As the municipal bond market experiences fluctuations in response to economic cues, recent trends indicate a mix of stabilization and caution among investors. Notably, municipal bonds remain largely firm in select areas, with triple-A benchmark yields appreciating by as much as three basis points in certain segments. This modest upward pressure in municipal yields contrasts with a current decline in U.S. Treasury yields, which fell up to five basis points, reaching unprecedented lows for 2023 across all maturities. Observers have noted that the municipal bond sector has struggled to keep pace with the gains in U.S. Treasuries, with this underperformance now noted for two consecutive weeks, as detailed by market analysts from Birch Creek.

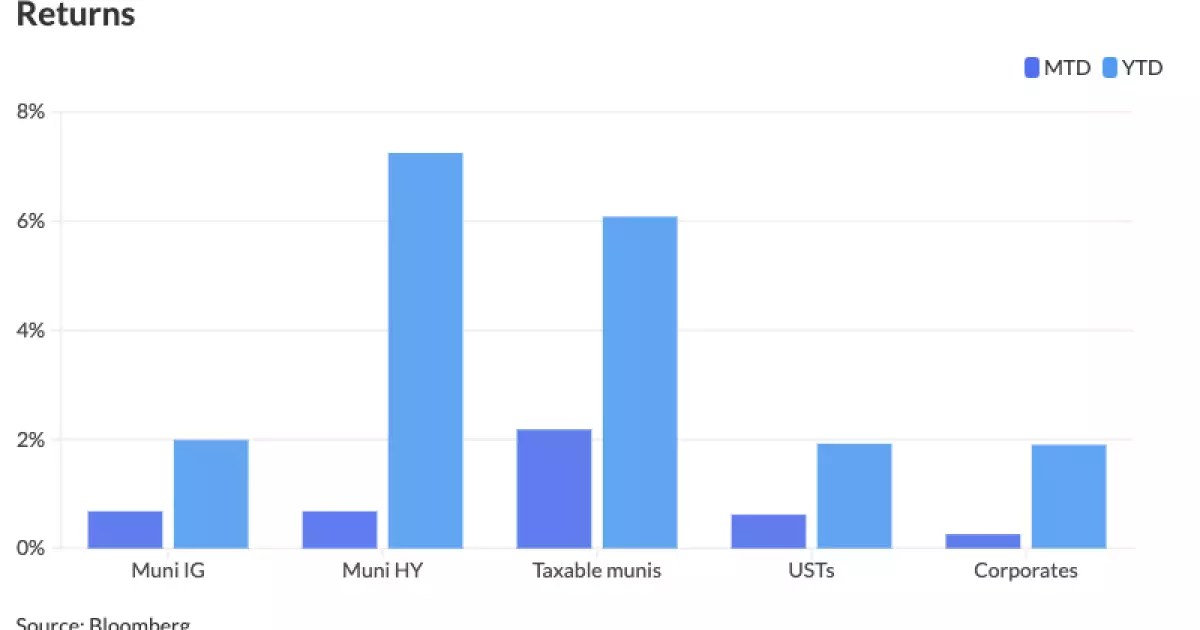

The simultaneous rise in the muni market’s returns—climbing 0.68% in September alone and 1.99% year-to-date—has created an intriguing paradox. Jason Wong from AmeriVet Securities pointed out that the recent rally represents the highest total return in the asset class since October of the previous year. This performance, juxtaposed against the backdrop of anticipated rate cuts from the Federal Reserve in the coming week, positions munis favorably for continued growth as investors prepare for potential opportunities created by lower borrowing costs.

Yield Ratios and Their Implications

Despite robust returns, the allure of munis is somewhat overshadowed by the comparison to Treasury yields. Festival-like yields are enticing on their own, but when laid alongside treasuries, many in the market are highly cognizant of the perceived overvaluation of municipal bonds relative to their government counterparts. The existing ratios starkly reflect this dynamic: the two-year muni-to-Treasury ratio sits at 66%, with similar ratios extending to 73% for ten-year bonds and peaking at 89% for thirty-year bonds. Such figures, reflecting the pricing disparities between municipal and Treasury securities, prompt investors to strategize their moves carefully.

While the steep ratios may signal potential caution among investors regarding municipal bond purchases, they also highlight an ongoing demand for these securities. Fund flows into municipal mutual funds remain vibrant, with inflows reaching an astounding $1.258 billion—this marks the eleventh consecutive week of positive influx, aligning with last year’s peak inflow records.

With the Federal Reserve’s impending decisions largely influencing the market direction, many issuers appear to be recalibrating their borrowing plans. Analysts suggest that a notable volume of new issues in the prior week was possibly driven by issuers’ urgency to navigate the changing economic landscape proactively. Pat Luby, head of municipal strategy at CreditSights, emphasizes this urgency, indicating that a solid 65% increase in issuance volume compared to average levels was observed recently, although upcoming weeks may see a drop in issuance as market players await clearer directives post-rate cut announcements.

As we look ahead, a series of substantial bond deals is anticipated, expected to materialize with several notable issuances from state and local authorities over the next month. These transactions include sizable issuances from entities such as the Texas Water Development Board and the New York City municipal bonds. The expectation of increased capital activity stems from both needs for infrastructure funding and proactive moves to optimize financing costs amid the anticipated Fed actions.

As the economic environment remains fluid, the municipal bond market must navigate the complexities introduced by changing yield profiles and potential Federal Reserve policy shifts. A significant consideration moving forward will be how the anticipated reductions in interest rates might reshape investor appetite for both new issuances and existing municipal securities.

While the current strikes of uncertainty pose challenges—creating an environment of selectivity in the face of attractive yields—many investors remain optimistic about the intrinsic value of municipal bonds, especially as issuers react strategically to market signals. Furthermore, sustained inflow trends and a healthy allocation toward municipal bonds suggest that even amid disparities, the overall market may continue to provide favorable opportunities for risk-managed investments.

The municipal bond market stands at a paradoxical juncture of underperformance against its Treasury counterparts, yet it remains resiliently attractive to investors. The interplay of growing demand, Federal policy decisions, and upcoming issuance volatility will collectively guide the course of future municipal bond performance, establishing new benchmarks in the ever-evolving economic landscape.

Leave a Reply