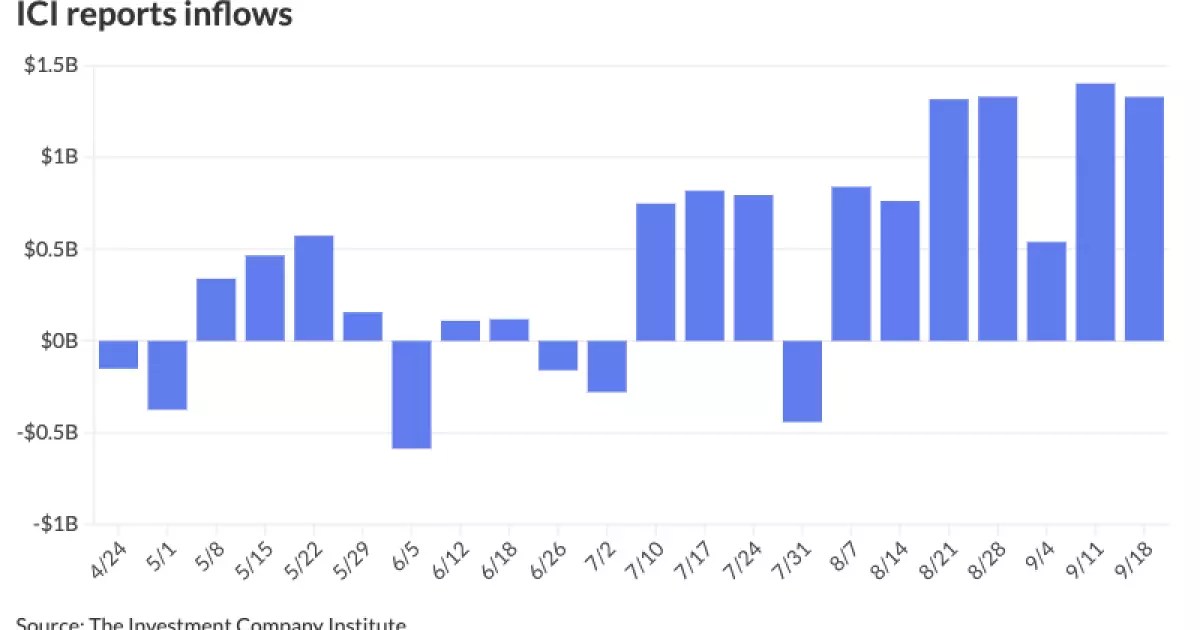

The municipal bond market has experienced a steady session recently, despite wider economic challenges. As U.S. Treasury yields trended down, institutional attention shifted to the primary market, where several significant deals led to yield adjustments favorable to investors. As pressure from equities diminished alongside Treasury market weaknesses, municipal bond mutual funds demonstrated a relative resilience. According to data from the Investment Company Institute, municipal bond mutual funds experienced inflows amounting to $1.329 billion for the week ending September 18. This followed the prior week’s inflow figure of $1.402 billion, indicating a sustained interest in municipal portfolio stability even as broader market dynamics presented challenges.

Analysts from Appleton Partners noted that with the close of summer, the influx of reinvestment capital traditionally correlated with seasonality is waning. They warned that this could pave the way for increased volatility in the coming months as the lower reinvestment capital will create a tighter market environment. The disappearance of this “crutch” might foster a more turbulent atmosphere leading to seasonal issuance spikes.

Throughout the summer months, issuance in the municipal bond market has been robust, culminating in nearly $14 billion in supply for the current week alone. High-profile deals characterized the primary market, where notable issuances include billion-dollar offerings. Such robust activity has been attributed to an underlying fear of potential market fluctuations associated with the upcoming presidential elections, prompting many issuers to accelerate their dealings in advance of November’s political uncertainty.

Jon Mondillo from abrdn highlighted that issuers are deploying strategies to mitigate fiscal risks tied to election outcomes. He explained that with changing political landscapes come varying implications for fiscal policies, which could adversely affect the market post-election. With the combination of heightened supply and subdued reinvestment demand, municipal bond yields could experience an uptick, thereby providing strategic entry points for investors pursuing growth opportunities.

Current metrics suggest that the municipal-to-Treasury ratios remain close to historical norms, hovering around 70% for the 10-year period. This figure could potentially rise as supply volumes swell, signifying a possible adjustment in valuation perspectives for municipal bond investors. Notably, long-term ratios have historically trended above 100%, indicating a shift toward what some industry experts consider the “new normal.” As Ratios settle in the realm of 85% to 86%, the conversation pivots toward whether Treasury yields would need to decline further for these ratios to revert to the historical averages witnessed in a zero-interest landscape.

Investors must remain attuned to these ratios as they offer insights into the relative value of municipal bonds versus their Treasury counterparts. The current financial strategies, especially as they pertain to longer maturities, suggest a time of reckoning for investors who previously enjoyed a different risk-reward paradigm.

The primary market has seen various institutions pricing substantial offerings recently. For example, BofA Securities recently placed $1.061 billion in consolidated bonds for the Port Authority of New York and New Jersey, where yields witnessed a minor downward correction. Investor interest has also underscored the significance of market responsive dealings common in the current environment.

Furthermore, Wells Fargo priced a series of school building bonds from the Cypress-Fairbanks Independent School District, while Baird handled an issuance of education facility revenue bonds by the Sierra Vista Industrial Development Authority. Such active participation from reliable issuers further solidifies the persistent demand for municipal securities despite the enveloping market challenges.

Looking ahead, the municipal bond market is preparing for a busy calendar featuring several noteworthy bond issuances. Future offerings include a sizable $1.258 billion revenue bonds deal from the Texas Water Development Board, along with multiple smaller scale bonds across various sectors. Industry players are keenly monitoring these developments, which could considerably shape market trajectories in the coming weeks.

As primary market dynamics evolve, investors need to adapt strategies to navigate volatility and align their portfolios better with future shifts in the economic landscape. The resilience shown by municipal bonds amidst broader pressures indicates their potential alignment with risk-averse investment strategies.

While the municipal bond market thrives with ongoing demand and strategic issuance activity, external factors will continue to play a crucial role in shaping investor outcomes. A vigilant approach is essential for navigating this complex landscape.

Leave a Reply