The municipal bond market remained relatively stable on Thursday, with minimal changes in response to rising U.S. Treasury yields and a decline in equities. According to AllianceBernstein strategists, this year’s summer technical landscape has shown more strength compared to the situation in 2023. In the previous year, total returns for June through August were negative, with August erasing gains from June and July as UST yields surged and muni yields increased. Notably, the 10-year muni experienced a rise of 36 basis points during August 2023.

Conversely, the current year has seen munis deliver a return of 3.11% from June through August 16, surpassing the performance in 2023 despite heightened issuance levels. Issuers have been frontloading bond offerings ahead of November to mitigate potential market volatility associated with the election. This proactive approach has contributed to the stability of the market, even as issuance rates remain high.

Despite the recent influx of supply and a series of large deals, including New York City’s $1.8 billion in GOs, the municipal bond market has managed to absorb new issuances effectively. According to Catherine Stienstra, head of municipal bond investments at Columbia Threadneedle Investments, the market’s resilience can be attributed to attractive yields, which have enticed investors, particularly high-net-worth individuals.

While yields did not experience significant changes on Thursday, they have remained relatively high, presenting lucrative opportunities for investors to lock in favorable rates. Stienstra emphasized that separately managed accounts (SMAs) have been actively acquiring most of the supply within 15 years, as reflected by muni-UST ratios that indicate rich valuation levels. These ratios signal the confidence of shorter-end SMA buyers in anticipating lower ratios in the future, aligning with the ongoing growth of SMAs.

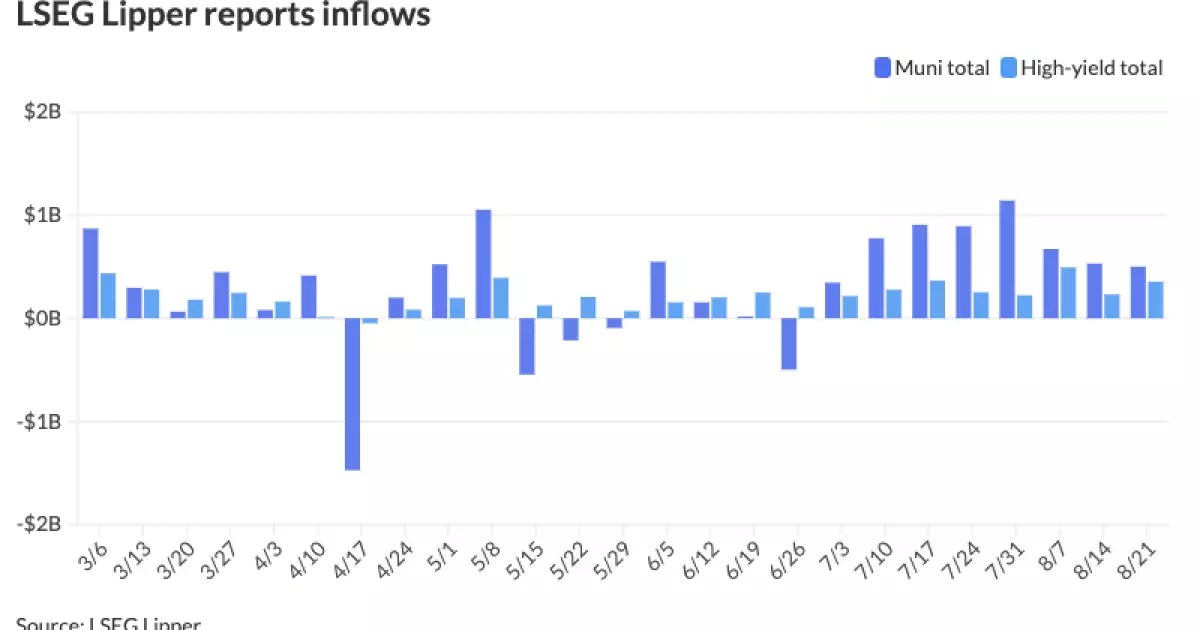

There has been a continued inflow of funds into municipal mutual funds, although the rate has been slower than anticipated following significant outflows in 2022 and 2023. Municipal bond mutual funds witnessed inflows as investors added $500.4 million to funds after a previous influx of $530.3 million, marking eight consecutive weeks of positive flows. The high-yield sector also displayed strength, with inflows amounting to $354.8 million.

Amidst expectations of a Federal Reserve rate cut, concerns about market volatility and duration risks are expected to diminish once the Fed initiates the anticipated reduction. The possibility of a rate cut at the September meeting hinges heavily on the upcoming monthly employment report. Despite some uncertainties surrounding the timing and extent of rate adjustments, market analysts remain optimistic about the Fed’s commitment to supporting economic stability through appropriate policy measures.

In the primary market on Thursday, notable bond offerings included the pricing of non-AMT Dallas Fort Worth International Airport joint revenue refunding and improvement bonds by Wells Fargo, as well as lease revenue bonds by the Los Angeles County Public Works Financing Authority and stormwater fee revenue refunding bonds by Charlotte, North Carolina. Each offering featured various bond maturities and yields, reflecting the diverse range of opportunities available to investors in the municipal bond market.

The current state of the municipal bond market demonstrates resilience in the face of changing economic conditions and market dynamics. Despite fluctuations in Treasury yields and equity performance, the stability and attractiveness of municipal bonds continue to appeal to a broad spectrum of investors, prompting continued interest and investment in this sector. As market participants navigate evolving uncertainties and opportunities, a strategic and informed approach to municipal bond investing remains essential for long-term success and portfolio growth.

Leave a Reply