The municipal bond market experienced improvement on Wednesday as focus shifted towards the primary market activities. Noteworthy deals included Chicago pricing its delayed general obligation bond deal, along with offerings from the Triborough Bridge and Tunnel Authority, the Pennsylvania Turnpike Commission, and the Las Vegas Valley Water Department. This shift in attention resulted from the release of CPI figures that aligned with market expectations, further reinforcing the likelihood of a rate cut by the Federal Reserve in September.

John Kerschner, the head of US Securitised Products and Portfolio Manager at Janus Henderson Investors, highlighted the recent rally in the bond market, indicating a significant decline in yields since July. Despite the favorable inflation data supporting a potential rate cut, uncertainties remain regarding the pace and magnitude of future rate adjustments. The bond market is expected to stabilize at the current levels as investors await further guidance from the Fed, especially after the Labor Day holiday.

Expert Opinions and Market Outlook

Scott Anderson, the chief U.S. Economist at BMO Capital Markets, acknowledged the progress made towards the Fed’s inflation targets based on the recent report. While the data does not deter expectations of a rate cut in September, the prospect of a larger cut remains uncertain in the current market environment. The yield curves for Triple-A rated bonds witnessed a modest decline, with U.S. Treasuries displaying mixed performance across different maturities.

Several key ratios, such as the muni-to-UST ratios, fluctuated during the trading session, underscoring the dynamic nature of the financial markets. Despite the general optimism surrounding the bond market, investors remain cautious due to ongoing economic uncertainties and geopolitical factors influencing market sentiment.

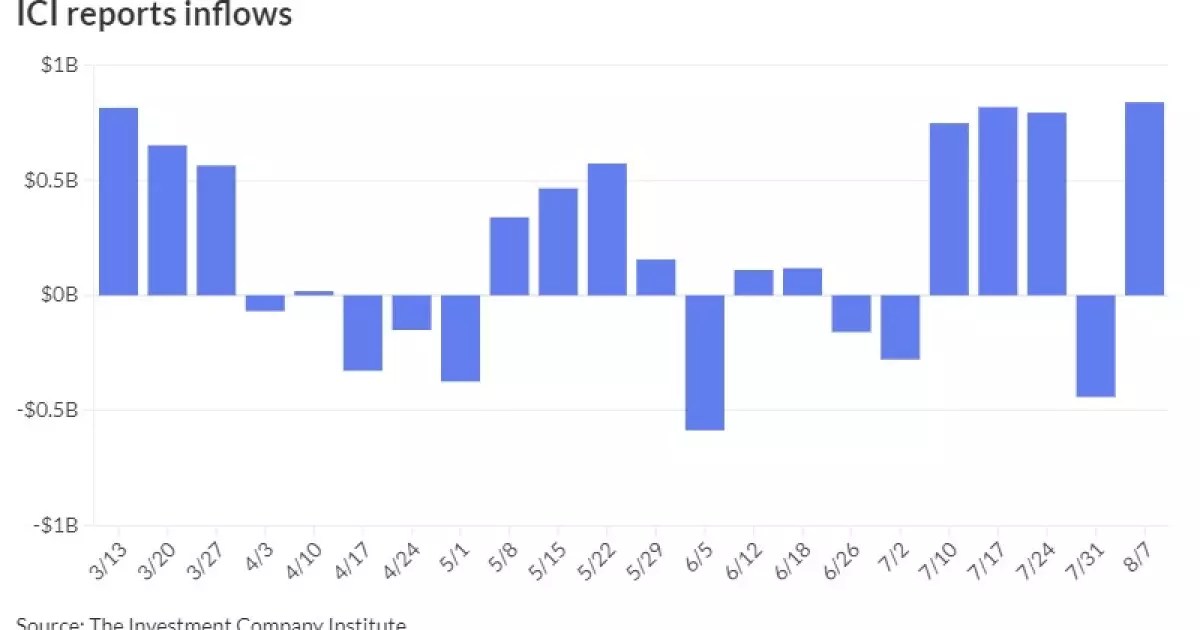

The Investment Company Institute reported a significant inflow of $839 million into municipal bond mutual funds for the week ending August 7, signaling renewed investor interest in the asset class. Additionally, exchange-traded funds attracted $680 million in inflows, reflecting a positive sentiment towards municipal bonds. However, tax-exempt money market funds experienced outflows of $2.29 billion, indicating a more risk-averse investment approach among some market participants.

In the primary market, several notable bond offerings were priced by financial institutions, including Ramirez & Co., Huntington Securities, Inc., Morgan Stanley & Co. LLC, and Raymond James & Associates. These offerings from public entities and organizations reflect the ongoing demand for municipal bonds as a source of funding for various projects and initiatives.

Key market indicators, such as the AAA yield curves from different sources, displayed minor variations across different maturity levels. Refinitiv MMD, ICE Data Services, S&P Global Market Intelligence, and Bloomberg BVAL reported changes in yield levels, highlighting the nuanced movements within the bond market. Despite fluctuations in yield curves, municipal bonds continue to attract investors seeking stable returns in a low-interest-rate environment.

Treasuries exhibited mixed performance, with varying yields across different maturities at the close of the trading session. The primary calendar features upcoming bond offerings from public institutions, including the California Community Choice Financing Authority, the Maryland Economic Development Corporation, the New Jersey Health Care Facilities Financing Authority, and the Reno-Tahoe Airport Authority. These anticipated bond issuances further reflect the robust activity in the municipal bond market and the diverse range of projects being financed through bond sales.

Overall, the impact of municipal bonds on the financial market remains significant, with investors closely monitoring market trends, expert opinions, and investment flows to make informed decisions in a dynamic economic environment. Despite uncertainties and volatility, municipal bonds continue to play a crucial role in funding public infrastructure and maintaining liquidity in the financial system.

Leave a Reply