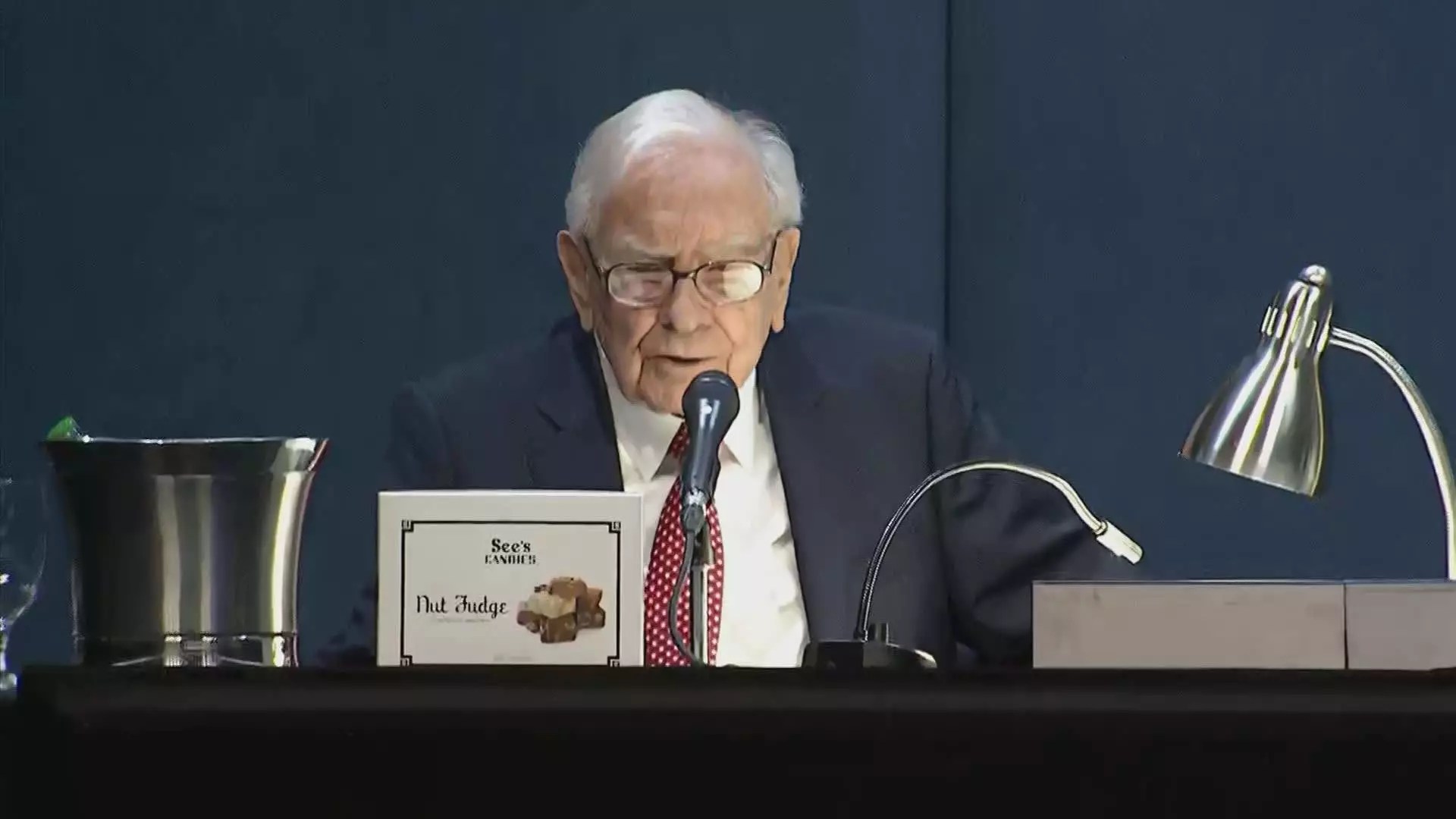

In a week where economic uncertainty reached alarmingly high levels, Warren Buffett’s Berkshire Hathaway showcased remarkable resilience, serving as a beacon of stability amid the storm. As stocks tumbled in reaction to President Trump’s aggressive tariff policies, Berkshire’s Class B shares fell just 6.2%, significantly outperforming the S & P 500’s staggering 9.1% decline. This significant divergence highlights Berkshire’s unique structure and financial strength, appealing to investors seeking refuge in a turbulent market.

While some may consider a 6.2% drop disheartening, it serves as an indicator of Berkshire’s robust business model, particularly compared to the overall market collapse. As uncertainties loom over Wall Street, Buffett’s conglomerate maintains its position above the 200-day moving average — a crucial momentum indicator that very few stocks can boast about in the current economic climate. This distinction not only underscores Berkshire’s relative strength but also reinforces the notion that certain companies can insulate themselves from the whims of politics and regulatory changes.

The Emotional Toll of Tariffs

As President Trump initiated a global trade war, invoking tariffs that have sent shockwaves through various sectors, investors found themselves grappling with fear, uncertainty, and doubt. The emotional toll of such aggressive policies weighs heavily on market sentiment, triggering massive sell-offs as traders rush for cover. However, this is where Berkshire Hathaway sets itself apart. Its diversified business model, spanning insurance, manufacturing, energy, and retail, allows it to mitigate risks associated with political upheaval.

In times of distress, adaptable companies with strong fundamentals tend to attract investors looking for stability. Berkshire’s vast cash reserves, totaling $334 billion at the end of 2024, position it favorably in the eyes of market participants. Rather than succumbing to panic, prudent investors recognize that Berkshire’s well-managed portfolio of businesses serves as a bulwark against the erratic swings dictated by Washington politics.

A New Era of Investment Anxiety

The sheer magnitude of the market movements during this tumultuous week — with the blue-chip Dow experiencing unprecedented back-to-back losses of more than 1,500 points — signals a crisis of confidence. Amidst this chaos, Berkshire Hathaway emerges as a strategic refuge, demonstrating that companies with strong ties to the domestic economy, devoid of excessive reliance on Trump’s volatile policies, can effectively weather the storm. Observers, including Ritholtz Wealth Management’s Josh Brown, have noted that Berkshire’s ability to attract investor interest is rooted in its independence from political machinations.

Today’s market landscape is increasingly characterized by anxiety. The unpredictability of political decisions can wreak havoc on stock prices, particularly for firms that depend heavily on favorable regulatory outcomes. By contrast, Buffett’s company is recognized as one that can retain its value even when faced with external shocks, such as tariff-induced disruptions.

The Importance of Strategic Alignment

While the market spiraled downward, the perception of relative safety surrounding Berkshire Hathaway’s stock cannot be understated. As the company continues to attract investors wary of the political landscape, it exemplifies the crucial importance of strategic alignment within the investment community. Buffett’s remarkable ability to adapt to changing economic winds and navigate the financial maze has reinforced the perception of Berkshire as a company that does not require rescue or intervention from presidential decrees.

This reliability indicates more than just financial acumen; it reflects a commitment to strong corporate governance and strategic investments that are less susceptible to external upheavals. Investors today are discerning; they seek out corporations that maintain agility and foresight even when political waters remain choppy.

Berkshire Hathaway: More than Just a Stock

Warren Buffett’s Berkshire Hathaway transcends the conventional perception of a stock; it represents an ethos of endurance and intelligence in the face of adversity. While the allure of big tech firms grappling with regulatory scrutiny might cause some anxiety, value investors are recognizing the wisdom in Buffett’s approach.

Thus, as we witness the market shake and tremble under pressure, one thing remains clear: Warren Buffett’s Berkshire Hathaway stands tall, embodying the spirit of resilience in uncertain times. By championing the strategic value of a diversified portfolio, it invites investors not only to look for immediate gains but also to seek long-term stability and growth amid political and economic upheaval.

Leave a Reply