In recent months, the municipal bond market has experienced a robust surge in weekly issuance. This trend has been driven by various factors such as pent-up capital needs, dwindling federal aid, and front-loaded issuance by state and local governments. As a result, the pace of issuance shows no signs of slowing down, with some strategists even revising their volume forecasts for 2024 upwards. For example, HilltopSecurities recently adjusted its issuance forecast to $480 billion from $420 billion due to stronger-than-expected economic growth.

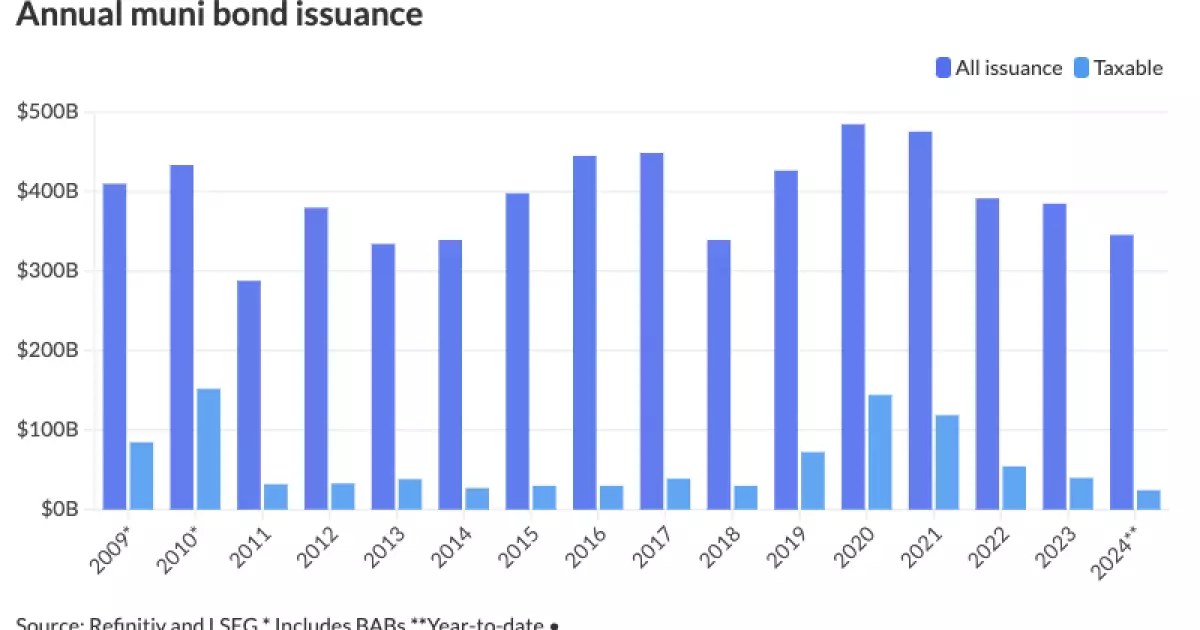

The total issuance of municipal bonds hit a record high of $484.6 billion in 2020, followed closely by $483.234 billion in 2021. However, the past two years saw a decline in volume, dropping to $391.298 billion in 2022 and $384.715 billion in 2023. Despite this downward trend, the current year is on track to surpass the previous record of $448.6 billion set in 2017. As of Wednesday, issuance has already reached $345.327 billion, marking a 32.7% increase compared to 2023.

The surge in issuance can be attributed to several key factors. The influx of new municipal bonds has been supported by a substantial new-issue calendar, totaling an estimated $13.345 billion for the week. Furthermore, the market has seen an increased number of mega-deals, including billion-dollar issuances from Washington, D.C., the New York City Transitional Finance Agency, and Illinois. These significant deals have been strategically timed to precede key economic reports, such as the Consumer Price Index and Producer Price Index.

The reception of these large deals serves as an indicator of how the municipal bond market is faring. The Washington, D.C., deal is expected to benefit from local reinvestment demand and potential interest from D.C. residents seeking to invest in D.C.-exempt bonds. Similarly, the NYC TFA deal is likely to attract investors looking to capitalize on lingering reinvestment demand in New York. However, the Illinois deal may face challenges, as its size and timing could result in pricing that is wider than the benchmark.

Despite the recent drop in The Bond Buyer 30-day visible calendar, experts anticipate that the surge in issuance will continue. Market participants are keen to stay ahead of potential market turbulence, particularly with the upcoming election. Historically, election years have seen a front-loading of issuance before a slowdown in November and December. Issuers are looking to secure their borrowing needs before November 5 to avoid any uncertainties in the market. With a decrease in issuance expected towards the end of the year, buy-side interest is also likely to decline as investors become more cautious.

The current surge in municipal bond issuance presents both opportunities and challenges for the market. As issuance levels continue to rise, market participants must closely monitor key economic indicators and market dynamics to navigate this rapidly evolving landscape. By staying informed and proactive, investors can capitalize on the potential opportunities presented by this unprecedented wave of bond issuances.

Leave a Reply