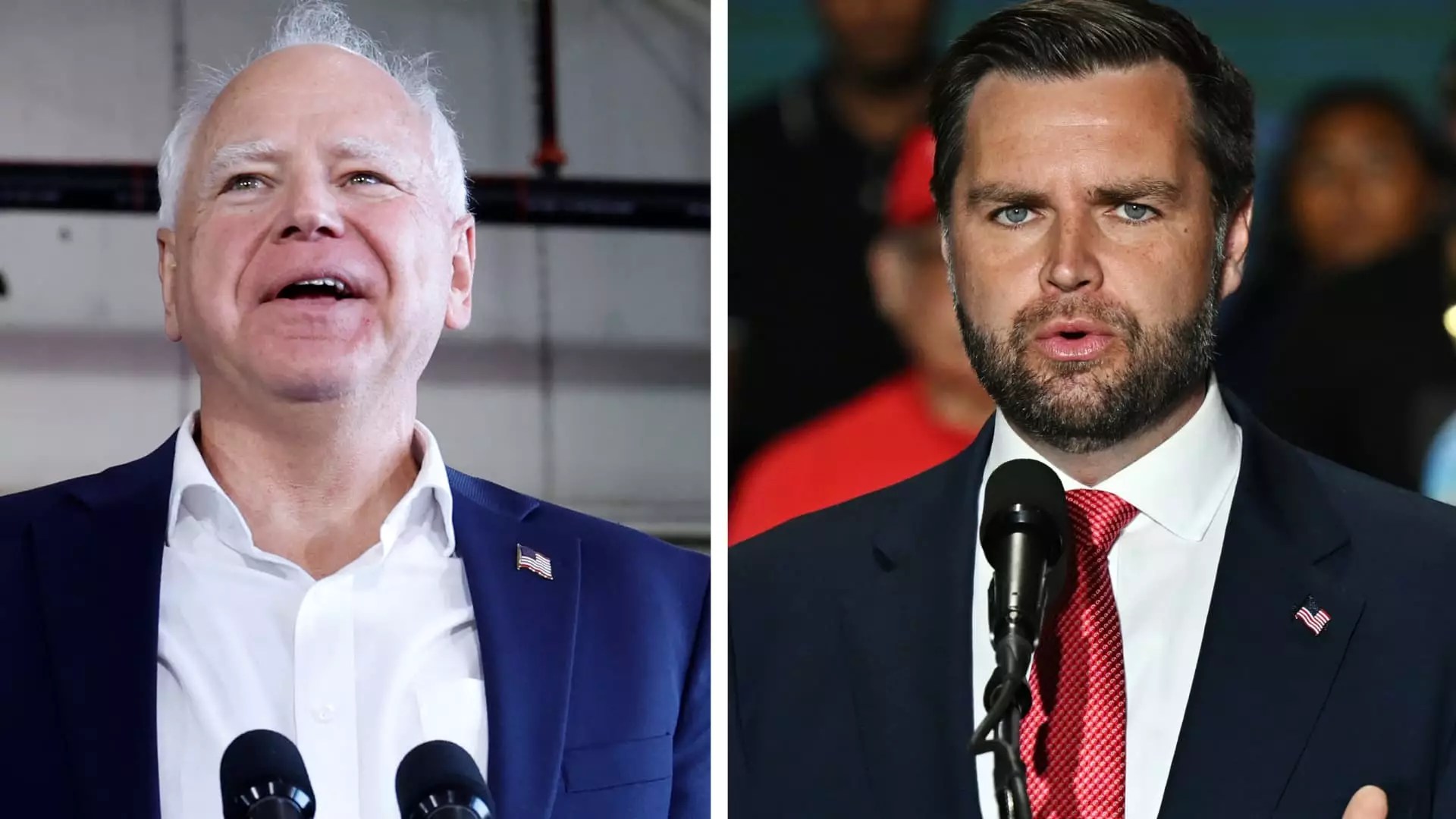

The original article discusses the contrasting views of Tim Walz and JD Vance on affordable housing policies. Walz signed housing legislation in 2023 that included substantial funding for down payment assistance, housing infrastructure, and workforce housing. On the other hand, Vance has highlighted the issue of affordable housing in his campaign, advocating for addressing the issue as a key to tackling poverty. While both candidates emphasize affordable housing, their approaches and solutions differ significantly.

The article delves into the impact of the child tax credit policy on low-income households, with Minnesota enacting a refundable state-level child tax credit in 2023. Jared Walczak of the Tax Foundation mentioned that Minnesota’s child tax credit is generous for low-income households but narrow in scope. The article raises concerns about the potential difficulty of permanently expanding the federal child tax credit amid a divided Congress and budget deficit worries. Additionally, it highlights the Senate Republicans’ opposition to a federal child tax credit expansion, underscoring the partisan divide on this issue.

JD Vance’s stance on student loan forgiveness emerges as a point of contention, with Vance opposing broad-based forgiveness policies. He argues that forgiving student debt primarily benefits the wealthy and corrupt university administrators, emphasizing the need to combat such policies vigorously. In contrast, the article mentions Vance’s limited approval of loan forgiveness in cases of permanent disability, indicating a nuanced approach to the issue. However, criticism from Jane Fox, highlighting the working-class nature of student debt forgiveness, suggests a disconnect in Vance’s perspective.

The original article outlines contrasting approaches to educational debt relief between Tim Walz and JD Vance. Walz, a former school teacher, is depicted as supporting programs to alleviate student loan burden, such as a student loan forgiveness program for nurses and a free tuition initiative for low-income students. In contrast, Vance’s skepticism towards broad-based student loan forgiveness is evident, with his focus on targeted relief for specific cases. The differing views of the two candidates reflect broader debates surrounding educational debt and the role of government intervention.

Overall, the analysis of the personal finance policies of Harris-Walz and Trump-Vance tickets underscores the divergent approaches of the candidates towards key economic issues. While both sets of candidates aim to address concerns such as affordable housing, child tax credits, and student loan forgiveness, their proposed solutions and policy orientations differ significantly. The article highlights the partisan divides and ideological distinctions that shape the candidates’ stances on personal finance, underscoring the complexity of economic policy debates in the ongoing election cycle.

Leave a Reply