In the ever-fluctuating world of municipal bonds, Wednesday’s trading sessions showcased a notable softness, yet the performance of municipal securities remained remarkably resilient when juxtaposed with the broader underperformance of U.S. Treasuries. Investors diligently directed their attention toward the primary market, highlighting the significance of new issuances that are attracting robust demand. While triple-A yield curves exhibited minor adjustments—reflecting slight declines varying from one to four basis points—the adjustments were relatively muted compared to the stark losses observed in longer-term Treasuries.

Municipal bonds continue to occupy a notable niche within the investment sector, with their completion rate standing resilient even amid challenges faced by other fixed-income instruments. Investors often take notice when there is a dip in U.S. Treasury performance, careful to leverage the cyclical nature of these markets to seek more favorable yields in safer territories, particularly within municipal bonds.

The ratios of municipal yields to U.S. Treasury yields offer an insightful perspective into the current market conditions. As evaluated against data from Refinitiv Municipal Market Data, the two-year municipal-to-treasury ratio stands at 63%, a consistent figure that suggests stability but also the pressure exerted by broader economic conditions. As we shift through the differing time horizons—three-year, five-year, ten-year, and even the thirty-year yields—the ratios present an intriguing picture of the liquidity dynamics at play.

According to Julio Bonilla, a prominent fixed-income portfolio manager at Schroders, the market showcases an “incredible” demand for new issues, reinforcing the notion that liquidity is burgeoning. With more than $6 trillion sitting in money market funds, coupled with perhaps $2.5 trillion in certificates of deposits, a substantial portion of capital is cycling through. This scenario indicates potent competition among fixed-income assets as investors search for the most attractive returns.

As interest rates exhibit a downward trend, there is an observable migration by marginal investors as they opt to divest from shorter instruments and position themselves towards the longer-end of the maturity spectrum. This phenomenon is especially pronounced as Fed policy begins to incrementally ease, triggering apprehensions about returns in conventional markets.

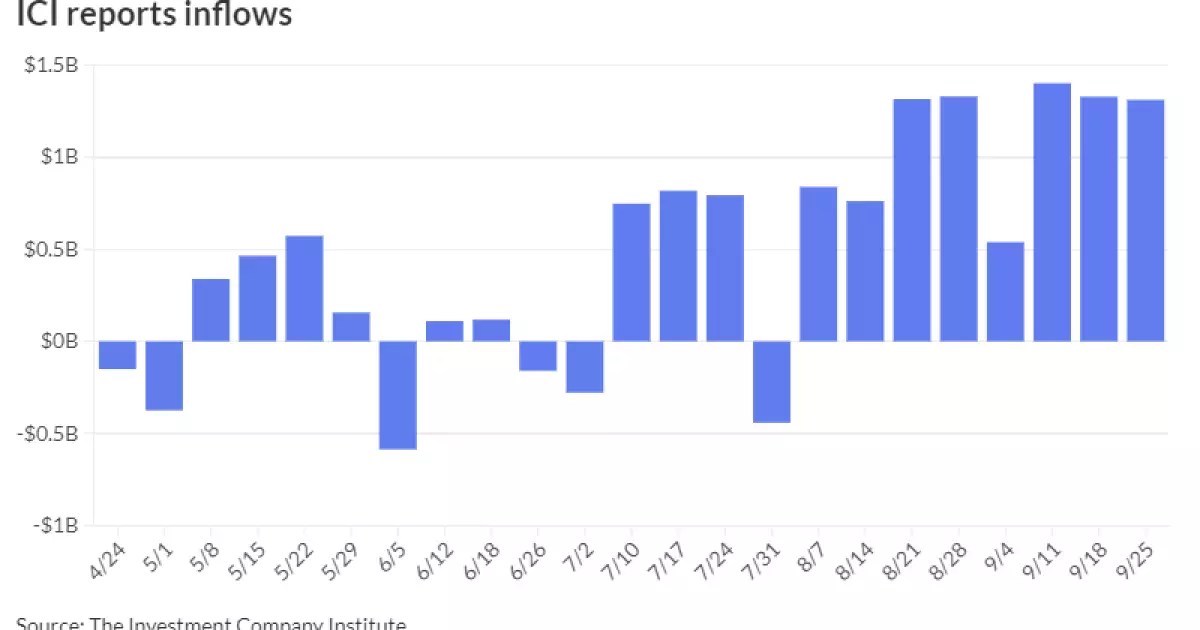

The continued inflows into municipal bond mutual funds further illustrate the enthusiasm for this sector. For the week ending September 25, reported inflows of $1.312 billion have punctuated a robust trend, slightly lower than the previous week. Exchange-traded funds have likewise experienced inflows, indicating solid retail interest. Moreover, year-to-date fund flows have exceeded $20 billion, attesting to the munificence of capital seeking refuge in the bond market.

Highlighting the dynamics of trading volumes, Matt Fabian from Municipal Market Analytics underscored the fluctuations in trading activity. Despite the drop in the total number of trades, the volumes remained significant, revealing a reliance on buying from funds rather than traditional underwriting. Given the relatively flat demand reported by banks, the municipal sector appears to be gaining prominence, which may culminate in an unprecedented year for bond issuances if the current rally continues.

The primary market exhibits intriguing new issuances that underscore investor confidence. Notable deals included a $600 million offering by the Kentucky State Property and Buildings Commission, which saw a competitive pricing structure attracting solid attention. Massachusetts followed suit with nearly $490 million in transportation fund revenue bonds, indicating a diverse pool of projects that constantly seek funding avenues.

Columbia University entered the market with a $500 million transaction, which included both taxable corporate CUSIPs and revenue bonds. This move reiterates the acute interest among large institutions as they leverage both public and private investment mechanisms to bolster their funding for essential projects.

As the market braces for forthcoming deals, including a planned $268.59 million of water system junior lien revenue bonds from San Antonio, Texas, the atmosphere remains electric with speculation around potential performance and the pivotal role of investor sentiment in driving interest.

The landscape for municipal bonds appears promising despite headwinds affecting other areas of the fixed-income market. Driven by an abundance of liquidity, favorable yield adjustments, and substantial retail demand, the municipal bond space seems poised for growth, provided the economic indicators remain stable. As we look ahead, market participants will undoubtedly continue to monitor developments closely, particularly changes in Fed policy that could further sway the tides of investor preference. This buoyant environment could very well point toward a record year for municipal bond issuances, with opportunities ripe for both institutional investors and retail participants seeking stability and relative yield in these fluid times.

Leave a Reply