The municipal bond market witnessed a notable rally on Thursday, with prices rebounding sharply from the previous day’s losses. This rollercoaster ride is emblematic of a broader market grappling with uncertainty fueled by external economic pressures and fluctuating investor sentiment. The quick recovery may seem like a positive turn of events, but it is essential to view this enthusiasm with a critical eye. Although municipal bonds managed to recapture some ground, the storm clouds of volatility linger ominously overhead, exposing the fragility of investor confidence in what should ostensibly be a safe-haven investment.

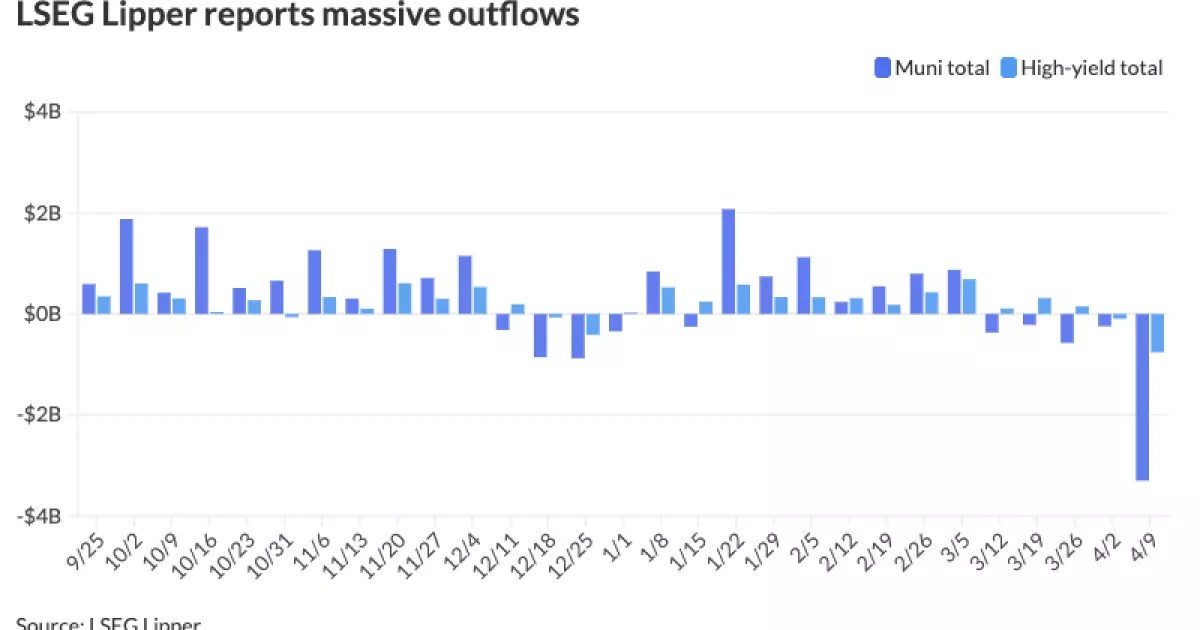

The market’s initial response to the U.S. Treasury’s announcement of a 90-day tariff extension and a lower-than-expected consumer price index (CPI) report serves as a stark reminder that good news can often be overshadowed by deeper structural issues. Municipal bond mutual funds reported outflows reaching $3.3 billion—the highest recorded since June 2022—indicating that investor confidence is anything but stable. In essence, investors are not merely reacting to market fluctuations, but are showing signs of a deeper discontent with the current state of affairs.

Yields and Outflows: A Troubling Trend

The data paints a bleak picture as the exchange-traded fund (ETF) segment faced the largest outflows since its inception. These figures may raise alarm bells: if institutional investors and retail participants alike are pulling back, what does that say about the overall market sentiment towards municipal bonds? While some analysts assert that yields saw a temporary decline—from 26 to 54 basis points for AAA scales—this might only be scratching the surface of broader issues that could undermine this apparent stability.

The alarming trend of outflows signals that the traditional safety associated with municipal bonds is being challenged—an unsettling reality that could have long-term implications for fiscal stability at the state and local levels. Investors are now faced with the double-edged sword of uncertainty surrounding tax policy, as headwinds from a historically high supply of municipal bonds continue to buffet the market. If demand continues to taper while supply remains elevated, the very equilibrium that supports pricing could be compromised.

Political Nuances: Tariffs and Treasuries

At the heart of the current municipal bond volatility lies the ongoing discussion surrounding tariffs—particularly the political maneuverings that accompany any announcement from the White House. The market’s sense of instability appears tied to fears of how trade policies may adversely affect interest rates, inflation, and economic growth. Such concerns could lead to a tightening of bond spreads, thereby squeezing both yields and potential total return rates.

Michael Pietronico, CEO of Miller Tabak Asset Management, provides a crucial warning: the debate over tariffs will remain a critical driver of bond performance throughout the coming months. The unpredictability surrounding U.S.-China relations adds a level of complexity that should keep investors alert and wary. The impending risk of a “yield shock” remains palpable, and if such an event occurs, it would likely destabilize the market yet again.

An Investor’s Dilemma: Confidence vs. Caution

As we examine the inverse relationship between investor confidence and current market conditions, it becomes evident that fear and uncertainty abound. Despite slight improvements in yields, the question must be asked: is this ephemeral rally just a momentary pause in a much larger storm? If market participants are “feeling confident” as some analysts suggest, that outlook may be deceptively grounded in wishful thinking rather than hard data and robust fundamentals.

Tom Murphy, a senior analyst at Morningstar, points out that the escalation in outflows began even prior to the recent market upheavals, indicating shifts in investor sentiment that could lead to sustained volatility rather than a brief episode of uncertainty. When high-yield fund outflows approach nearly $1 billion, it raises concerns about the viability of such investments in a landscape increasingly defined by lack of clarity and fallout from trade disputes.

The Broader Implications: Navigating the Unknown

Ultimately, the challenges inherent in the muni market extend beyond mere statistics; they reveal a systemic fragility that mandates the attention of stakeholders from all backgrounds. Policymakers would do well to understand the multi-faceted pressures facing municipal bonds—a space that is often billed as low-risk for municipalities regardless of long-term potential and stability.

In a political environment rife with division and uncertainty, the synchronization of fiscal and monetary policy becomes paramount. The latest market movements could serve as a prelude to even greater scrutiny around municipal debt, putting pressure on responsible governance and financial oversight. Investors should remain vigilant, understanding that the municipal bond landscape is not simply a reflection of interest rates but a complex interplay of political, economic, and social factors—a dynamic that may redefine what it means to invest for the future.

Leave a Reply