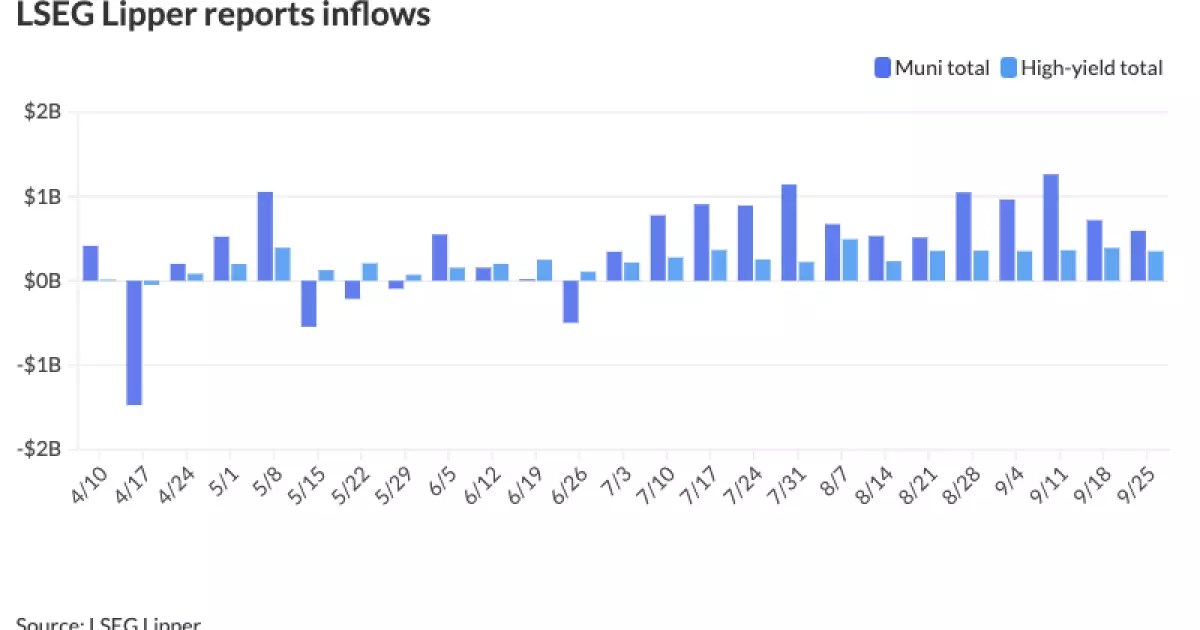

The municipal bond market exhibited stability on Thursday, setting itself apart from the fluctuations observed in other sectors. This trend comes as the final significant deals of the week were being priced, coinciding with 13 consecutive weeks of inflows into municipal bond mutual funds, primarily driven by high-yield offerings. This resilience indicates a growing confidence in the municipal bond space, even as the U.S. Treasury market displayed mixed results and equities experienced a rally.

Observers noted key ratios comparing municipal bonds to U.S. Treasuries, which highlighted the performance metrics across different durations. According to data from Refinitiv Municipal Market Data, the two-year municipal-to-Treasury ratio was recorded at 64%, maintaining the same level for three years, while the five-year ratio reached 65%. For the 10-year bonds, this figure stood at 69%, and in the case of 30-year bonds, it peaked at 85%. These ratios demonstrate that investors are navigating a complex landscape, with municipalities holding their own amid the broader financial market volatility.

One notable trend in the current municipal environment is the observed decrease in demand, juxtaposed against significant issuance volumes. Kim Olsan, a senior fixed income portfolio manager at NewSquare Capital, pointed out that the daily bids for municipal bonds saw a 15% drop in September compared to the annual average of $1.05 billion. This decline unfolds during a month when municipal bond issuance is expected to surpass $40 billion—significantly above the last decade’s average of $34 billion. As of now, the Bond Buyer’s 30-day visible supply is at $13.98 billion, reinforcing the notion of a robust supply backdrop.

Despite the increasing supply, the mutual fund inflows are indicative of consistent demand for munis. Data from the Investment Company Institute reveals that for the current quarter, there have been $8.8 billion in inflows, with only one week registering nominal outflows. The investment community is continuously attracted to high-yield categories. High-yield municipal fund inflows alone amounted to $349.2 million during the most recent week, showcasing sustained investor interest in this segment.

Yield Opportunities and Strategic Moves

Investors are increasingly capitalizing on yield opportunities, particularly in the intermediate and long-dated municipal bonds. Current metrics suggest that AA-rated bonds within this space are offering yields around 2.75%, translating to taxable equivalent yields (TEYs) of approximately 4.50%. In contrast, long-dated AA-rated bonds with 5% coupons are trading around 3.60%, with TEYs around 6.00%. This underscores a competitive advantage for high-tax-bracket investors looking to maximize their returns.

The recent activity from issuers further reflects this trend. For example, the Salt River Project Agricultural Improvement and Power District in Arizona offered 5s of 2034 at 2.72% and 5s of 2049 at 3.64%, attracting notable interest from both individual and corporate investors. Olsan noted the emergence of larger issues embracing 4% coupon structures for maturities extending beyond 15 years, signaling sustained demand and potential future price gains as rate rallies unfold.

The upcoming months are poised for heightened volatility in the municipal market, especially with the anticipated supply surge related to election cycles. Olsan pointed out that outsized supply levels could potentially trigger upward movements in yields, though short-term fluctuations are expected to remain contained. The influx of sidelined cash coupled with a renewed focus on fixed income investments has led to a more favorable environment for municipal bonds.

Moreover, as inflows into municipal high-yield funds and longer-dated instruments continue to rise, September may emerge as a pivotal month that could redefine seasonal patterns in the market. Historically, the 10-year MMD spot yield has not finished lower in yield from August since 2015, illustrating a significant shift in trends as more buyers turn their attention towards munis.

The current trajectory of the municipal bond market reflects a unique resilience that stands apart from varied external market pressures. With sustained inflows, robust issuer activity, and promising yield opportunities, municipal bonds continue to attract a diverse array of investors. As strategies are re-evaluated in light of upcoming economic shifts, it is evident that the sector remains an essential consideration for investors looking for stability amidst uncertainty. The dynamics observed in the bond market will be crucial to monitor in the near future, particularly as larger socioeconomic factors continue to evolve.

Leave a Reply