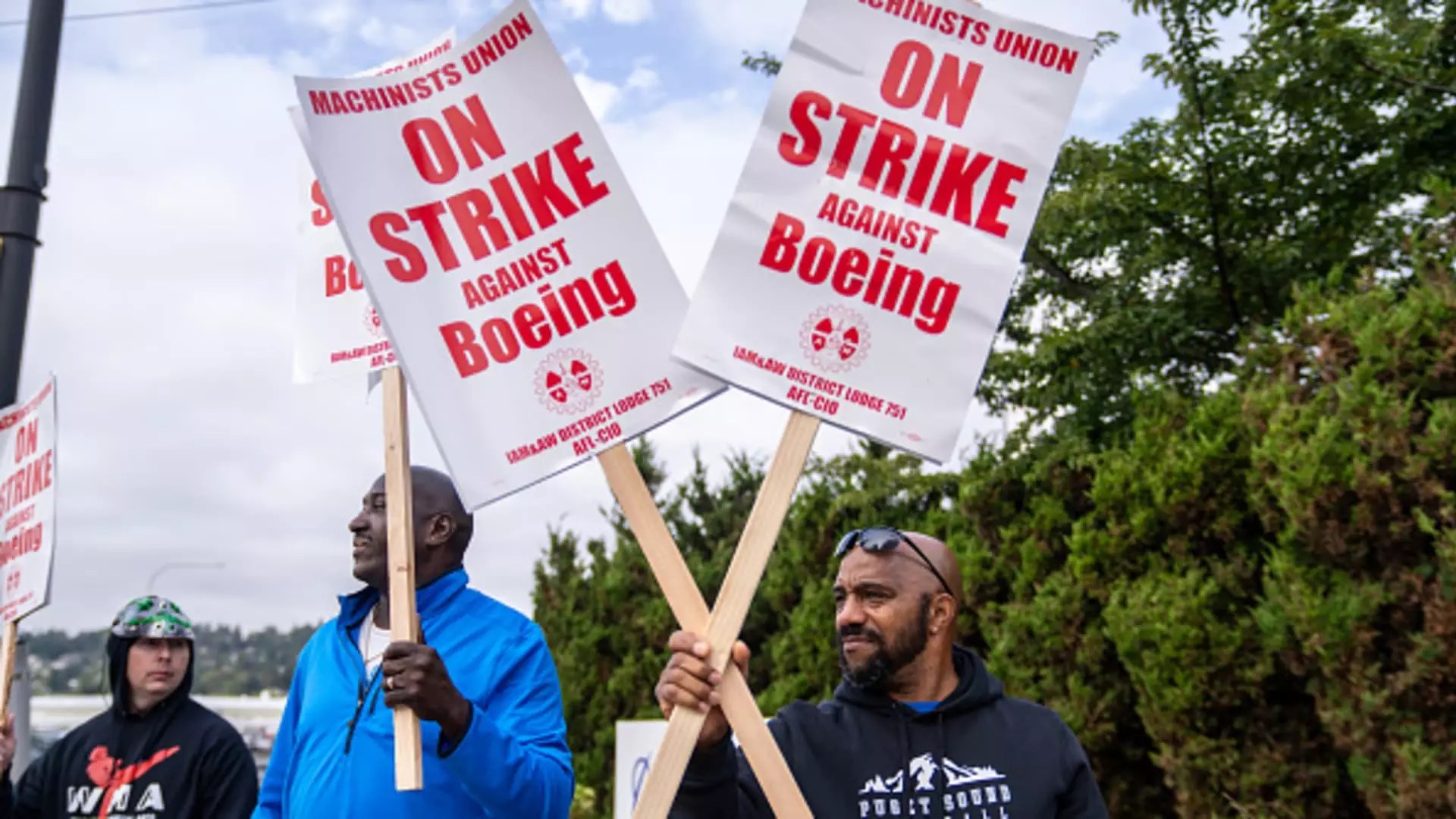

In an unprecedented move, Boeing machinists, numbering over 30,000, initiated a strike just over a month ago after a resounding 95% disapproval of a proposed labor contract. This protest reflects growing dissatisfaction among workers and has subsequently initiated a series of complications for the aerospace giant, which is grappling with financial and reputational turmoil. As production halts at Boeing’s Seattle factories and various locations nationwide, the company faces mounting costs, with estimates indicating losses exceeding $1 billion monthly.

Kelly Ortberg, who took the helm as Boeing’s CEO last summer, must navigate these choppy waters and find a way to restore not just production but also trust within the ranks of workers. The strike is layered on top of previous troubles, such as the catastrophic failures associated with the 737 Max, highlighting a pattern of crisis that has plagued Boeing for years. While Ortberg’s initial optimism in negotiations failed to bear fruit, the repercussions of this labor strife on both the company’s financial condition and its relationships with employees are severe.

Initially, there was a sense of optimism among Boeing executives who believed a resolution could be reached swiftly; reports suggested that negotiations were on a positive trajectory prior to the strike. However, this proved to be an exercise in naivety. Disillusionment within the workforce is further compounded by Boeing’s recent decision to retract a contract offer, leading to claims from union leaders that the company is “negotiating in bad faith.” This backtracking represents a significant escalation in tensions, as the union, represented by IAM District 751, pushes back against what they perceive as intimidation tactics from management.

The need for a more palatable contract is clear. As labor negotiations stalled midweek with federally mediated discussions failing to yield results, both sides appear entrenched in their positions. Labor experts predict that the strike could prolong for weeks, placing additional pressure on the company’s precarious financial state while eroding public confidence. It is critical for Boeing to make concessions that reflect the workers’ needs, particularly as numerous machinists are now navigating unemployment and the loss of benefits during this critical period.

As the strike continues, the financial implications for Boeing cannot be overstated. The company is layered in challenges—recent reports reveal expectant losses nearing $10 per share for the third quarter, alongside projected charges of nearly $5 billion within its commercial and defense sectors. Last profitable year? 2018—further illustrating the depth of Boeing’s crisis. With stock prices plummeting at rates unseen since the financial collapse of 2008, Boeing’s leadership must not only react to current challenges but also proactively strategize to regain lost ground.

In a recent company memo, Ortberg announced plans for a significant workforce reduction of approximately 10%, which includes strategic layoffs of executives and management. Moreover, the decision to cease production of commercial 767 freighters by 2027 underscores the urgency of cost-discipline measures as Boeing strives to stabilize its operations. While decisions like these may allow for quick cost-cutting, they also raise questions about long-term sustainability and morale among remaining employees, who are already feeling the strain of uncertainty in the workplace.

The Road Ahead: Rebuilding Trust and Stability

Boeing is not just fighting an operational battle but also a war for its reputation and the hearts and minds of its employees. The relationship between Boeing and its workforce has deteriorated, prompting union leaders to call for new dialogue and negotiations based on mutual respect and compromise. Ortberg has been challenged to break away from so-called “old tactics” of management just to appease investors and address financial losses.

The future of Boeing rests on its ability to reconcile its operational wounds while still serving shareholders. If the company cannot navigate out of the “doom loop” described by analysts—characterized by quality issues, labor disputes, and acute cash burn—the risk of further downturns looms large. The looming danger extends beyond its operations to affect suppliers and the broader aerospace ecosystem, indicating that unless Boeing finds a way to mend its internal and external relationships soon, the consequences will reverberate throughout the aerospace supply chain.

Boeing stands at a critical juncture where the decisions made today will not only impact the immediate future but will also merit long-term consequences for its workforce, its financial health, and its overarching brand promise. The challenge for Ortberg and his team is to not only emerge from the current crises but to institute a reformed approach to labor relations—one that acknowledges the intrinsic value of its workers in crafting its storied legacy as a leader in aerospace manufacturing.

Leave a Reply