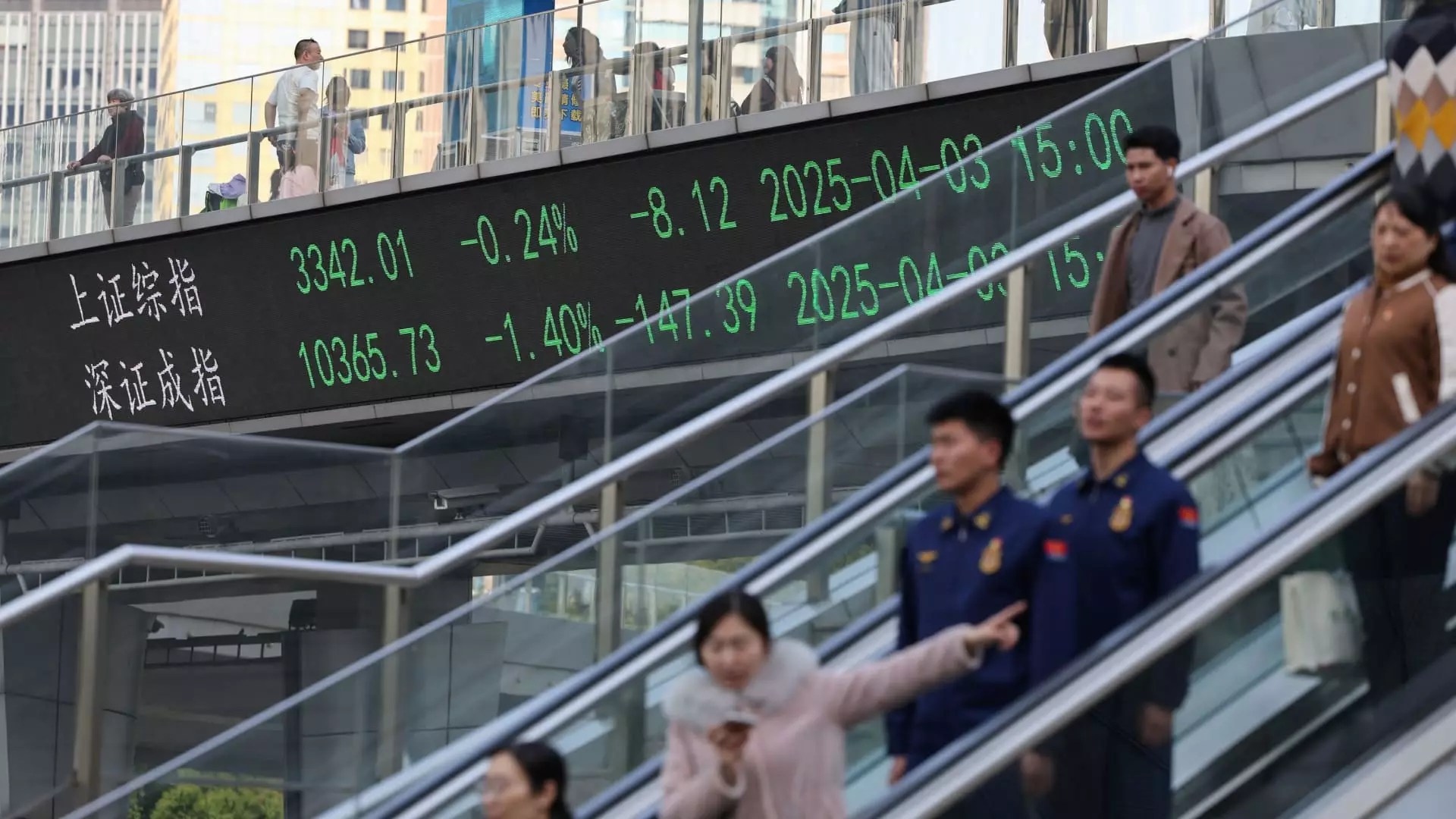

The recent wave of U.S. tariffs targeting China and its Southeast Asian trade companions has sent shudders through the global investment community. Market responses have varied from shock to overreaction, with Chinese stocks responding in tandem. Yet, amid this turmoil, there lies an undeniable resilience in China’s technology sector, particularly driven by the emerging interest in homegrown generative artificial intelligence (AI). The early panic in the markets, where stocks plummeted upon announcement, has begun to settle, revealing that many tech and consumer giants in China have only a limited exposure to the U.S. market. This distinction is crucial; while the headlines may scream fear, the fundamental underpinnings of these companies appear robust.

Reacting to Market Shifts

Analysts suggest that the initial reaction to the tariffs may have been excessively pessimistic. As Kai Wang of Morningstar pointed out, larger tech firms are better positioned to weather these storms than many investors might presume. In fact, with the anticipated support from fiscal policy in response to macroeconomic weaknesses, one can argue that these industries are poised not just to endure, but to thrive. This anticipatory response from the finance ministry reflects a strategic understanding of the market that many investors ought to consider. The confidence that policymakers express in their ability to stimulate growth at home stands as a counter-narrative to the bleak outlook portrayed by headline-driven fear.

Valuations: A Mixed Bag

The comparison of valuations between Chinese tech stocks and U.S. counterparts brings an eye-opening perspective to the forefront. With average price-to-earnings ratios of leading Chinese tech stocks significantly lagging behind the extolled “Magnificent Seven” of the U.S., there lies an opportunity for discerning investors. If Chinese stocks are indeed 52% cheaper relative to U.S. tech giants, an attractive proposition emerges for those inclined toward growth rather than value. Both short-term and long-term investors can be skewered by focusing too rigidly on the fear pushed by media narratives rather than recognizing genuine market opportunities. While others may shy away due to the tariff narrative, discerning investors could see this as a time to explore undervalued assets poised for comeback.

The Shift Towards Domestic Growth

Uncertainty about tariffs has fostered a paradigm shift among strategists and investors alike. Rather than doubling down on export-focused plays, a growing sentiment advocates for prioritizing domestic growth options. The recent uptick in investor interest—where nearly a quarter of international investors are becoming increasingly optimistic about Chinese tech—demonstrates a critical pivot in thinking. The focus on sectors like internet technology and transportation places the spotlight directly on domestic consumption, which offers a more stable avenue of growth amidst international turbulence. Investors should be grateful for such narrative shifts; ignoring these can lead to missed opportunities in a sector actively innovating and adapting.

AI: The Game Changer

One cannot overlook the role artificial intelligence plays in bolstering the Chinese tech sector even against a backdrop of uncertainty. The emergence of startups like DeepSeek, which claims to rival established giants such as OpenAI, emphasizes the robust innovation happening in China. Given the ongoing limitations imposed by U.S. restrictions on advanced chips, it is telling that these firms continue to make groundbreaking strides. Adopting AI isn’t just a technological upgrade—it has implications for operational efficiency and cost reduction, both of which are attractive to investors. If anything, spending lower in areas dominated by tariffs could spur higher growth in high-tech sectors, revealing a characteristic resilience that will ultimately be a linchpin in China’s economic recovery.

The Healthcare Sector: Unscathed by Tariffs?

As panic surrounding tariffs continues to swirl, one area demonstrates exceptional resilience: the Chinese healthcare sector. With pharmaceuticals exempt from recent tariffs, analysts believe that biotech companies here, such as Wuxi Biologics, are viable long-term investments. Their partnerships with U.S. firms strengthen their standing, making them less susceptible to international political gamesmanship. Investors inclined towards long-term gains should take a closer look at healthcare, particularly as bipartisan support for lowering drug prices in the U.S. may serve to buttress the growth of Chinese firms in this space.

The Road Ahead

While short-term market volatility is likely, the reality remains that the core elements of China’s tech sector demonstrate potential for growth that is often overlooked. U.S. tariffs may pose challenges, but they should also be seen through the lens of opportunity. The eventual recovery of the Chinese economy, buoyed by government support, innovation, and strategic market positions, paints a picture of resilience that is hard to ignore. Discerning investors who prioritize a strategic approach will likely find ample opportunities in a market that defies both pessimism and simplistic narratives.

Leave a Reply